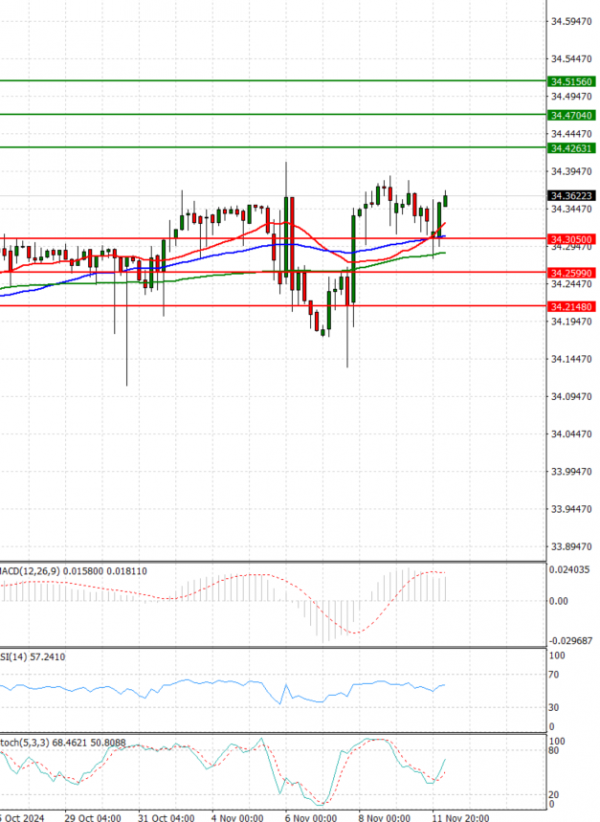

The US Dollar increased against the Turkish Lira during the Asian session, above 34.300 levels.

The currency pair jumped higher in an important week for Turkey, in terms of economic data releases. In Turkey, Retail Sales data for September will be posted. In the United States, Fed Members Waller (15:00 GMT), Kashkari (19:00 GMT) and Harker (22:00 GMT) will speak today.