USD/CAD weekly special report based on 1 Lot Calculation:

TECHNICAL ANALYSIS:

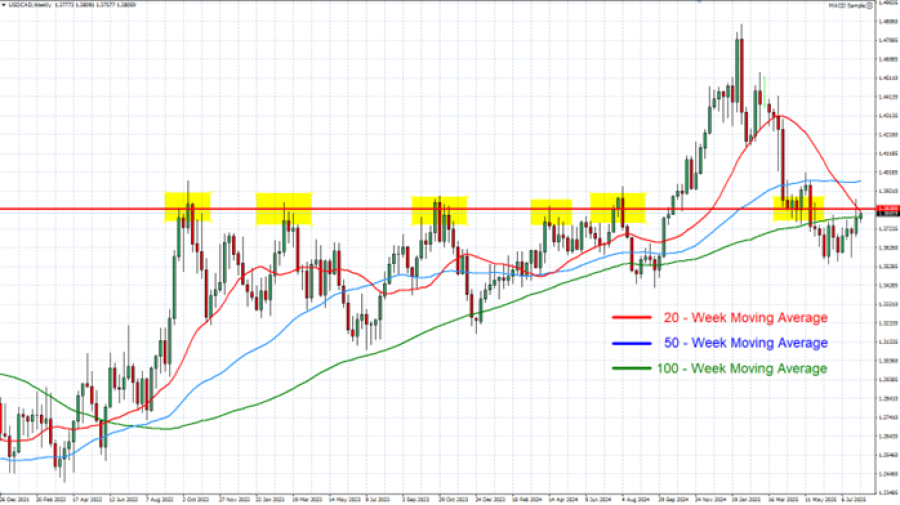

- DAILY MOVING AVERAGES POINT TO DOWNTREND: USD/CAD has recently traded below the 20, 50, and 100 – Weekly Moving Averages, pointing to an ongoing downtrend. However, USD/CAD could also change its trend if prices rise above the 20, 50, or 100 – Weekly Moving Averages.

- LONG-TERM RESISTANCE LEVEL: The red-lined resistance level at 1.3830 has been tested 6 times in the last three years, with the currency pair retreating lower after touching this resistance level.

GRAPH (Weekly): January 2022 – August 2025

Please note that past performance does not guarantee future results

GEOPOLITICS: U.S. – CANADA TRADE TALKS TO CONTINUE BEYOND AUGUST 1

- US PRESIDENT TRUMP AND CANADA’S PRIME MINISTER CARNEY SET TO MEET: Any trade war de-escalation or resolution could prove positive for the Canadian dollar. Trump and Carney are set to meet in the coming days in order to discuss a potential resolution to the US-Canada trade conflict.

EVENTS (CANADA):

- FRIDAY, AUGUST 8, AT 13:30 GMT+1: CANADA EMPLOYMENT CHANGE AND UNEMPLOYMENT RATE (JULY): A strong Canadian labor market (higher than expected employment change and lower than expected unemployment rate) will be supportive for the Canadian dollar. Employment change data for last month stood at 83.100, which was higher than the month before (8.800).

EVENTS (UNITED STATES):

- THURSDAY, AUGUST 7, AT 13:30 GMT+1: US INITIAL JOBLESS CLAIMS: A higher-than-expected reading could prove negative for the USDCAD currency pair because it will point to more interest rate cuts by the FED, creating negative pressure on the US dollar. This data measures the number of individuals who filed for unemployment insurance for the first time during the past week. The data for the previous week is 218.000, which is higher than the week before (217.000).

- TUESDAY, AUGUST 12, AT 13:30 GMT+1: US INFLATION (CPI) (JULY): Lower-than-expected inflation could prove negative for the US dollar and the currency pair overall, because it will point to more interest rate cuts by the FED. This data measures the change in the price of goods and services from the perspective of the consumer. Inflation for the previous month is 2.7%.

USD/CAD August 05, 2025.

Current Price: 1.3806

|

USD/CAD |

Weekly |

|

Trend direction |

|

|

1.4050 |

|

|

1.4000 |

|

|

1.3950 |

|

|

1.3650 |

|

|

1.3500 |

|

|

1.3400 |

Example of calculation based on weekly trend direction for 1 Lot1

|

USD/CAD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

-1,768 |

-1,406 |

-1,043 |

1,130 |

2,217 |

2,942 |

|

Profit or loss in €2 |

-1,533 |

-1,219 |

-905 |

980 |

1,922 |

2,550 |

|

Profit or loss in £2 |

-1,332 |

-1,059 |

-786 |

852 |

1,670 |

2,216 |

|

Profit or loss in C$2 |

-2,440 |

-1,940 |

-1,440 |

1,560 |

3,060 |

4,060 |

- 1.00 lot is equivalent of 100,000 units

- Calculations for exchange rate used as of 13:15 (GMT+1) 05/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.