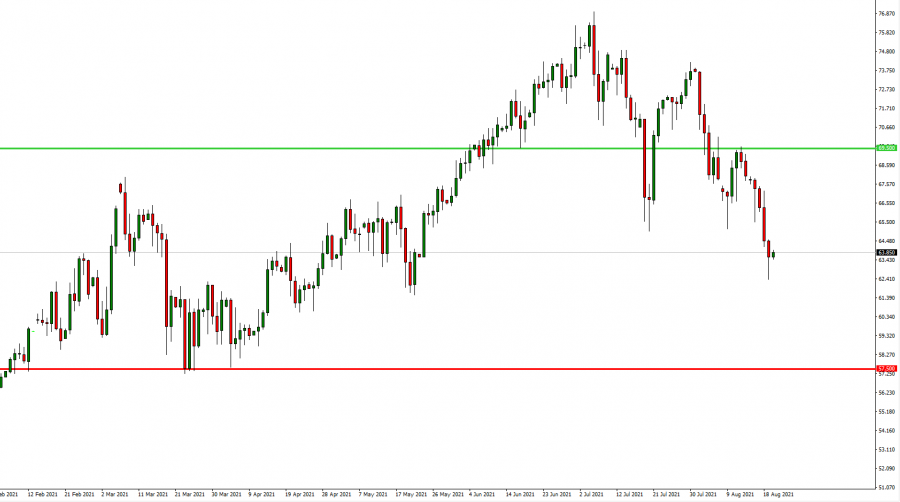

TRADING RANGE: $57.5-$69.5

MARKET OVERVIEW:

Crude oil has traded around the mark of $64 after a strong sell off during this week. Rising number of covid cases all over the world increased worries about future oil demand. Strengthening of the US dollar also put pressure on all commodity prices including crude oil. The points below explain why short term Crude oil could continue to trade in a range between $57.5 and $69.5 a barrel.

NEGATIVE ARGUMENTS TO PRESSURE THE OIL PRICES:

- On Wednesday, August 18, in its meeting minutes, the Fed signaled it was set to start tapering asset purchases within months. The statement lifted the US dollar and other safe haven instruments and pushed down commodities prices including crude oil. If the narrative of Fed officials continues to support this stance we can witness further crude oil price decline.

- Although crude stockpiles fell in the US, there was a surprise rise in gasoline inventories, signaling fuel demand is at risk with the delta variant spreading all over the world.

- OPEC+ has pushed ahead with gradually restoring supplies.

- The upcoming end of the driving season usually signals a reduction in oil demand

POSITIVE ARGUMENTS TO SUPPORT THE OIL PRICES:

- Uncertainty over Fed decisiveness to start tapering due to the increasing number of Covid cases which can prolong this decision. Jerome Powell will speak at Jackson Hole at the end of the next week, and there is possibility that he may signal a delay in the slow withdrawal of asset purchases which analysts believe was due in September due to the weaker than expected economic data published recently in the US. (Note: Meeting minutes which showed support for tapering was published with a delay of almost 3 weeks since the Fed meeting and showed Fed opinion before the weaker economic data.)

- Acceleration of vaccination programs in the US and other countries.

- Possibility that OPEC will intervene if crude oil price declines too much (below $60) in order to keep control over the oil market. Next OPEC meeting is expected to take place during the first week of September where OPEC officials will consider current prices and possibly modify its policy to balance the market if necessary.

Graph: Crude Oil, Daily

Current Price: 63.41

|

Crude Oil |

Weekly |

|

Resistance |

69.5 |

|

Support |

57.5 |

Example of calculation based on UPTREND ($69.5) direction for 1.00 Lot*

|

Resistance |

Support |

|

|

Profit or loss in $ |

6,090.0 |

-5,910.0 |

|

Profit or loss in €** |

5,212.79 |

-5,058.72 |

|

Profit or loss in £** |

4,471.17 |

-4,339.02 |

|

Profit or loss in C$** |

7,863.77 |

-7,631.35 |

Example of calculation based on DOWNTREND ($57.5) direction for 1.00 Lot*

|

Resistance |

Support |

|

|

Profit or loss in $ |

-6,090.0 |

-5,910.0 |

|

Profit or loss in €** |

-5,212.79 |

-5,058.72 |

|

Profit or loss in £** |

-4,471.17 |

-4,339.02 |

|

Profit or loss in C$** |

-7,863.77 |

-7,631.35 |

* 1.00 lot is equivalent of 1000 units

** Calculations for exchange rate used as of 8:30 a.m. (GMT+1) 20/08/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details