PFIZER special report based On 1.00 Lot Calculation:

GLOBAL PHARMACEUTICAL INDUSTRY:

-

THE GLOBAL PHARMACEUTICAL INDUSTRY IS CURRENTLY WORTH ~$1.11T: According to the most recent reports, the Pharmaceutical industry is worth approximately $1.11T. The pharmaceutical industry is one of the largest industries in the world, which provides products that deal with infectious diseases and various illnesses.

-

MARKET POTENTIAL: THE PHARMACEUTICAL INDUSTRY IS EXPECTED TO GROW TO A $2.13T DOLLAR MARKET BY 2026: Some analysts are forecasting, that at the current rate of growth, the pharmaceutical industry could be expected to reach $2.13trillion in value. This represents an industry compounded annual growth of 7.7% a year.

-

MARKET SHARE: Pfizer 9%, Roche 6%, Johnson and Johnson 5% and AbbVie holds 5%.

PFIZER: THE COMPANY AND OTHER ANALYSIS

-

Pfizer Inc. is one of the world’s largest pharmaceutical companies. It produces medicines, vaccines, medical devices, and other healthcare products for the entire globe. It is a research-based pharmaceutical company that develops medicines for cardiovascular health, metabolism, oncology, immunology, and other ailments 40% of its revenue is from the United States.

-

LATEST PRODUCT NEWS: PFIZER OBESITY DRUG IN PHASE 2 TRIALS, EXPECTED DATA BY THE END OF 2023, AS COMPANY AIMS TO TACKLE OBESITY PROBLEM IN AMERICA, WHERE 41.9% OF ADULTS ARE OBESE: Pfizer is currently developing an obesity drug that is in phase 2 trials. According to reports, the market for oral obesity pills is worth around $100B, with Pfizer aiming to capitalize on the market.

-

PFIZER TO CUT COSTS AS PART OF $3.5B COST CUTTING PLAN IN ORDER TO BOOST EFFICIENCY: Pfizer has engaged in a cost cutting plan in order to improve the company’s efficiency, while also reallocating capital to more profitable projects. The move could improve Pfizer’s net income and sentiment around the stock.

PFIZER: SEASONAL WINTER PERIOD

-

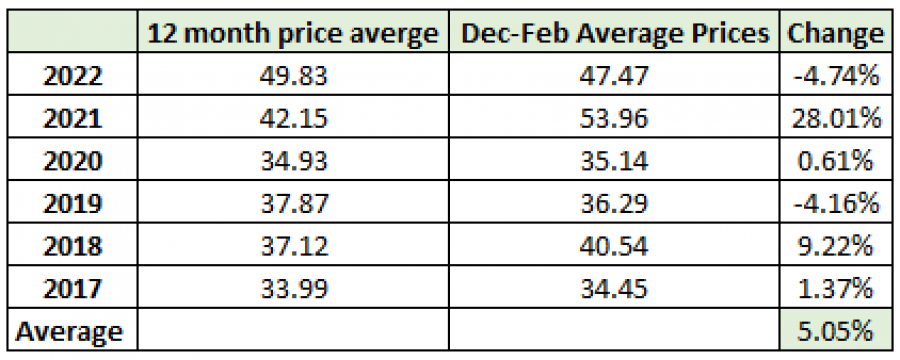

STATISTICS (2017- 2022): PFIZER HAS HISTORICALLY EXHIBITED SEASON PRICING OVER THE FLU SEASON, BETWEEN DECEMBER AND FEBRUARY:

SOURCE: BLOOMBERG

Please note that past performance does not guarantee future results.

TECHNICAL ANALYSIS:

-

The Pfizer stock chart indicates a long term support level around $30. The stock is currently trading in the support zone and may be deeply oversold. The stock is currently trading at its lowest levels since 2020.

SOURCE: MT4

-

STOCK PRICE ACTION: Pfizer’s stock reached an all-time high of $61.25 on December 16th, 2021. The price would need to rise over 104% to reach that level again.

-

ANALYST OPINIONS: The consensus price target on Bloomberg is $39.80. Goldman Sachs set a price target of $48. HSBC is targeting $45, while Morningstar is targeting $48 a share.

(#PFIZER), November 22, 2023

Current Price: 30.00

|

Pfizer |

Weekly |

|

Trend direction |

|

|

48.00 |

|

|

42.00 |

|

|

35.00 |

|

|

25.00 |

|

|

22.00 |

|

|

20.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pfizer |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

18,000.00 |

12,000.00 |

5,000.00 |

-5,000.00 |

-8,000.00 |

-10,000.00 |

|

Profit or loss in €2 |

16,515.13 |

11,010.08 |

4,587.53 |

-4,587.53 |

-7,340.06 |

-9,175.07 |

|

Profit or loss in £2 |

14,364.89 |

9,576.59 |

3,990.25 |

-3,990.25 |

-6,384.40 |

-7,980.50 |

|

Profit or loss in C$2 |

24,671.88 |

16,447.92 |

6,853.30 |

-6,853.30 |

-10,965.28 |

-13,706.60 |

-

1.00 lot is equivalent of 1000 units

-

Calculations for exchange rate used as of 10:45 (GMT) 22/11/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

-

You may wish to consider closing your position in profit, even if it is lower than suggested one.

-

Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more details.