SILVER weekly special report based on 1.00 Lot Calculation:

SOUTH AMERICA GEOPOLITICAL TENSIONS ESCALATE

- BREAKING (JANUARY 3): US ARMY ATTACKS VENEZUELA WITH AIRSTRIKES, CAPTURING VENEZUELAN PRESIDENT MADURO. According to Reuters, after a coordinated land and air strike the US military captured President Maduro, with Maduro set to appear in court on Monday (January 5) on charges of drug trafficking. US President Trump has threatened harsh punishments to the new interim leader Delcy Rodriguez if compliance with US is ignored.

SILVER MARKET: HIGHER DEMAND AMID SUPPLY SHORTAGES LEADS TO A WIDENING DEFICIT

- MARKET DEFICIT: SILVER MARKET REMAINS IN DEFICIT SINCE AT LEAST 2016. The silver market faced a deficit of around 300 million ounces in 2025 according to recent reports from The Silver Institute. While the market has been in deficit since 2016, the gap has grown significantly since 2022.

- SUPPLY CONSTRAINTS: SILVER PRODUCTION REMAINS AROUND 800 MILLION OUNCES PER YEAR. Annual production has held near 800 million ounces remaining largely unchanged since 2016. There is no clear indication that output will be meaningfully higher in 2026 or the following years.

- DEMAND REMAINS STRONG: SOLAR PANELS, ELECTRIC VEHICLES AND A.I. INFRASTRUCTURE. Silver demand is expected to increase in 2026 and beyond due to rising demand from solar production, electric vehicles, and rapidly expanding A.I. data center infrastructure.

SILVER MARKET: NEWS

- NEWS: CHINA ANNOUNCED EXPORT RESTRICTIONS STARTING 2026. Starting in 2026 China will enforce a licensing framework that replaces its previous quota system according to Global Times. This will effectively restrict 60–70% of the global silver supply to domestic use. China is the second largest silver producer in the world, responsible for 13% of total global supply, and second largest silver exporter in the world (11%). It is estimated that if China reduces exports by 50%, global deficits could exceed 5,000 metric tons annually.

- SAMSUNG SOLID-STATE BATTERIES: A NEW SOURCE OF SILVER DEMAND. Samsung is developing solid-state battery technology, which uses more silver than traditional lithium-ion batteries due to silver’s superior electrical conductivity.

EVENTS

- WEDNESDAY, JANUARY 7 AT 13:15 GMT: US ADP NONFARM EMPLOYMENT CHANGE (DECEMBER). A lower-than-expected reading could be positive for silver because it will indicate a worsening situation in the labor market, with the FED having more incentive to intervene by lowering interest rates.

- FRIDAY, JANUARY 9 AT 13:30 GMT: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (DECEMBER). A lower-than-expected NFP reading could be positive for silver because it will signal a worsening situation in the labor market, with the FED having more incentive to intervene by lowering interest rates, thus potentially supporting silver.

TECHNICAL ANALYSIS

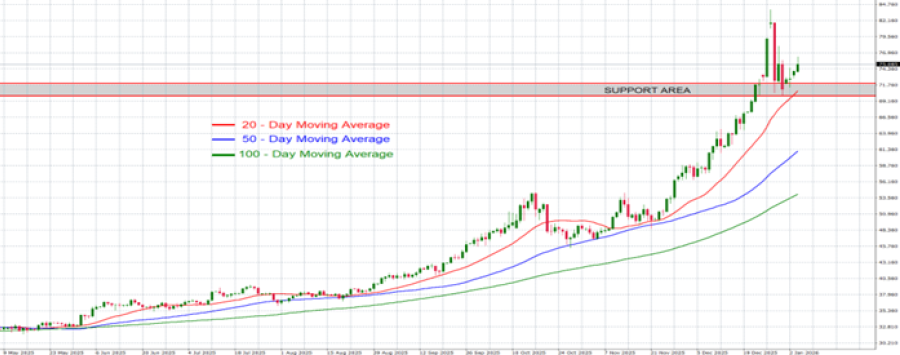

- SILVER PRICE HIT A NEW ALL-TIME HIGH ON DECEMBER 28, 2025 ($83.895). Silver price has broken out to a new all-time high of $83.895, confirming the strong uptrend since the beginning of 2025, trading well above moving averages. The zone between $72 and $70 has now become silver’s new support area.

- SILVER RECOVERS AFTER A PULL BACK. Since the beginning of 2025, silver has had 13 downward corrections, taking on average 9 days to recover to previous top. The current price of Silver stands around $77.40, and if it recovers to its all-time highs ($83.895), it could potentially rise by around 8%. However, it could also decline.

GRAPH (Daily): May 2025 – January 2026

Please note that past performance does not guarantee future results

SILVER, January 6, 2026.

Current Price: 77.40

|

SILVER |

Weekly |

|

Trend direction |

|

|

90.00 |

|

|

85.00 |

|

|

82.00 |

|

|

73.00 |

|

|

72.50 |

|

|

72.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

126,000 |

76,000 |

46,000 |

-44,000 |

-49,000 |

-54,000 |

|

Profit or loss in €2 |

107,497 |

64,839 |

39,245 |

-37,538 |

-41,804 |

-46,070 |

|

Profit or loss in £2 |

93,005 |

56,098 |

33,954 |

-32,478 |

-36,169 |

-39,859 |

|

Profit or loss in C$2 |

173,405 |

104,593 |

63,307 |

-60,554 |

-67,435 |

-74,316 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 13:30 (GMT) 06/01/2026

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.