META (#FACEBOOK) weekly special report based on 1 Lot Calculation:

META (FACEBOOK): ARTIFICIAL INTELLIGENCE WORLD

- META A.I.: According to META, built with Meta Llama 3, Meta AI is one of the world’s leading AI assistants, already on phones, in pockets for free, and it is starting to go global with more features. One can use Meta AI on Facebook, Instagram, WhatsApp, and Messenger to get things done, learn, create and connect with the things that matter.

- META A.I. EXPANSION: Since its debut in September 2023, Meta AI has expanded into more than 22 countries, including the US, Australia, and India. Meta AI will be available in 43 countries and in a dozen languages soon.

- META STOCK belongs to the two most important US stock indices, including the NASDAQ 100 (USA100) index and the S&P 500 (USA500) index.

META (FACEBOOK): EVENTS

- EVENT (WEDNESDAY, OCTOBER 29, AFTERMARKET): Q3 EARNINGS REPORT. The company is expected to print $49.491 billion in revenue (a new record high), up around 21.9% from the same period last year ($40.589 billion). The company is expected to report a net income of $19.386 billion, up around 39.2% from the same period last year ($15.694 billion). Also, the company is expected to report Earnings Per Share (EPS) of $8.27, up around 37.04% from the same period last year ($6.03). FORWARD GUIDANCE (Q4): The company is expected to project $57.377 billion revenue for Q4 of 2025, which would mark another new record high and an increase of around 18.6% year on year.

- REVENUE AND EARNINGS PERFORMANCE: META TENDS TO BEAT ESTIMATES. Over the past eight quarters, the company has beat Earnings Per Share (EPS) estimates 8 times over the past 8 quarters, and similarly Meta has managed to beat revenue estimates 8 times over the past 8 quarters.

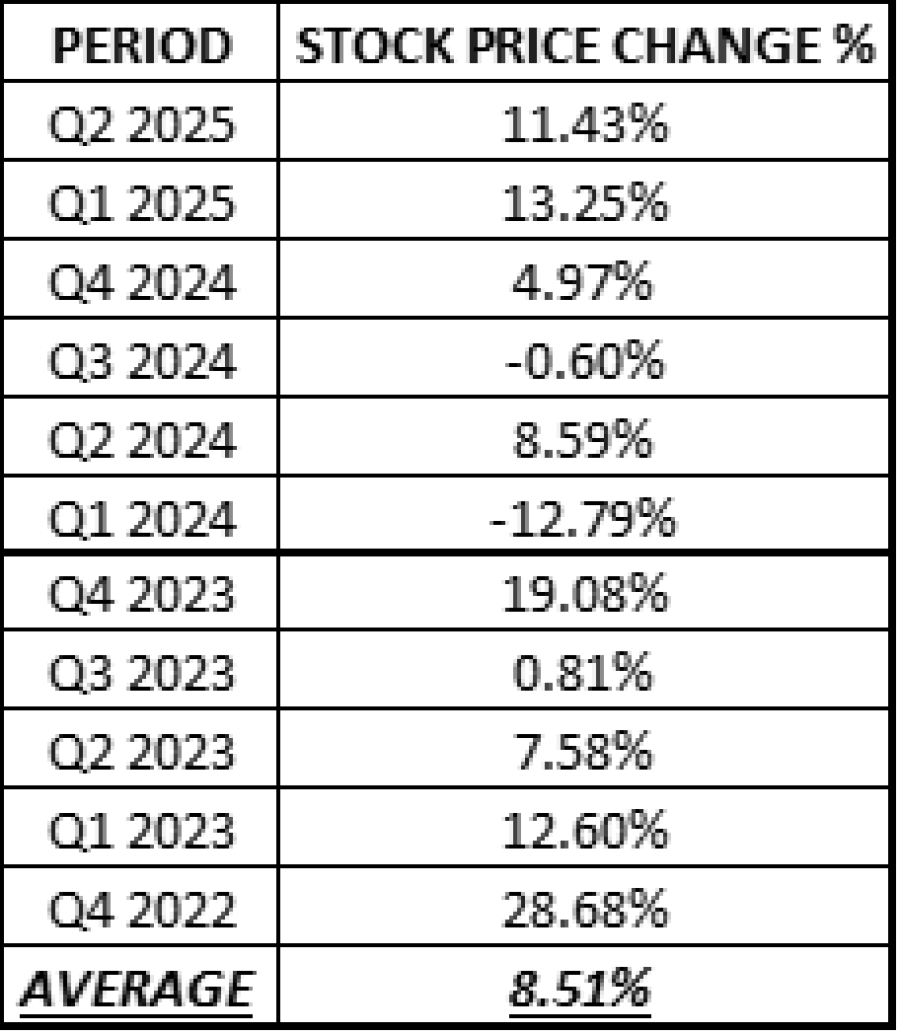

- STATISTICS (SINCE THE A.I. BOOM BEGAN IN LATE 2022): META STOCK PRICE ROSE ON AVERAGE 8.51% WITHIN A WEEK AFTER THE QUARTERLY EARNINGS RELEASE.

Data Source: MetaTrader4

Please note that past performance does not guarantee future results

META (FACEBOOK): TECHNICAL ANALYSIS

- META STOCK PRICE ABOVE 20- AND 100-DAILY MOVING AVERAGES: Meta stock price has remained above its 20- and 100-day moving averages, indicating an uptrend. The trend could reverse if Meta stock price goes below these averages.

GRAPH (Daily): March 2025 – October 2025

Please note that past performance does not guarantee future results

META (FACEBOOK): PRICE ACTION

- THE STOCK PRICE HIT AN ALL-TIME HIGH OF $794.18 ON AUGUST 15TH, 2025. The stock price currently trades around $730, suggesting a potential upside of around 8.8% should it return to its previous record high.

- ANALYST OPINION: Rosenblatt forecasts $1086, Deutsche Bank forecasts $930, Jefferies forecasts $950, Wedbush forecasts $920, Citi forecasts $915, and JP Morgan forecasts $875, Cantor Fitzgerald forecasts $920.

#FACEBOOK, October 22, 2025.

Current Price: 730

|

|

Weekly |

|

Trend direction |

|

|

900 |

|

|

850 |

|

|

790 |

|

|

680 |

|

|

670 |

|

|

660 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

|

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

170,000 |

120,000 |

60,000 |

-50,000 |

-60,000 |

-70,000 |

|

Profit or loss in €² |

146,740 |

103,581 |

51,791 |

-43,159 |

-51,791 |

-60,422 |

|

Profit or loss in £² |

127,543 |

90,031 |

45,015 |

-37,513 |

-45,015 |

-52,518 |

|

Profit or loss in C$² |

238,490 |

168,346 |

84,173 |

-70,144 |

-84,173 |

-98,202 |

- 1.00 lot is equivalent of 1 000 units

- Calculations for exchange rate used as of 12:45 (GMT+1) 22/10/2025

There is a possibility to use Stop-Loss and Take-Profit

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit