SILVER weekly special report based on 1.00 Lot Calculation:

EVENTS:

- FRIDAY, JANUARY 9 AT 13:30 GMT: US NONFARM PAYROLLS (NFP) AND UNEMPLOYMENT RATE (DECEMBER). A lower-than-expected NFP reading could be positive for silver because it will signal a worsening situation in the labor market, with the FED having more incentive to intervene by lowering interest rates, thus potentially supporting silver.

- TUESDAY, JANUARY 13 AT 13:30 GMT: US INFLATION (CPI) DATA (DECEMBER). US Inflation came in at 2.7% in November, below the previous 3%. This is its lowest reading since July 2025. Core Inflation also fell in November, coming in at 2.6% (vs. 3% expected and the previous 3%). It is its lowest reading since March 2021.

GEOPOLITICAL TENSIONS ESCALATE:

- MIDDLE EAST TENSIONS RISE: 12TH DAY OF IRANIAN PROTESTS: SECURITY SITUATION DETERIORATES (January 8). Iran continues to face protests against the regime, spreading nationwide and turning increasingly violent, with at least 34 deaths and more than 2,000 arrests reported so far. Demonstrators have seized control of at least two cities in Iran’s Kurdish province, after security forces reportedly withdrew.

- VENEZUELA TENSIONS RISE: US ARMY ATTACKS VENEZUELA WITH AIRSTRIKES, CAPTURING VENEZUELAN PRESIDENT MADURO (January 3). According to Reuters, after a coordinated land and air strike, the US military captured President Maduro. US President Trump has threatened harsh punishments for the new interim leader, Delcy Rodriguez, if compliance with the U.S. is ignored.

SILVER MARKET: HIGHER DEMAND AMID SUPPLY SHORTAGES LEADS TO A WIDENING DEFICIT

- MARKET DEFICIT: SILVER MARKET REMAINS IN DEFICIT SINCE AT LEAST 2016. The silver market faced a deficit of around 300 million ounces in 2025, according to recent reports from The Silver Institute. While the market has been in deficit since 2016, the gap has grown significantly since 2022.

- SUPPLY CONSTRAINTS: SILVER PRODUCTION REMAINS AROUND 800 MILLION OUNCES PER YEAR. Annual production has held near 800 million ounces, remaining largely unchanged since 2016. There is no clear indication that output will be meaningfully higher in 2026 or the following years.

- DEMAND REMAINS STRONG: SOLAR PANELS, ELECTRIC VEHICLES, AND A.I. INFRASTRUCTURE. Silver demand is expected to increase in 2026 and beyond due to rising demand from solar production, electric vehicles, and rapidly expanding A.I. data center infrastructure.

SILVER MARKET: NEWS

- NEWS: CHINA ANNOUNCED EXPORT RESTRICTIONS STARTING IN 2026. Starting in 2026, China will enforce a licensing framework that replaces its previous quota system, according to Global Times. This will effectively restrict 60–70% of the global silver supply to domestic use. China is the second largest silver producer in the world, responsible for 13% of total global supply, and the second largest silver exporter in the world (11%). It is estimated that if China reduces exports by 50%, global deficits could exceed 5,000 metric tons annually.

TECHNICAL ANALYSIS

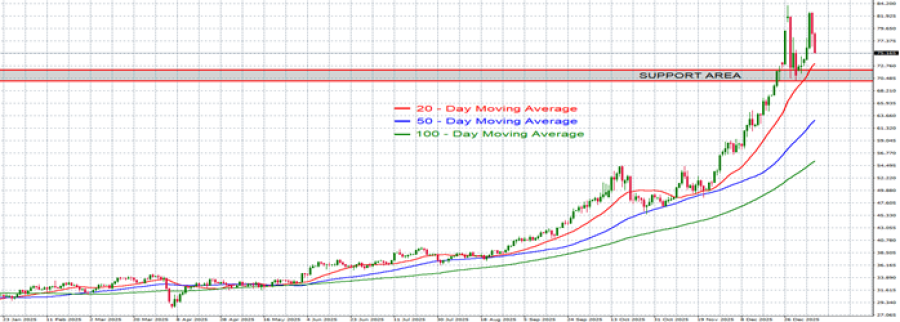

- SILVER PRICE HIT A NEW ALL-TIME HIGH ON DECEMBER 28, 2025 ($83.895). Silver price has broken out to a new all-time high of $83.895, confirming the strong uptrend since the beginning of 2025, trading well above moving averages. The zone between $72 and $70 has now become silver’s new support area.

- SILVER RECOVERS AFTER A PULLBACK. Since the beginning of 2025, silver has had 13 downward corrections, taking on average 9 days to recover to the previous top. The current price of Silver stands around $75.50, and if it recovers to its all-time high ($83.895), it could potentially rise by around 11%. However, it could also decline.

GRAPH (Daily): January 2025 – January 2026

Please note that past performance does not guarantee future results

SILVER, January 8, 2026.

Current Price: 75.50

|

SILVER |

Weekly |

|

Trend direction |

|

|

90.00 |

|

|

85.00 |

|

|

82.00 |

|

|

70.00 |

|

|

69.00 |

|

|

68.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

145,000 |

95,000 |

65,000 |

-55,000 |

-65,000 |

-75,000 |

|

Profit or loss in €2 |

124,246 |

81,403 |

55,696 |

-47,128 |

-55,696 |

-64,265 |

|

Profit or loss in £2 |

107,883 |

70,682 |

48,361 |

-40,921 |

-48,361 |

-55,801 |

|

Profit or loss in C$2 |

201,269 |

131,866 |

90,224 |

-76,343 |

-90,224 |

-104,105 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 08:40 (GMT) 08/01/2026

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.