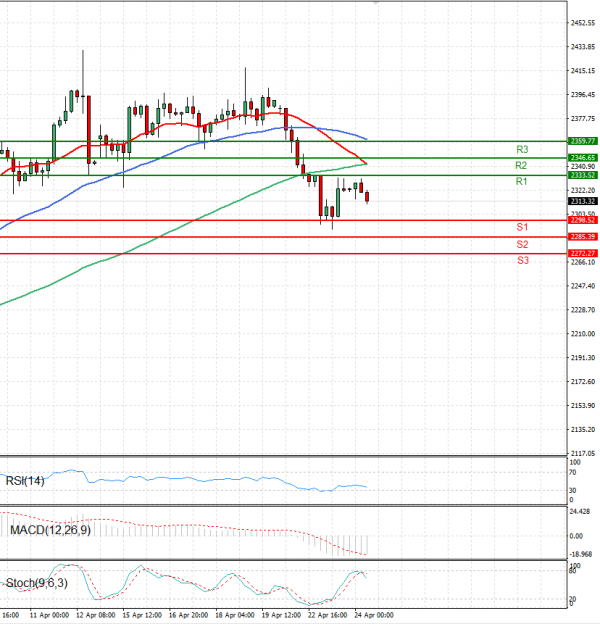

Gold prices are trading in today’s European session below 2320 levels.

Reduced worries about escalating conflict in the Middle East contribute to a decrease in the attractiveness of safe-haven precious metals.

Moreover, growing recognition of the Federal Reserve's commitment to keeping interest rates high amidst ongoing inflationary pressures limits the potential for gains in gold, which doesn't offer any yield