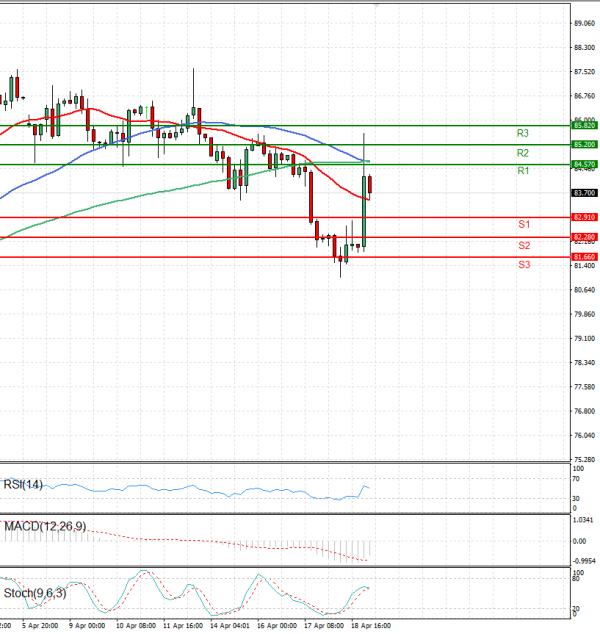

Crude Oil is trading today in the Asian session above the $83 level.

On Friday, crude oil prices experienced a significant increase, jumping over 4%, driven by the conflict in the Middle East, specifically Israel's attack on Iran.

The surge in oil prices was prompted by reports of Israeli missiles hitting a location in Iran, with explosions reported at an airport in Isfahan, according to Iran's Fars news agency.

Throughout the year, crude oil prices have been steadily climbing, driven by escalating tensions in the Middle East and supply cuts by OPEC, which have led to a tightening of the market.