SILVER weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

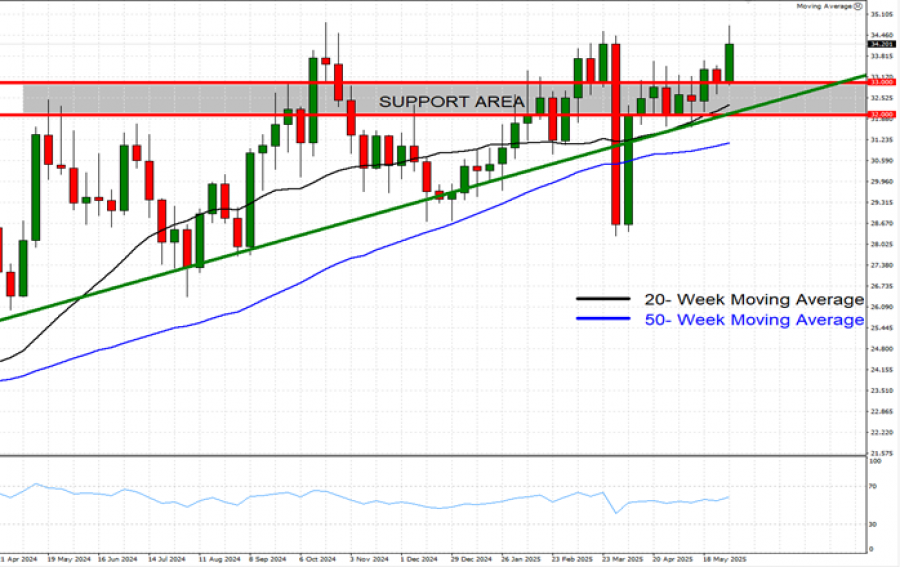

- SUPPORT AT $33. Silver has maintained support in the region between $33 and $32.

- LONGER–TERM UPTREND LINE: As depicted by the weekly chart below, the silver price has kept trading above the longer-term black uptrend line, confirming its longer-term trend is up.

- WEEKLY MOVING AVERAGES POINT TO AN UPTREND: Silver prices have recently traded above the 20- and 50-week moving Averages, pointing to an ongoing uptrend. However, gold prices can also change their trend if prices fall below the 20- and 50-week moving Averages.

- 14-WEEK RELATIVE STRENGTH INDEX (RSI) STAYS ABOVE 50: The chart below shows that the 14-week relative strength index (RSI) remains in an uptrend, floating above the break-even point of 50, towards the upper limit of 70.

- RESISTANCE AND SUPPORT LEVELS: Silver has remained in a short-term uptrend, looking at Resistance 1 of $34.90, Resistance 2 of $35.50, and Resistance 3 of $36.00 to the upside. On the downside, Silver looks at Support 1 of $33.40, then towards Support 2 of $33.20 and Support 3 of $33.00. However, there remains a risk of a potential breakout below this level if market conditions change.

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $34.10, and if a full recovery is made, this could offer an upside potential of around 46%. However, the price could also decline.

GRAPH (Weekly): April 2024 – June 2025

Please note that past performance does not guarantee future results

EVENTS:

- FRIDAY, JUNE 6, AT 13:30 GMT+1: US NON-FARM PAYROLL (NFP) AND UNEMPLOYMENT RATE (MAY): A lower-than-expected NFP reading should be taken as positive for the silver price, because a weaker US economy could exert negative pressures on the US dollar. This data measures the change in the number of people employed during the previous month, excluding the farming industry. The data for the previous month stood at 177,000, which is lower than for the month before (228,000).

GEOPOLITICS:

- US – IRAN NUCLEAR TALKS: MIDDLE EAST TENSIONS RISE AS NO CONCRETE DEALS HAVE BEEN MADE BETWEEN THE USA AND IRAN. The latest round of talks between the US and Iran in Rome, Italy, brought no concrete agreements. Iran is still insisting on continuing its uranium enrichment program, while the USA wants zero uranium enrichment from Iran. The next and sixth round of talks is expected to take place sometime in June.

ANALYSTS’ OPINION:

- UBS: The bank targets a price of $38.

- CITIGROUP: The bank targets a price of $40.

- J.P. MORGAN: The bank targets a price of $38.

Source: Reuters, Bloomberg, CNBC

SILVER June 3, 2025

Current Price: 34.10

|

SILVER |

Weekly |

|

Trend direction |

|

|

36.00 |

|

|

35.50 |

|

|

34.90 |

|

|

33.40 |

|

|

33.20 |

|

|

33.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,000 |

14,000 |

8,000 |

-7,000 |

-9,000 |

-11,000 |

|

Profit or loss in €2 |

16,660 |

12,276 |

7,015 |

-6,138 |

-7,892 |

-9,645 |

|

Profit or loss in £2 |

14,061 |

10,361 |

5,921 |

-5,181 |

-6,661 |

-8,141 |

|

Profit or loss in C$2 |

26,088 |

19,223 |

10,985 |

-9,611 |

-12,358 |

-15,104 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 11:30 (GMT+1) 03/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.