WEEKLY TREND: UP

Fundamental Overview:

- GOLD FELL ON RISING LONG- TERM YIELDS IN THE U.S.: Gold traded around 1750 after falling on February 26 to its lowest rate since June 2020 (1717.06). Gold fell as longer- term (10 and 30 year) yields continue to rise to new multi month highs. Dollar related rising rates makes the currency more attractive, which rose on Thursday, to put further negative pressure on the Gold prices. SPECULATION: Analysts start to speculate that the Fed might need to step in and buy more of longer term government bonds to slash the yields. The Fed wants to keep rates across the curve low otherwise persistently rising yields could make a big damage especially to the housing markets as mortgage loan rates are closely related to 10- year and 30-year bond yields changes.

Other Central Banks, including the Reserve Bank of Australia, started to act making unscheduled bond purchases to suppress rising longer- term yields. - NEW STIMULUS PACKAGE OF 1.9 TRILLION DOLLARS. THE US HOUSE VOTED IN FAVOUR OF BIDEN’S STIMULUS BILL ON FRIDAY (February 26): The US Senate takes over from here. US President Joseph Biden promised to push for the 1.9 trillion-dollar aid package, with or without the Republican support. Key element: Direct payments of $1,400, on top of the $600 approved in December. The Senate approved a budget resolution clearing a path for Biden’s plan to pass without the need for Republican support. The Democrats will need a simple majority of 51 votes (They have it). The bill could be expected to be passed by March 14, 2021.

- US FEDERAL RESERVE TO CONTINUE TO PRINT MONEY: In addition, the US Federal Reserve (January 27 meeting) said it will maintain its “POWERFUL” massive asset purchasing programme (monthly 120 billion dollars) (equivalent to 1.44 trillion dollars per annum) until it sees substantial further progress in employment and inflation. The Fed did not announce policy changes, which was a bit of disappointment to some investors. The dot plot projections on interest rates said that 0.00%- 0.25% rate should stay in place until the end of 2023.

- MORE THAN 3 TRILLION DOLLARS TO BE INJECTED INTO THE U.S. ECONOMY IN 2021: Increased money supply in the U.S. is expected to increase upward pressure on inflation, which could grow hot later this year. Therefore, the US Dollar’s purchasing power could fall, while investors could be expected to seek protection with the safe- haven Gold. To this end, the markets could still expect the Gold prices to recover.

- ANALYSTS OPINION (GOLDMAN SACHS/BANK OF AMERICA/CITIGROUP): GOLDMAN SACHS has kept their target price at $2300. BANK OF AMERICA 2021 average estimate stands at $2063. CITIGROUP maintains a price target of $2300.

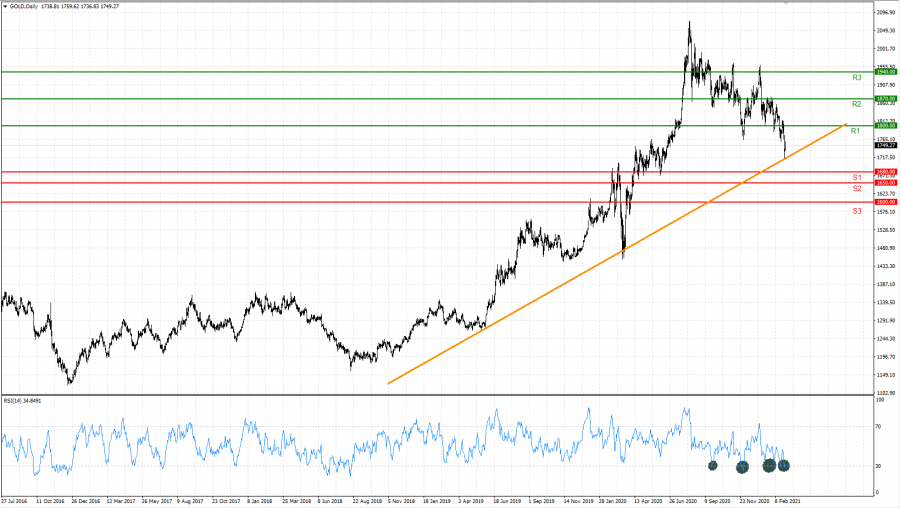

Statistical and Technical Overview

- Since it first broke above 1800 in July 2020 Gold has continued to find strong support with the area below 1800 (strong support).

- It has broken only twice below the mark of 1800, but it has always come back above 1800.

- Gold’s Daily Relative Strength Index has fallen recently to its oversold threshold of 30 to suggest a possible upward recovery.

Please note that past performance does not guarantee future performance.

Graph: (Gold, Daily)

Current Price: 1740

|

GOLD |

Weekly |

|

Trend direction |

|

|

1940 |

|

|

1870 |

|

|

1800 |

|

|

1680 |

|

|

1650 |

|

|

1600 |

Example of calculation based on trend direction for 1.00 Lot*

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

20,000.00 |

13,000.00 |

6,000.00 |

-6,000.00 |

-9,000.00 |

-14,000.00 |

|

Profit or loss in €** |

16,593.65 |

10,785.88 |

4,978.10 |

-4,978.10 |

-7,467.14 |

-11,615.56 |

|

Profit or loss in £** |

14,338.56 |

9,320.07 |

4,301.57 |

-4,301.57 |

-6,452.35 |

-10,036.99 |

|

Profit or loss in C$** |

25,385.40 |

16,500.51 |

7,615.62 |

-7,615.62 |

-11,423.43 |

-17,769.78 |

* 1.00 lot is equivalent of 100 units

** Calculations for exchange rate used as of 9:09 (GMT) 01/03/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details