Palladium weekly special report based on 1.00 Lot Calculation:

PALLADIUM USE AND MARKET SHARE:

- Palladium is mostly used in catalytic converters by the car industry to reduce harmful gas emissions, while tightening regulations are forcing automakers to put more Palladium into each vehicle, which in turn could keep the demand outlook positive. Palladium has also been used in fuel cells to generate power.

- MARKET SHARE (PRODUCERS): Russia is the largest producer, holding 43% of the market, while South Africa is the second largest with 33.00% of the market. Canada is third on the list with 9.5% of the global production.

- MARKET SHARE (CONSUMERS): China is the largest Palladium consumer with 31%, while Europe and North America (USA) hold 20% each. Japan stands at 11%.

TECHNICAL ANALYSIS:

- CURRENT UPTREND CHANNEL: Palladium has been moving upwardly within a consistent uptrend channel since early April 2025.

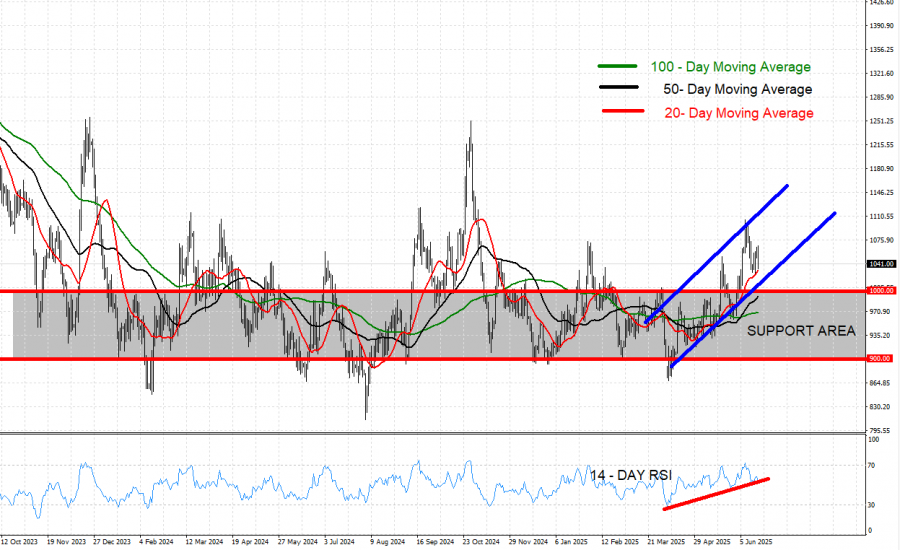

- SUPPORT AREA: $1,000 - $900. According to the daily chart below, Palladium has maintained a strong support area in the region between $1,000 and $900, which has been the case since November 2023.

- DAILY MOVING AVERAGES POINT TO UPTREND: Palladium prices have recently traded above the 20-, 50-, and 100-Daily Moving Averages, pointing to an ongoing uptrend. However, Palladium prices can also change their trend if prices fall below the 20-, 50-, and 100-Daily Moving Averages.

- 14- DAY RELATIVE STRENGTH INDEX (RSI) POINTS TO UPTREND: The index has been upward-sloping since March this year, and it currently trades above the neutral point of 50, indicating an uptrend. Although, this could change should the index drops back below the neutral point of 50.

- PALLADIUM HIT AN ALL-TIME HIGH OF $3,409 (MARCH 2022). Palladium trades around $1,033, and if the price of Palladium moves to the level of $3,409, this would be around 230% of a price change. However, the price could decline.

GRAPH (Daily): November 2023 – June 2025

Please note that past performance does not guarantee future results

EVENTS (USA):

- MONDAY, JUNE 23 AT 14:45 GMT+1: US MANUFACTURING PMI (JUNE). A lower-than expected result should be positive for palladium because it could signal more interest rate cuts by the FED. This data measures the activity level of purchasing managers in the manufacturing sector. The result for the previous month stands at 52.0 which is higher than for the month before (50.2).

- TUESDAY, JUNE 24 AT 15:00 GMT+1: FEDERAL RESERVE CHAIR JEROME POWELL TESTIMONY BEFORE U.S. CONGRESS. According to Bloomberg, Federal Reserve Chair Jerome Powell will deliver semi-annual testimony to the House Financial Services Committee on June 24. Jerome Powell will appear before Congress again on Wednesday (June 25) at 15:00 GMT+1.

- THURSDAY, JUNE 26 AT 13:30 GMT+1: GROSS DOMESTIC PRODUCT (GDP) (Q1) (third reading). A lower-than-expected result should be supportive for palladium, because it will motivate the FED to conduct a more aggressive interest rate cut policy in order to stimulate the economy. This data measures the annualized change in the inflation-adjusted value of goods and services produced by the economy. According to the second reading published in May, the results for Q1 stood at -0.2% which is lower than the result for the previous quarter (2.4%).

EVENTS (CHINA):

- MONDAY, JUNE 30 AT 02:30 GMT+1: CHINA MANUFACTURING PMI (JUNE). The index that measures the Chinese manufacturing activity grew in May to 49.5, up from April 49. If the trend continues in June, Palladium prices could be expected to see some upward pressure as growing manufacturing activity in China, the largest palladium consumer in the world, improves the demand outlook for Palladium. (Previous: 49.5)

PALLADIUM, June 19, 2025

Current Price: 1,033

|

PALLADIUM |

Weekly |

|

Trend direction |

UP |

|

Resistance 3 |

1,200 |

|

Resistance 2 |

1,150 |

|

Resistance 1 |

1,090 |

|

Support 1 |

980 |

|

Support 2 |

960 |

|

Support 3 |

950 |

Example of calculation base on weekly trend direction for 1.00 Lot1

PALLADIUM

|

Pivot Points |

||||||

|

Profit or loss in $ |

16,700 |

11,700 |

5,700 |

-5,300 |

-7,300 |

-8,300 |

|

Profit or loss in €2 |

14,547 |

10,191 |

4,965 |

-4,617 |

-6,359 |

-7,230 |

|

Profit or loss in £2 |

12,428 |

8,707 |

4,242 |

-3,944 |

-5,433 |

-6,177 |

|

Profit or loss in C$2 |

22,906 |

16,048 |

7,818 |

-7,269 |

-10,013 |

-11,384 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 14:15 (GMT+1) 19/6/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.