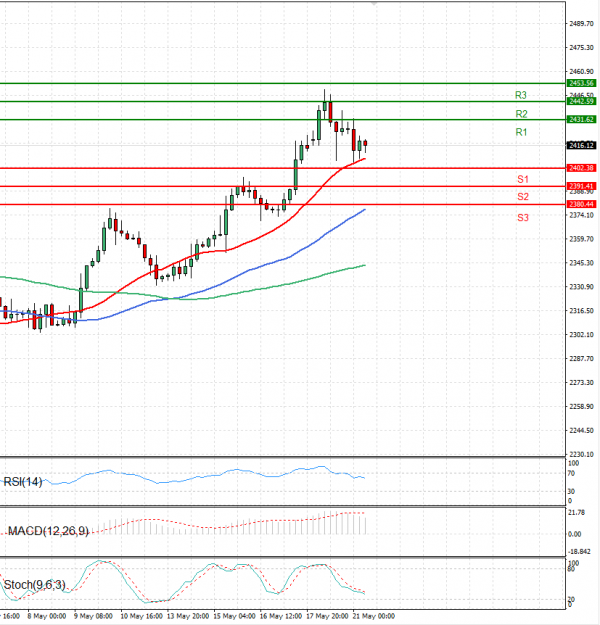

Gold prices are trading in today’s European session above 2410 levels.

Gold prices lost their recovery momentum on Tuesday after previously reaching a record high. In a quiet session devoid of significant economic data, the precious metal's potential for further gains might be limited due to the lack of new catalysts.

However, several factors could provide support to gold: increased expectations of interest rate cuts from the US Federal Reserve (Fed), ongoing geopolitical tensions, and strong demand from central banks and European buyers.

Gold traders will be looking for more cues from Fed officials, with speeches from Waller, Williams, Barr, Bostic, Collins, and Mester scheduled for later on Tuesday. The highlight will be the release of the FOMC Minutes on Wednesday. Additionally, the hawkish stance from Fed officials is likely to strengthen the Greenback, which could, in turn, push USD-denominated gold lower.