SILVER weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

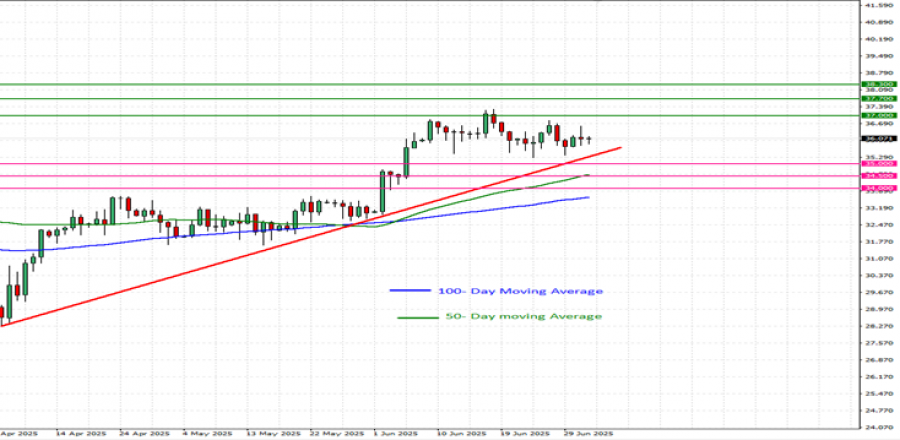

- DAILY MOVING AVERAGES POINT TO AN UPTREND: Silver prices have remained above the 50 - and 100-day moving averages, pointing to an ongoing uptrend. However, silver prices can also change their trend if prices fall below the 50 - and 100 - day moving averages.

- MID–TERM UPTREND: As depicted by the daily chart below, the silver price has kept trading above the mid-term red-lined uptrend line, confirming its mid-term trend is up. However, there remains a risk of a potential breakout below this level if market conditions change

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, Silver trades around $36.00 and if full recovery is made this could offer an upside potential of around 38%. However, the price could decline.

GRAPH (Daily): April 2025 – July 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: US TAX CUT BILL

- BREAKING (JULY 1): U.S. SENATE PASSED TRUMP’S BIG TAX CUT BILL; THE BILL IS HEADED BACK TO THE U.S. HOUSE THAT COULD BE VOTED ON WEDNESDAY (JULY 2). The legislation now heads to the House of Representatives for possible final approval. It will need to pass back through the House after the Senate before heading to the president’s desk, which Trump wants to have it signed by July 4th. Reminder, Trump’s Republicans hold a majority of 220-213 in the U.S. House.

- ANALYSTS’ OPINION: The bill is expected to provide tax cuts of around 3.3 trillion dollars, and provide the US the possibility to increase their debt by another, near, 4 trillion dollars. The measure has been putting negative pressure on the US dollar, which in turn provides support to the silver prices.

EVENTS:

- WEDNESDAY, JULY 2, AT 13:15 GMT+1: US ADP NONFARM EMPLOYMENT CHANGE (JUNE). The report gives figures on non-farm, private employment change. Data in May printed the lowest figures since December 2020 (37,000), missing analysts’ expectations as well. If employment market data continue to show weak numbers, chances for the US Federal Reserve to cut interest rates sooner than later could rise, putting negative pressure on the US dollar, while supporting silver prices.

- THURSDAY, JULY 3, AT 13:30 GMT+1: US NON-FARM PAYROLL (NFP) AND UNEMPLOYEMENT RATE (JUNE). A lower than expected result should prove positive for silver, because it could point to the further FED interest rate cuts. This data measures the change in the number of people emplyed during the previous month, excluding the farming industry. The data for the previous month came in at 139,000, which was lower than for the month before (147,000).

ANALYSTS’ OPINION:

- UBS: The bank targets a price of $38.

- CITIGROUP: The bank targets a price of $40.

- J.P. MORGAN: The bank targets a price of $38.

Source: Reuters, Bloomberg, CNBC

SILVER, July 2, 2025

Current Price: 36.00

|

SILVER |

Weekly |

|

Trend direction |

|

|

38.30 |

|

|

37.70 |

|

|

37.00 |

|

|

35.00 |

|

|

34.50 |

|

|

34.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

23,000 |

17,000 |

10,000 |

-10,000 |

-15,000 |

-20,000 |

|

Profit or loss in €2 |

19,528 |

14,434 |

8,491 |

-8,491 |

-12,736 |

-16,981 |

|

Profit or loss in £2 |

16,771 |

12,396 |

7,292 |

-7,292 |

-10,937 |

-14,583 |

|

Profit or loss in C$2 |

31,389 |

23,201 |

13,647 |

-13,647 |

-20,471 |

-27,295 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 09:00 (GMT+1) 02/07/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.