GOLD weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

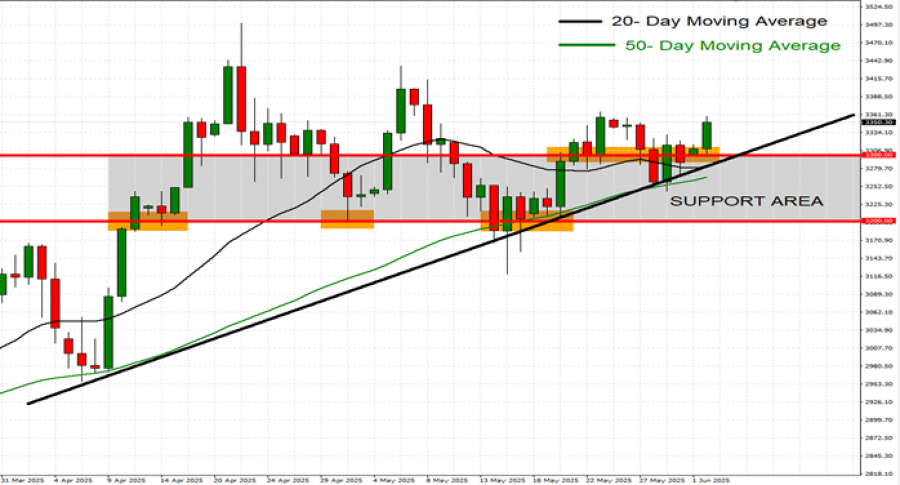

- SUPPORT AT $3,300: Gold has maintained near-term support at $3,300, well protected by the area between $3,300 and $3,200, which has been respected since mid- April 2025.

- DAILY MOVING AVERAGES POINT TO AN UPTREND: Gold prices have recently traded above the 20- and 50- Day Moving Averages, pointing to an ongoing uptrend. However, gold prices can also change their trend, if prices fall below the 20- and 50- Day Moving Averages.

- LONGER – TERM UPTREND LINE: As depicted by the daily chart below, the gold price has kept trading above the longer-term black uptrend line, confirming its longer-term trend is up.

- GOLD HIT A NEW ALL-TIME HIGH OF $3,499.76 (April 22, 2025). Gold has traded around $3,345, and if a full recovery takes place, the price of Gold could rise around $155. Although the price could decline as well.

GRAPH (Daily): April 2025 – June 2025

Please note that past performance does not guarantee future results

EVENTS:

- FRIDAY, JUNE 6, AT 13:30 GMT+1: US NON-FARM PAYROLL (NFP) AND UNEMPLOYMENT RATE (MAY): A lower-than-expected NFP reading should be taken as positive for the gold price, because a weaker US economy could exert negative pressures on the US dollar. This data measures the change in the number of people employed during the previous month, excluding the farming industry. The data for the previous month stood at 177,000 which lower than for the month before (228,000).

GEOPOLITICS:

- RUSSIA – UKRAINE POTENTIAL PEACE AGREEMENT IN JEOPARDY AHEAD OF ANOTHER ROUND OF TALKS. Uncertainties remain high even after President Trump- President Putin phone call on May 19 as no breakthroughs have been announced. The phone call happened after a round of unsuccessful talks between Russia and Ukraine in Istanbul, Turkey on May 16, where there were no signs of a major breakthrough, neither. A new round of talks was scheduled for Monday, June 2 at 11:00 GMT+1.

- US – IRAN NUCLEAR TALKS: MIDDLE EAST TENSIONS RISE AS NO CONCRETE DEALS HAVE BEEN MADE BETWEEN THE USA AND IRAN. The latest round of talks between the US and Iran in Rome, Italy brought no concrete agreements. Iran is still insisting on continuing its uranium enrichment program, while USA wants zero uranium enrichment from Iran. The next and sixth round of talks is expected to take place sometime in June.

ANALYSTS’ OPINION:

- CITIGROUP has a price target of $3,500

- J.P. MORGAN has a price target of $3,675.

- GOLDMAN SACHS has a price target of $3,700.

- UBS has a price target of $3,500.

Source: Reuters, Bloomberg, CNBC

GOLD, June 2, 2025

Current Price: 3345

|

GOLD |

Weekly |

|

Trend direction |

|

|

3500 |

|

|

3450 |

|

|

3400 |

|

|

3300 |

|

|

3280 |

|

|

3250 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

15,500 |

10,500 |

5,500 |

-4,500 |

-6,500 |

-9,500 |

|

Profit or loss in €2 |

13,579 |

9,199 |

4,818 |

-3,942 |

-5,694 |

-8,322 |

|

Profit or loss in £2 |

11,453 |

7,758 |

4,064 |

-3,325 |

-4,803 |

-7,019 |

|

Profit or loss in C$2 |

21,222 |

14,376 |

7,530 |

-6,161 |

-8,899 |

-13,007 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 11:30 (GMT+1) 02/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.