GOLD weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

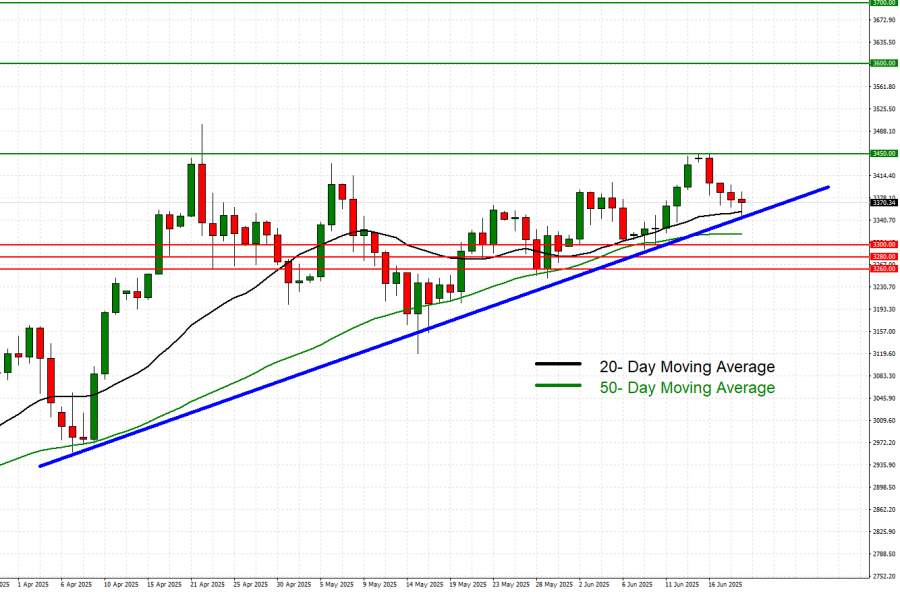

- DAILY MOVING AVERAGES POINT TO AN UPTREND: Gold prices have remained above the 20 - and 50-day moving Averages, pointing to an ongoing uptrend. However, gold prices can also change their trend if prices fall below the 20 - and 50 - day moving averages.

- MID–TERM UPTREND: As depicted by the daily chart below, the gold price has kept trading above the mid-term blue-lined uptrend line, confirming its mid-term trend is up. However, there remains a risk of a potential breakout below this level if market conditions change.

- GOLD HIT A NEW ALL-TIME HIGH OF $3,499.76 (April 22, 2025). Gold has traded around $3,371, and if a full recovery takes place, the price of Gold could rise around $130. Although the price could decline as well.

GRAPH (Daily): April 2025 – June 2025

Please note that past performance does not guarantee future results

GEOPOLITICS:

- MIDDLE EAST TENSIONS KEPT RISING: The possibility of the US entering the Israel – Iran conflict is becoming higher by the day, with the USS Nimitz aircraft carrier group approaching the Middle – Eastern theatre to reinforce the USS Carl Winston carrier group already operating in the area. Furthermore, 17 US air tanker and squadrons of F-22A Raptors and F-25As have also been deployed.

EVENTS:

- MONDAY, JUNE 23 AT 14:45 GMT+1: US MANUFACTURING PURCHASING MANAGERS INDEX (JUNE). A lower-than expected result should be positive for Gold because it could signal more interest rate cuts by the FED. This data measures the activity level of purchasing managers in the manufacturing sector. The result for the previous month stands at 52.0 which is higher than for the month before (50.2).

- TUESDAY, JUNE 24 AT 15:00 GMT+1: FEDERAL RESERVE CHAIR JEROME POWELL TESTIMONY BEFOR U.S. CONGRESS. According to Bloomberg, Federal Reserve Chair Jerome Powell will deliver semi-annual testimony to the House Financial Services Committee on June 24. Jerome Powell will appear before Congress again on Wednesday (June 25) at 15:00 GMT+1.

- THURSDAY, JUNE 26 AT 13:30 GMT+1: GROSS DOMESTIC PRODUCT (GDP) (Q1) (third reading). A lower-than-expected result should be supportive for gold, because it will motivate the FED to conduct a more aggressive interest rate cut policy in order to stimulate the economy. This data measures the annualized change in the inflation-adjusted value of goods and services produced by the economy. According to the second reading published in May, the results for Q1 stood at -0.2% which is lower than the result for the previous quarter (2.4%).

ANALYSTS’ OPINION:

- CITIGROUP has a price target of $3,500

- J.P. MORGAN has a price target of $3,675.

- GOLDMAN SACHS has a price target of $3,700.

- UBS has a price target of $3,500.

Source: Reuters, Bloomberg, CNBC

GOLD, June 19, 2025

Current Price: 3,370

|

GOLD |

Weekly |

|

Trend direction |

|

|

3,700 |

|

|

3,600 |

|

|

3,450 |

|

|

3,300 |

|

|

3,280 |

|

|

3,260 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

33,000 |

23,000 |

8,000 |

-7,000 |

-9,000 |

-11,000 |

|

Profit or loss in €2 |

28,763 |

20,047 |

6,973 |

-6,101 |

-7,845 |

-9,588 |

|

Profit or loss in £2 |

24,586 |

17,135 |

5,960 |

-5,215 |

-6,705 |

-8,195 |

|

Profit or loss in C$2 |

45,250 |

31,538 |

10,970 |

-9,598 |

-12,341 |

-15,083 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:30 (GMT+1) 19/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.