WEEKLY TREND: UP

Fundamental Overview:

- MODERNA RECENT PRICE ACTION: Moderna has lost around 35% over the past month, to test its lowest rate in two and a half months ($296.20). Moderna came under pressure after another company (Merck) released positive data for its pill treatment tests against COVID-19 virus, which looked like a competition to Moderna’s Covid-19 vaccines.

- EVENTS TO WATCH:

- U.S. FDA FULL APPROVAL: The US Federal Drug Administration (FDA) is expected soon (Q4) to grant Moderna a full approval to its COVID-19 vaccine in the U.S. It is currently used under Emergency Use Authorization.

- U.S. FDA BOOSTER SHOT APPROVAL: U.S. regulators are expected to decide at a later date on widespread boosters for COVID vaccines by Moderna. Moderna submitted data to the FDA seeking evaluation for its booster shot on September 1.

- COVID-19 VACCINE SALES TO STAY STRONG: Moderna is still expected to rake in around 20 billion dollars of revenue in 2021, and similar numbers in 2022. Just recently they said that made a deal with Peru to supply them with 20 million doses.

- IMMUNITY FROM VACCINE WANES WITH TIME: According to Pfizer and Moderna researches, the immunity after the second dose wanes within a few months, which means that vaccination process should roll over in order to keep the pandemic under control. Therefore, Moderna could be still expected to sell COVID-19 vaccines and to make money from it. In addition, the COVID-19 vaccine is still the best weapon to the fight the COVID-19 pandemic.

Technical Overview:

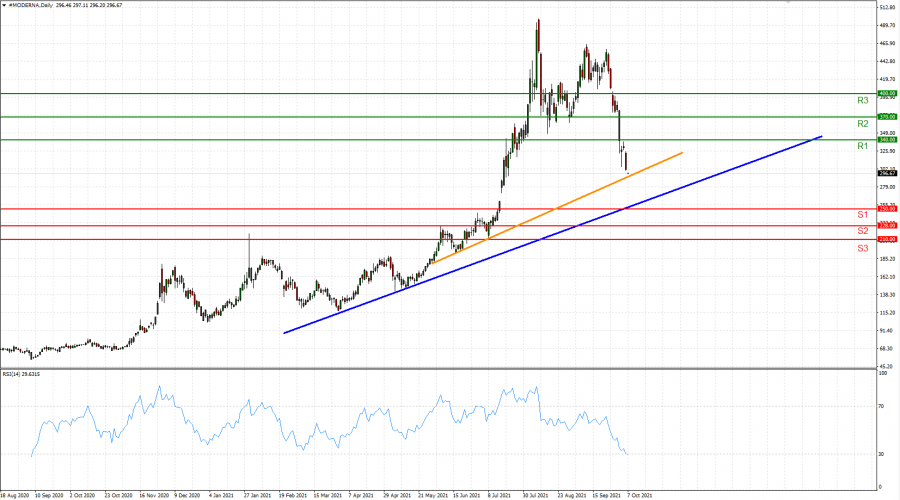

- LONG TERM UPTREND: Despite the most recent sell-off, Moderna managed to stay above its long term uptrend lines. This could suggest an upward recovery as long as it stays above the two uptrend (black and orange) lines.

- 14-DAY RELATIVE STRENGTH INDEX (RSI): The 14-Day RSI has fallen below the oversold threshold of 30. This might signal a potential upward correction.

- RESISTANCE AND SUPPORT LEVELS: If Moderna manages to stay above the uptrend lines and speculators gather up to trade on 14-Day RSI oversold signal, then it might be expected the prices to start recovering, targeting Resistance 1 of 340. If, however, the prices fail to stay above the uptrend lines, then it might be expected Moderna to continue falling and target Support 1 of 250.

Graph: Moderna, Daily

Current Price: 294

|

MODERNA |

Weekly |

|

Trend direction |

|

|

400 |

|

|

370 |

|

|

340 |

|

|

250 |

|

|

228 |

|

|

210 |

Example of calculation based on weekly trend direction for 1.00 Lot*

|

MODERNA |

||||||

|

Profit or loss in $** |

106,000.00 |

76,000.00 |

46,000.00 |

-44,000.00 |

-66,000.00 |

-84,000.00 |

|

Profit or loss in € |

91,704.23 |

65,750.20 |

39,796.17 |

-38,065.91 |

-57,098.86 |

-72,671.27 |

|

Profit or loss in £** |

78,009.43 |

55,931.29 |

33,853.15 |

-32,381.27 |

-48,571.91 |

-61,818.80 |

|

Profit or loss in C$** |

133,356.48 |

95,614.08 |

57,871.68 |

-55,355.52 |

-83,033.28 |

-105,678.72 |

* 1.00 lot is equivalent of 1000 units

** Calculations for exchange rate used as of 10:30 (GMT+1) 07/10/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details