Palladium weekly special report based on 1.00 Lot Calculation:

PALLADIUM WORLD MARKET SHARE:

- MARKET SHARE (PRODUCERS): Russia is the largest producer, holding 43% of the market, while South Africa is the second largest with 33.00% of the market.

- MARKET SHARE (EXPORTS): Russia is the largest exporter in the world, responsible for 23% of total global exports.

- MARKET SHARE (CONSUMERS): China is the largest Palladium consumer with 31%, while Europe and North America (USA) hold 20% each.

TECHNICAL ANALYSIS:

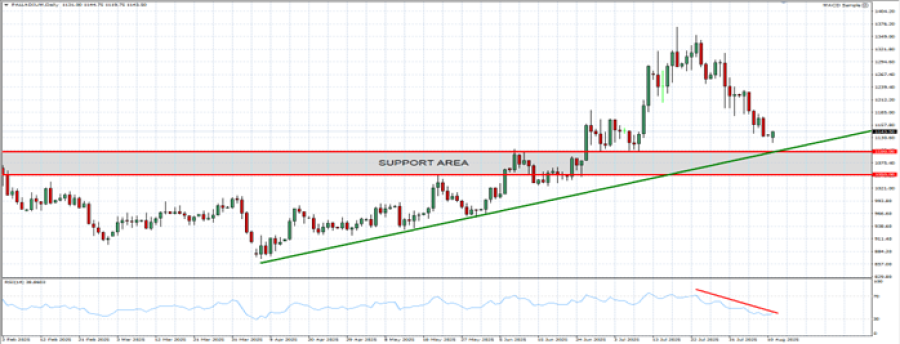

- LONG-TERM UPTREND SINCE APRIL 2025: As shown in the daily chart below, palladium has been in a steady uptrend, supported by a rising diagonal trend line (green) since April 2025. However, the price could decline.

- SUPPORT AREA: $1100 - $1050. Palladium prices have maintained a strong support zone between $1050 and $1100.

- 14-DAY RELATIVE STRENGTH INDEX (RSI) POINTS TO POTENTIAL RECOVERY: According to the daily chart below, the 14-Day RSI is trading near the 30 level, a threshold for an oversold territory, reflecting weaker recent price performance. Therefore, a price recovery could be expected next, although prices could go in the other direction as well.

- PALLADIUM PRICE HAS TESTED ITS LOWEST PRICE IN ONE MONTH ($1119.75): After the most recent pullback of palladium prices, losing more than 17% over the past 18 days, palladium prices have tested their lowest levels in one month ($1119.75).

- PALLADIUM HIT AN ALL-TIME HIGH OF $3,409 (March 2022): Palladium price has traded around $1160, and if a full recovery takes place, the price of palladium could see an upside of around 190%. Although the price could decline as well.

GRAPH (Daily): February 2025 – August 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: RUSSIA – UKRAINE WAR

- EVENT (FRIDAY, AUGUST 15): U.S. PRESIDENT TRUMP AND RUSSIAN PRESIDENT PUTIN MEETING IN ALASKA (USA). Following earlier threats of 100% secondary tariffs on countries importing Russian goods if no Russia–Ukraine ceasefire was reached by August 8, President Trump will now meet with President Putin in Alaska to discuss ending the conflict. Talks are expected to focus on potential territorial swaps, but with Russia demanding recognition of control over occupied territories, and Ukraine firmly rejecting those demands, markets see little chance of meaningful progress. Given Russia’s position as the world’s largest palladium supplier, continued war stalemate heightens the risk of new sanctions or trade restrictions, which could disrupt global supply chains and support higher palladium prices.

EVENTS:

- TUESDAY, AUGUST 12 AT 13:30 GMT+1: US INFLATION (CPI) (JULY). A lower than expected reading should be positive for Gold, because it could point to the FED cutting interest rates sooner and more aggresively. This index measures the change in the price of goods and services from the perspective of the consumer. The data for the previous month (June) came in at 2.7%.

- FRIDAY, AUGUST 15 AT 03:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (JULY): A strong result in China’s industrial production would reinforce optimism for palladium demand, as expanding factory and manufacturing output typically drives higher consumption in the automotive sector where palladium plays a vital role in catalytic converters. With China being the world’s largest consumers of the metal, continued industrial growth would further support the bullish momentum in palladium prices.

Palladium, August 12, 2025.

Current Price: 1,160

|

PALLADIUM |

Weekly |

|

Trend direction |

|

|

1,400 |

|

|

1,300 |

|

|

1,230 |

|

|

1,100 |

|

|

1,075 |

|

|

1,050 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

PALLADIUM |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

24,000 |

14,000 |

7,000 |

-6,000 |

-8,500 |

-11,000 |

|

Profit or loss in €² |

20,674 |

12,060 |

6,030 |

-5,168 |

-7,322 |

-9,476 |

|

Profit or loss in £² |

17,833 |

10,403 |

5,201 |

-4,458 |

-6,316 |

-8,173 |

|

Profit or loss in C$² |

33,091 |

19,303 |

9,652 |

-8,273 |

-11,720 |

-15,167 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:10 (GMT+1) 12/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.