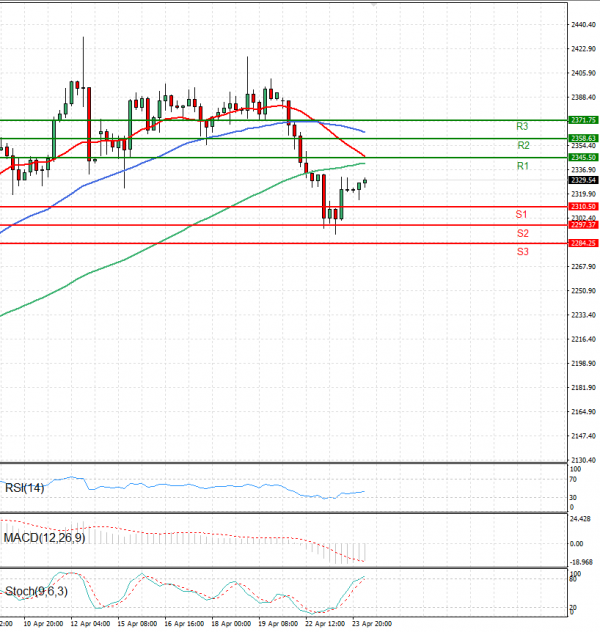

Gold prices are trading in today’s Asian session above 2320 levels.

Reduced concerns regarding the intensified conflict in the Middle East emerge as a significant factor in diminishing the appeal of safe-haven precious metals.

Additionally, the increasing acknowledgment that the Federal Reserve (Fed) intends to maintain elevated interest rates in the face of persistent inflation adds to the constraints on the potential gains of the non-yielding gold.