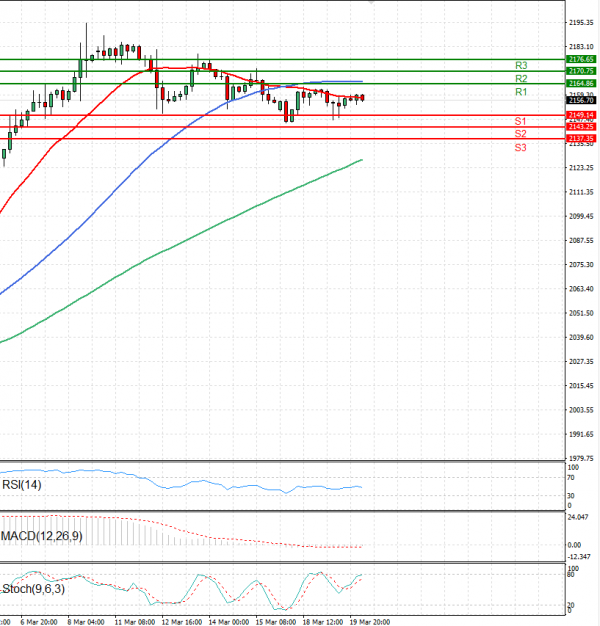

Gold prices are trading in today’s Asian session above 2150 levels.

In Asian trading on Wednesday, gold prices showed little movement, stabilising amidst recent volatility as investors awaited guidance from the Federal Reserve regarding potential interest rate cuts in 2024.

Despite remaining significantly below the peak levels reached earlier in March, gold prices seemed to have found support near the $2,150 per ounce mark.

Attention in the metal markets has shifted towards the conclusion of the Fed meeting scheduled for later today, with widespread anticipation that the central bank will maintain current interest rates.

However, the market is keenly attuned to any indications regarding future interest rate cuts in 2024, with particular interest in insights provided during the press conference with Fed Chair Jerome Powell following the meeting.