Australian Dollar - Canadian Dollar Australian Dollar - Swiss Franc Australian Dollar - Japanese Yen Australian Dollar - New Zealand Dollar Australian Dollar - US Dollar Canadian Dollar - Swiss Franc Canadian Dollar - Japanese Yen Swiss Franc - Japanese Yen US Dollar - Turkish Lira Euro - Australian Dollar Euro - Canadian Dollar Euro - Swiss Franc Euro - Danish Krone Euro - Pound Euro - Hungarian Forint Euro - Israeli Shekel Euro - Japanese Yen Euro - Norwegian Krone Euro - New Zealand Dollar Euro - Polish Zloty Euro - Swedish Krona Euro - Turkish Lira Euro - US Dollar Euro - South African Rand Pound - Australian Dollar Pound - Canadian Dollar Pound - Swiss Franc Pound - Japanese Yen Pound - New Zealand Dollar Pound - Singapore Dollar Pound - Turkish Lira Pound - US Dollar New Zealand Dollar - Canadian Dollar New Zealand Dollar - Swiss Franc New Zealand Dollar - Japanese Yen New Zealand Dollar - US Dollar Turkish Lira - USDTRY/2+EURTRY/2 US Dollar - Canadian Dollar US Dollar - Swiss Franc US Dollar - Chinese Yuan US Dollar - Danish Krone US Dollar - Hungarian Forint US Dollar - Israeli Shekel US Dollar - Japanese Yen US Dollar - Mexican Peso US Dollar - Norwegian Krone US Dollar - Polish Zloty US Dollar - Russian Ruble US Dollar - Swedish Krona US Dollar - Singapore Dollar US Dollar - South African Ran Adidas AG Alcatel-Lucent ALIBABA Ltd ALLIANZ SE AMAZON.COM, Inc. AMERICAN EXPRESS APPLE ASML HOLDING AT&T AXA BAIDU BANCO BILBAO BANCO POPOLARE BANCO SANTANDER BANK OF AMERICA BANKIA BARCLAYS BAYER BERKSHIRE HATHAWAY BERKSHIRE HATHAWAY BNP PARIBAS BOEING BP PLC BRITISH AMERICAN TOBACCO CATERPILLAR CHEVRON CISCO CITIGROUP COCA COLA COMMERZBANK AG DEUTSCHE BANK DEUTSCHE TELEKOM AG ENAGAS EXXON MOBIL FACEBOOK FERRARI FIAT CHRYSLER FIREEYE GAMESA CORP. GENERAL ELECTRIC GENERAL MOTORS GLAXOSMITHKLINE PLC GOLDMAN SACHS GROUP GOOGLE GOPRO GROUPON HP HSBC HOLDINGS INTEL JOHNSON&JOHNSON JP MORGAN CHASE LINKEDIN LUFTHANSA AG MCDONALDS MICROSOFT MONDI ORD MORGAN STANLEY NETFLIX INC PAYPAL PEUGEOT PFIZER PHILIPS POTASH PROCTER&GAMBLE ROYAL DUTCH SAB MILLER SAB MILLER SAP SE SCHNEIDER ELEKTRIC SIEMENS AG SINA TELEFONICA TESLA TWITTER UNILEVER DR VALEANT VERIZON VISA VODAFONE GROUP VOLKSWAGEN WALMART Disney YAHOO YANDEX ZYNG GOLD GOLD - EURO GOLD - TRY COPPER GASOLINE BRENT OIL WHEAT NATURAL GAS GAU - TRY GAU - USD SILVER Crude OIL COCOA HEATING OIL CORN COTTON PLATINUM SUGAR SOYBEA CAC40 CNA50 DAX30 DJ30 DOLLAR INDEX EUR INDEX FTSE100 FTSEMIB40 IBEX35 NASDAQ100 NIKKEI225 S&P500 10-Year T-Note Futures US 30 Year T-Bond Futures 5 Year US T-NOTES Bitcoin Ger30 Euro50 USA500 PALLADIUM USA100 USA30 American Airlines Zoom Video Communications Moderna Inc Virgin Galactic AstraZeneca plc Nio Inc Xiaomi Corporation Nvidia Corporation Plug Power Inc. US Tilray, Inc. Linde PLC.US AMD Cronos Group Inc. Beyond Meat Inc. Royal Caribbean Delta Air Lines Inc Carnival COINBASE Global Inc. Air Canada United Airlines Holdings Inc. Applied Materials NOVAVAX Ger40 PepsiCo-Inc Sunrun Inc. Lemonade Inc. ChargePoint FedEx Corporation Fisker UK100 Spotify Shopify Inc Fresnillo Vale First Solar Upstart Holdings, Inc. XPeng Inc. Weibo Ford Motor Company QUALCOMM Incorporated NIKE Taiwan Semiconductor Company Wells Fargo Uber Technologies Inc. Expedia Group, Inc. Airbnb Rivian Automotive, Inc. ARM Electronic Arts Inc. ZIM Integrated Shipping Services Ltd. Sainsbury’s Starbucks Corporation Reddit Lockheed Martin Corp.

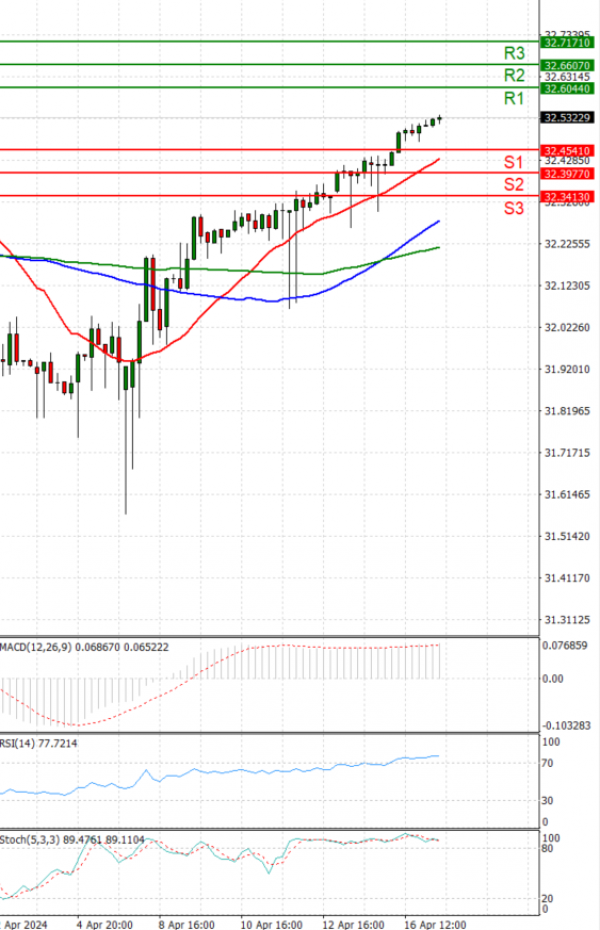

Opened Positions