Fundamental analysis

21 January, 2022

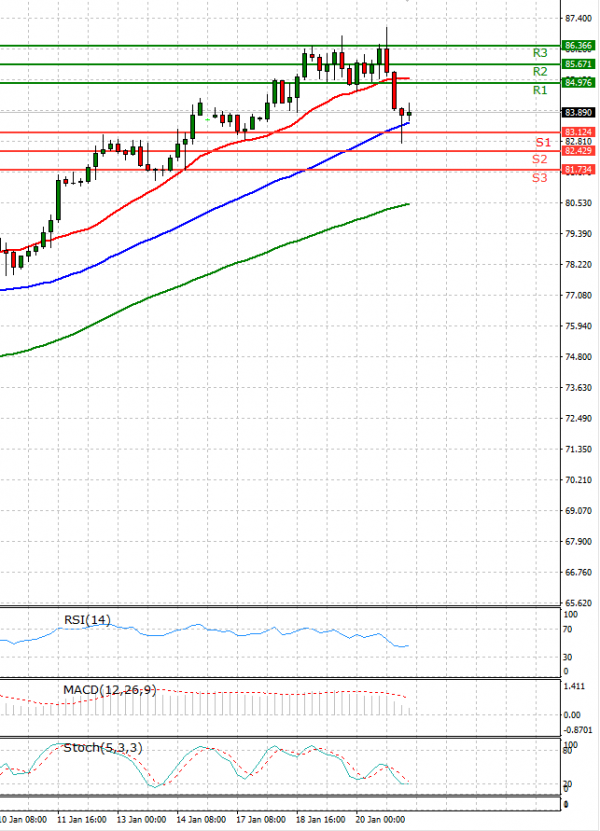

Oil prices plunged on Friday, after rising to seven-year highs this week, as an increase in U.S. crude and fuel stockpiles prompted investors to take profits from the rally. The recent rally in crude prices appeared to run out of steam on Thursday when Brent and WTI ended the trading session with slim losses. Both benchmarks have gained more than 10% so far this year amid concerns over tight supply. Gasoline inventories in the United States, the world’s biggest oil consumer, rose by 5.9 million barrels, to their highest since February 2021, according to the U.S. Energy Information Administration (EIA). Crude stockpiles rose by 515,000 barrels last week, against industry expectations.