WEEKLY TREND: UP

Fundamental Overview:

- President Joseph Biden asked the US Congress for additional $1.9 trillion. The U.S. Congress has already approved a $900 billion coronavirus aid package in late 2020. In January, President Joseph Biden laid out a proposal worth 1.9 trillion dollars to boost the US economy. President Elect Joseph Biden wants to increase the recently enacted $600 rebate checks to $2,000 per person. The new money coming in (high money supply) could devalue the US currency due to high inflationary expectations, which in turn could have a positive impact on the dollar-denominated Gold and Silver.

- MORE THAN 3 TRILLION DOLLARS TO BE INJECTED INTO THE U.S. ECONOMY IN 2021: The US Dollar’s purchasing power could fall, while investors should be expected to seek protection with the safe- haven Gold. To this end, the markets could still expect the Gold and Silver prices to recover.

- INDUSTRIAL USE RISES: Silver is the best electrical and thermal conductor of all the metals, and so it is used in industrial fabrication, including electrical applications such as conductors, switches, contacts and fuses.

Global silver demand is forecast to reach 1 billion oz in 2021, its highest in 8 years, rising 11% year-on-year and marking an eight-year high, largely driven by industrial end-users. Industrial demand is projected to increase by 9% year-on-year to 510 moz this year (source: The Silver Institute).

Today silver is invaluable to batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, photography, photovoltaic (or solar) energy, solder and brazing alloys, RFID chips (for tracking parcels or shipments worldwide), semiconductors, touch screens, water purification, wood preservatives and many other industrial uses.

The launch of 5G technology in consumer electronics expected to boost silver demand. In a future 5G connected world, silver will be a necessary component in almost all aspects of this technology. With the distribution of 5G in the coming years, silver’s role in the electronic applications used in 5G is forecast to rise significantly to approximately 16 million oz by 2025 and as much as 23 million oz by 2030, which would represent a 206% increase over today. - 2021 OUTLOOK: The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 %. (source: The Silver Institute)

- ANALYSTS OPINION (GOLDMAN SACHS): GOLDMAN SACHS increased its price target to $33 per ounce.

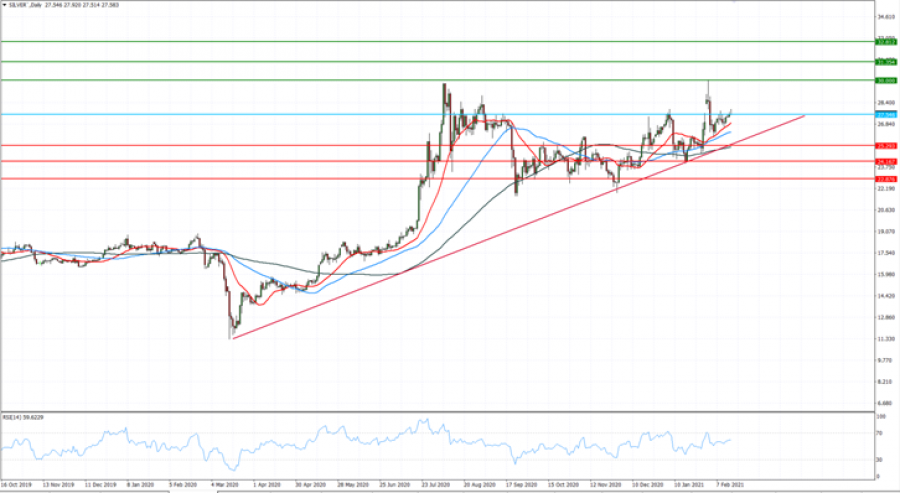

Graph: (Silver, Daily)

Current Price: 27.54

|

SILVER |

Weekly |

|

Trend direction |

|

|

32.81 |

|

|

31.35 |

|

|

30.00 |

|

|

25.29 |

|

|

24.17 |

|

|

22.87 |

Example of calculation based on weekly trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

52,700.00 |

38,100.00 |

24,600.00 |

-22,500.00 |

-33,730.00 |

-46,700.00 |

|

Profit or loss in €** |

43,438.84 |

31,404.55 |

20,276.95 |

-18,545.99 |

-27,802.51 |

-38,493.24 |

|

Profit or loss in £** |

37,879.88 |

27,385.64 |

17,682.07 |

-16,172.62 |

-24,244.56 |

-33,567.18 |

|

Profit or loss in C$** |

66,610.69 |

48,156.88 |

31,093.42 |

-28,439.10 |

-42,633.37 |

-59,026.93 |

* 1.00 lot is equivalent of 10,000 units

** Calculations for exchange rate used as of 8:15 (GMT) 16/02/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details