SILVER weekly special report based on 1.00 Lot Calculation:

US FEDERAL RESERVE:

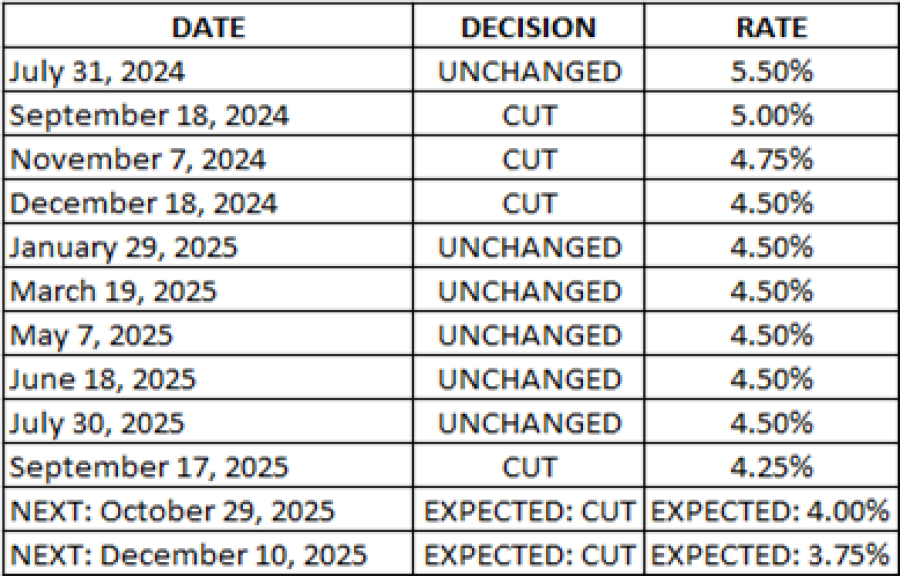

- BREAKING NEWS (SEPTEMBER 17): US FEDERAL RESERVE CUT ITS BENCHMARK INTEREST RATE TO 4.25% FROM THE PREVIOUS 4.50%. After some weak employment market data in August, July, and June, the US Federal Reserve decided to cut its benchmark interest rate in September and said it could cut rates further by 2025, expecting rates to fall to 3.75% by the end of 2025.

MARKET EXPECTATIONS (AFTER WEDNESDAY, SEPTEMBER 17): US FEDERAL RESERVE IS EXPECTED TO ANNOUNCE MORE INTEREST RATE CUTS BY THE END OF 2025 TO BRING RATES DOWN TOWARDS 3.75% (Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html)

TABLE (MOST RECENT INTEREST RATE DECISIONS): US FEDERAL RESERVE INTEREST RATE POLICY SINCE JULY 2024

Data Source: Bloomberg Terminal; CMEGROUP.COM;

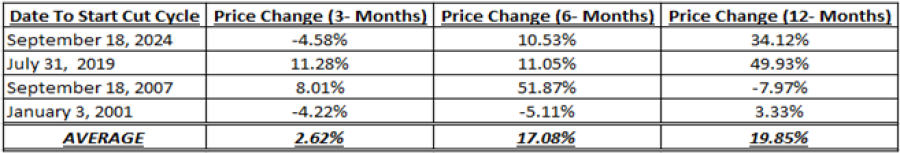

- STATISTICS (2000 - 2025): SILVER PRICE REACTION WITHIN 3, 6, 12 MONTHS AFTER THE FIRST RATE CUT BY THE FEDERAL RESERVE AS A NEW RATE CUT CYCLE BEGINS. Silver prices rose 2.62% on average within the first 3 months after the first rate cut of the cycle took place. Within the first 6 months, Silver prices rose 17.08% on average. Silver price rose nearly 20% on average within the first 12 months after the first cut.

Date Source: Meta Trader 4

Please note that past performance does not guarantee future results

TECHNICAL ANALYSIS:

- PSYCHOLOGICAL SUPPORT: $40. After hitting fresh 14-year highs ($42.947), silver prices have remained above the level of $40, which has now become its next psychological support. Silver was last trading slightly below $42.

- UPTREND SINCE APRIL 2025: After the March-April price pullback, silver prices have since been trading in an uptrend, as depicted by the daily chart below and the solid black uptrend line on the same chart. Since the beginning of 2025, silver prices have risen by around 45%.

- ALL-TIME HIGH PRICE: $49.80. Silver jumped to $49.80 in 2011, during the debt crisis in Europe. Currently, silver trades around $41.80, and if a full recovery is made, this could offer an upside potential of around 19%. However, the price could decline.

- ANALYSTS’ OPINION: Deutsche Bank forecasts $45.

GRAPH (Daily): January 2025 – September 2025

Please note that past performance does not guarantee future results

Silver, September 18, 2025.

Current Price: 41.80

|

Silver |

Weekly |

|

Trend direction |

|

|

49.80 |

|

|

46.00 |

|

|

43.00 |

|

|

40.80 |

|

|

40.40 |

|

|

40.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

80,000 |

42,000 |

12,000 |

-10,000 |

-14,000 |

-18,000 |

|

Profit or loss in €2 |

67,622 |

35,501 |

10,143 |

-8,453 |

-11,834 |

-15,215 |

|

Profit or loss in £2 |

58,651 |

30,792 |

8,798 |

-7,331 |

-10,264 |

-13,196 |

|

Profit or loss in C$2 |

110,224 |

57,868 |

16,534 |

-13,778 |

-19,289 |

-24,800 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 10:15 (GMT+1) 18/9/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.