Special Report: USA500

Date: January 4, 2023

WEEKLY TREND: UP

US STOCK MARKETS

- STOCK MARKET TREND DEFINITION

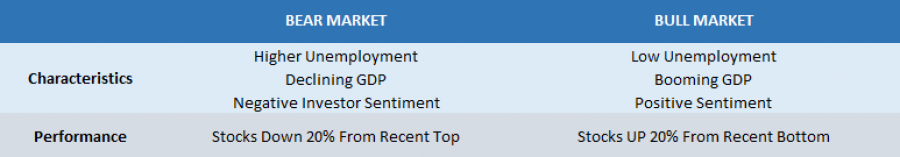

BEAR MARKET: DEFINITION. According to Forbes, economists define a bear market as a decline of 20% or more of a major stock market index, such as the S&P 500, for a sustained period. SENTIMENT: During a bear market, market sentiment is poor. Investors are pessimistic about the stock market’s prospects, making them more likely to sell assets than hold them.

BULL MARKET: DEFINITION. While bear markets signal a time of pessimism and economic decline, a bull market is defined by optimism and economic growth. A bull market is a period when stock prices are rising and investor sentiment is positive. During a bull market, stocks in a broad market index increase in value by 20% or more.

Table: Bear and Bull Market Characteristics

Data Source: Forbes

USA500 INDEX

- THE CASE OF THE USA500 INDEX

BEAR MARKET CONFIRMED on May 20, 2022. The Index fell 20% from 4807.82 (January 2, 2022) to 3846.25 (May 15, 2022). The market has been there for the past 11- 12 months, having a maximum drop of 27.16% (October 13, 2022).

BEAR MARKET BOTTOM: October 13, 2022. The Index fell to 3502.08 by October 13, 2022, marking a total decline of 27.16% from its recent top of 4807.82 (January 2, 2022).

INDEX HAS RISEN 9.93% FROM RECENT BOTTOM: January 4, 2023. The index currently trades around 3850. If it adds 9% more, it will then confirm the index is in a new Bull Market. However, the price could decline further.

- MOST RECENT RECOVERY FOLLOWING A BEAR MARKET (USA500):

2020 (COVID PANDEMIC DECLINE): After the pandemic decline of 34%, testing the rate of 2170.25 (March 22, 2020), the index had risen around 121.5% to its most recent all time high of 4807.82 (January 2, 2022).

2007- 2008 (GLOBAL FINANCIAL CRISIS): After a decline of around 57%, testing the rate of 665.75 (March 1, 2009), the index trended up in a strong bull run to add around 410% until the Covid Pandemic Crisis (February 16, 2020 to reach the level of 3397.08).

However, please note that past performance does not guarantee future results.

STOCK MARKET TRENDS

- THE JANUARY EFFECT:

According to Investopedia, The January Effect is a market anomaly whereby stock prices may tend to rise in the first month of the year.

However, please note that past performance does not guarantee future results.

JANUARY ECONOMIC CALENDAR

- EVENT (Friday, January 6 at 13:30 GMT): US NONFARM PAYROLLS AND UNEMPLOYMENT RATE (December). NFP is expected to come in at 220,000, while the unemployment rate at 3.7% (unchanged).

- EVENT (Thursday, January 12 at 13:30 GMT): US INFLATION (December). US inflation in November fell to 7.1%. December Inflation is expected to show a decrease to 6.7% (according to Bloomberg estimates).

- EVENT (JANUARY 13): US QUARTERLY (Q4) EARNINGS SEASON STARTS. US inflation in November fell to 7.1%. December Inflation is expected to show a decrease to 6.7% (according to Bloomberg estimates). Falling inflation is expected to further encourage the US Federal Reserve to finish the current rate hike cycle at the end of Q1 of 2023.

- EVENT (FEBRUARY 1): US FEDERAL RESERVE INTEREST RATE DECISION. FEDERAL RESERVE raised interest rates as expected by 0.50% points to 4.50% in December. The markets also expect that the Fed will close the current hike cycle by the end of Q1 of 2023, raising the benchmark interest rate to terminal 5.00%.

Current Price: 3850

|

USA500 |

Weekly |

|

Trend direction |

|

|

4200 |

|

|

4100 |

|

|

3980 |

|

|

3740 |

|

|

3700 |

|

|

3660 |

Example of calculation based on weekly trend direction for 1 Lot1

|

USA500 |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

3,500 |

2,500 |

1,300 |

-1,100 |

-1,500 |

-1,900 |

|

Profit or loss in €2 |

3,296 |

2,354 |

1,224 |

-1,036 |

-1,413 |

-1,789 |

|

Profit or loss in £2 |

2,901 |

2,072 |

1,077 |

-912 |

-1,243 |

-1,575 |

|

Profit or loss in C$2 |

4,743 |

3,388 |

1,762 |

-1,491 |

-2,033 |

-2,575 |

1. 1.00 lot is equivalent of 10 units

2. Calculations for exchange rate used as of 09:31 (GMT) 4/1/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail