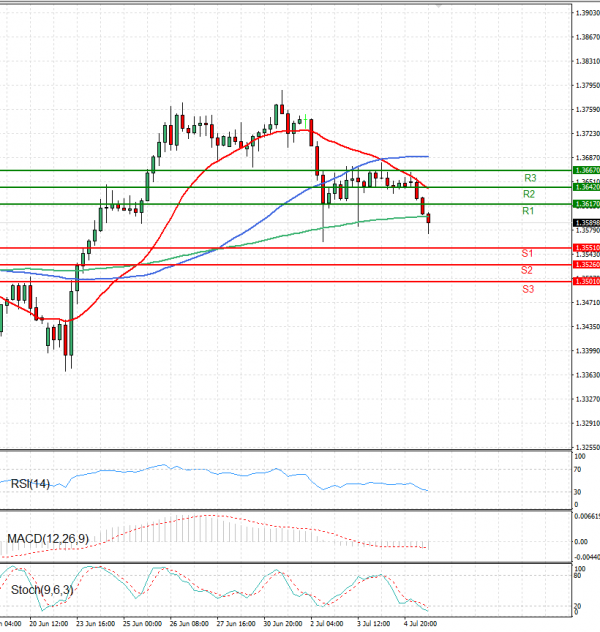

During European trading, the British Pound retreated against the US Dollar, trading below 1.3600 levels.

The GBP/USD currency traded lower in the European Session, as new tariff tensions between the US and BRICKS countries are creating safe-haven demand for the US dollar. In the UK, the Halifax Price Index for June was released with data being higher than expected (0.0% realised vs -0.1% expected). In the US, the Fed’s Balance Sheet (6.622 bln) will be published (21:30 GMT+1).