Fundamental analysis

29 April, 2022

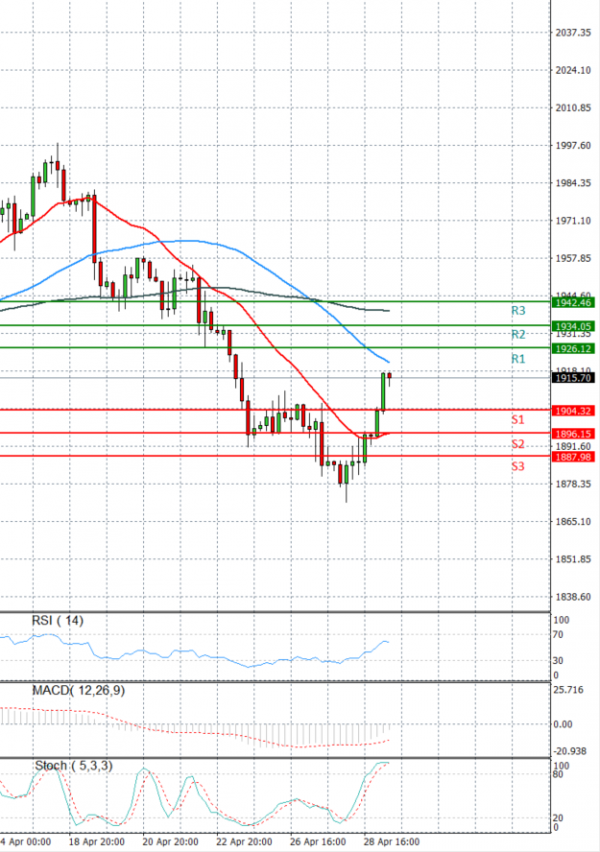

The price of gold rose on Friday morning in Asia, as worrying data on US GDP forced some investors to "safe haven" instrument. However, the yellow metal is set for the biggest monthly drop since September 2021 because the US Federal Reserve is expected to aggressively raise interest rates when it makes its policy decision next week. Jerome Powell, chairman of the US Federal Reserve, said last week that he to increase the interest rate by half a percent, which, until recently, was not the case. There is also speculation that the Fed, at least according to the efforts of a number of decision-makers, could, at the next meeting on May 4, increase the interest rate by as much as 0.75% (which is less certain). That, along with the further growth of yields on long-term US bonds, is (currently) putting pressure on the price of gold. Early this morning, the price of gold was trading around 1915 dollars per fine ounce, which represents a price increase of 1.05% since the beginning of trading on Friday.