Amazon (#AMAZON) weekly special report based On 1 Lot Calculation:

GLOBAL E-COMMERCE:

- MARKETS SIZE (EXPECTED: $7.3 TRILLION IN 2025, UP 30% FROM 2022): The global e-commerce market is forecast to be over $7.3 trillion in 2025, compared to 2021’s $4.921 trillion. E- commerce worldwide could be expected to represent 24.5% of all global sales IN 2025, up from 19.6% in 2021 and 17.8% in 2020.

- MARKET SHARE BY COMPANY AND BY SALES: Amazon accounts for 13% and Alibaba 24% of the global e- commerce market. JD.com claimed 9.20% of the market.

US E-COMMERCE:

- MARKET GROWTH POTENTIAL (TO INCREASE BY 2025 TO $2.05 FROM CURRENT $1.4 TRILLION): U.S. e-commerce value could be expected to grow at a strong average growth rate (annually) of 10% between 2021 and 2025 to reach US$2.05 trillion in 2025. That would be 28% of estimated global e- commerce sales of $7.3 trillion in 2025.

- MARKET SHARE: Amazon is the largest online retailer in the US with 37.8% market share. Walmart is second capturing 6.3%, while Apple and eBay cover 3.9% and 3.5% respectively. Amazon Web Services dominate the cloud markets with 34% market share, ahead of Microsoft Azure (24%), Google Cloud (10%) and Alibaba Cloud (5%). The Cloud industry could be expected to grow at a compounded annual growth rate at 17.9% until 2028, to $791.49B, with Amazon Web Services set to maintain dominance. If Amazon Web Services maintains its 34% market share, it could generate $269B revenue per year from 2028.

AMAZON (ANALYSIS AND EVENTS)

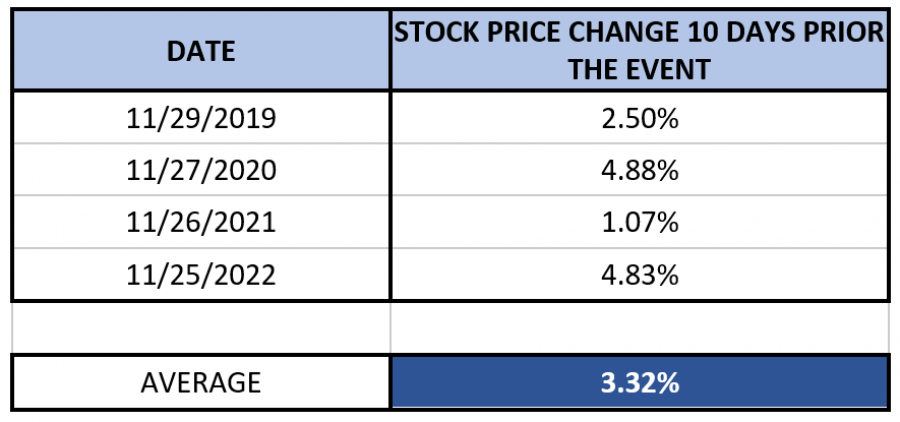

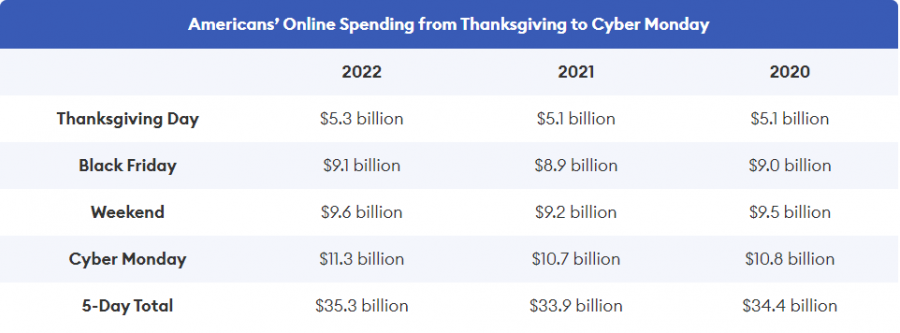

- EVENT (November 17-24): BLACK FRIDAY. Amazon announced that its Black Friday event will start Friday, November 17 giving customers more days to shop than last year’s event. Black Friday promotions traditionally result in a spike in sales. In 2022, despite inflation, sales reached a staggering $9.12 billion, setting a new record high. In 2022, the numbers went up to 2.3% comparing the year before. Out of total sales, Amazon accounted for 21% of total Black Friday sales.

Source: MT4

*Please note, that past performance does not guarantee future performance.

- EVENT (November 25-27): CYBER MONDAY. In 2022, Cyber Monday registered a whopping $11.3 billion at a 5.8% rise compared to 2021. Cyber Monday is following Thanksgiving and it is also known for online shopping deals and promotions.

According to the statistics, Amazon’s average stock price rise in November for the last 10 years is 3.93%.

Source: MT4

*Please note, that past performance does not guarantee future performance.

PRICE ACTION

- AMAZON STOCK TRADES AROUND 24% BELOW ITS ALL- TIME HIGH OF $188.65 (September 30, 2021). The stock currently trades around $142.5 and If a full recovery follows, the stock could increase around 31.4%. However, the price could decline further.

- ANALYST OPINION: Tigress Financial targets $210. Wedbush’s price target is $180. UBS is targeting $178. Barcleys is targeting $190.

(#AMAZON) November 13, 2023

Current Price:142.50

|

Amazon |

Weekly |

|

Trend direction |

|

|

200.00 |

|

|

180.00 |

|

|

153.50 |

|

|

132.00 |

|

|

125.00 |

|

|

118.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Amazon |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

5,750.00 |

3,750.00 |

1,100.00 |

-1,050.00 |

-1,750.00 |

-2,450.00 |

|

Profit or loss in €² |

5,379.59 |

3,508.43 |

1,029.14 |

-982.36 |

-1,637.27 |

-2,292.17 |

|

Profit or loss in £² |

4,694.32 |

3,061.51 |

898.04 |

-857.22 |

-1,428.71 |

-2,000.19 |

|

Profit or loss in C$² |

7,939.80 |

5,178.13 |

1,518.92 |

-1,449.88 |

-2,416.46 |

-3,383.05 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:30 (GMT+1) 13/11/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail.