Platinum weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

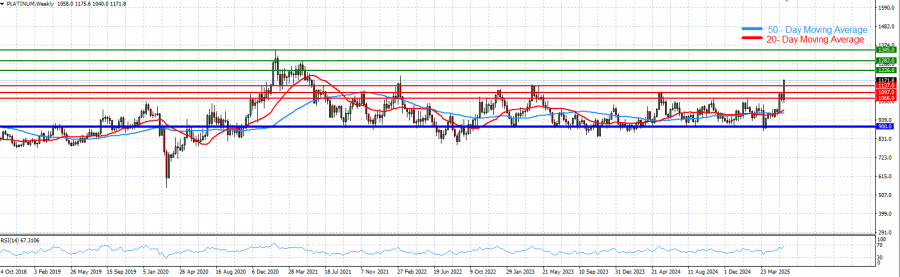

- DAILY MOVING AVERAGES SIGNAL UPTREND: Platinum prices have recently moved above both the 20-day and 50-day moving averages, indicating a continued uptrend. However, this trend could reverse if prices drop below these key moving averages.

- 14-DAY RELATIVE STRENGTH INDEX (RSI) REMAINS ABOVE 50: The chart below shows that the 14-day RSI continues to trend upward, staying above the neutral level of 50 and approaching the upper threshold of 70. This suggests sustained bullish momentum, though a move into overbought territory could signal a potential trend reversal.

- RESISTANCE AND SUPPORT LEVELS: Platinum remains in a short-term uptrend, with key resistance levels at $1226 (R1), $1282 (R2), and $1345 (R3). On the downside, support levels are observed at $1137 (S1), followed by $1097 (S2) and $1066 (S3).

GRAPH (Weekly): August 2020 – June 2025

Please note that past performance does not guarantee future results

PRICE ACTION:

- PLATINUM HIT AN ALL-TIME HIGH OF $2,300 (March 2008). Platinum currently trades around $1,171, and if a full recovery takes place, then platinum prices could see an upside of 96%. However, Platinum prices could decline, too.

- ANALYSIST’S OPINION: J.P. Morgan forecasts $1,200;

US-CHINA TRADE AGREEMENT:

- BREAKING (JUNE 5): US-CHINA TRADE DEAL TALKS TO RESUME AS SOON AS POSSIBLE AFTER US PRESIDENT DONALD TRUMP HAD A 90-MINUTE PHONE CALL WITH CHINA PRESIDENT XI. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer will represent the U.S. side in negotiations. The ministry said in a statement that Xi asked Trump to “remove the negative measures” that the U.S. has taken against China.

- IN MAY U.S. AND CHINA ANNOUNCED A TARIFF RELIEF FOR THE NEXT 90 DAYS: U.S. and China have reduced tariffs—145% to 30% (U.S.) and 125% to 10% (China). The deal may boost platinum demand by easing trade and stimulating China’s economy, which is likely to drive higher usage of platinum in key sectors like automotive, chemical, and jewelry, supporting global prices.

EVENTS (CHINA):

- MONDAY, JUNE 9 AT 02:30 GMT+1: CHINA INFLATION (CPI) (MAY): In April, China’s Consumer Price Index (CPI) declined by 0.1%. A similar decrease of 0.1% is expected for May.

- MONDAY, JUNE 9 AT 04:00 GMT+1: CHINA EXPORT/IMPORT (MAY): In April, China’s exports rose by 8.1%, significantly surpassing the expected 1.9%, while imports declined by just 0.2%, performing much better than the anticipated 5.9% drop.

- MONDAY, JUNE 16 AT 03:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (MAY): In April, China’s industrial production rose by 6.1%, exceeding expectations of a 5.7% increase.

EVENTS (USA):

- WEDNESDAY, JUNE 11 AT 13:30 GMT+1: US INFLATION (CPI) (MAY): In April, US’s Consumer Price Index (CPI) fell from 2.4% a month before to 2.3%.

Platinum, Jun 06, 2025

Current Price: 1,171

|

PLATINUM |

Weekly |

|

Trend direction |

|

|

1,345 |

|

|

1,282 |

|

|

1,226 |

|

|

1,137 |

|

|

1,097 |

|

|

1,066 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PLATINUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

17,400 |

11,100 |

5,500 |

-3,400 |

-7,400 |

-10,500 |

|

Profit or loss in €² |

15,235 |

9,719 |

4,816 |

-2,977 |

-6,479 |

-9,194 |

|

Profit or loss in £² |

12,846 |

8,195 |

4,060 |

-2,510 |

-5,463 |

-7,752 |

|

Profit or loss in C$² |

23,808 |

15,188 |

7,525 |

-4,652 |

-10,125 |

-14,367 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 12:20 (GMT+1) 06/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.