The Eurodollar fell sharply last week after Eurozone interest rates remained at 4.5%. ECB head Lagarde signaled that a rate cut in June may take place.

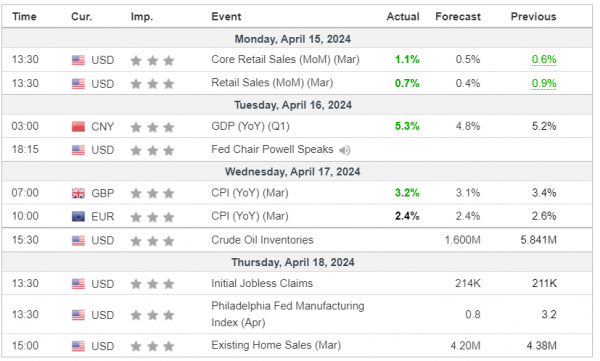

The British pound dollar pair also ended the week firmly lower following higher than expected US Inflation data on Wednesday. The Fed, which was previously expected to cut interest rates in June, is now expected to cut rates in the second half of the year.

The USD/JPY hit a 34 year low last week as the dollar strengthened against its peers. Japanese Finance Minister Suzuki was the latest official to state that the country might intervene in the markets to support the yen’s value.

Gold continued its push higher last week as the precious metal recorded another series of all-time highs. Market focus was on an expected attack upon Israel, amid threats from Iran that the country may also block shipping traffic in the Strait of Hormuz.

Stock indexes declined as hopes for a June interest rate cut faded. Apple’s stock price climbed after the company revealed an AI chip will be built into its flagship iPhone 17, to be released next year.

Oil prices saw high volatility last week as traders nervously awaited a fresh spike in Middle Eastern tensions. Prices inched lower by close of business on Friday after rising US inventories and a stronger dollar put pressure on crude.