WEEKLY TREND: UP

Fundamental Overview:

- Palladium is most heavily used in the production of catalytic converters integrated into vehicles to curb gas emission and air pollution. Europe and China have recently imposed stricter emission standards, which could require bigger use of Palladium.

- CHINA IS THE LARGEST PALLADIUM CONSUMER IN THE WORLD WHICH COVERS ONE THIRD OF GLOBAL AUTOMOTIVE PRODUCTION: Recent data showed that the Chinese economy has continued to recover along with its car industry, which is one of the largest consumers of Palladium. China reported Q4 GDP growth rate of 6.5% year on year, beating expectations for a rate of 6.1%. That being said, the demand for Palladium may rise, which could support Palladium prices.

- SUPPLY SHORTAGE: Palladium supply is expected to stay lower as South Africa, the second largest Palladium producer in the world, faces a new strain of the coronavirus, which forces some Palladium mines to close again.

- EXPECTED DEFICIT COULD POSITIVELY SUPPORT PALLADIUM PRICES: As demand is expected to stay above supply in 2021, there may be a deficit with the Palladium markets to stay on. This could support the Palladium prices.

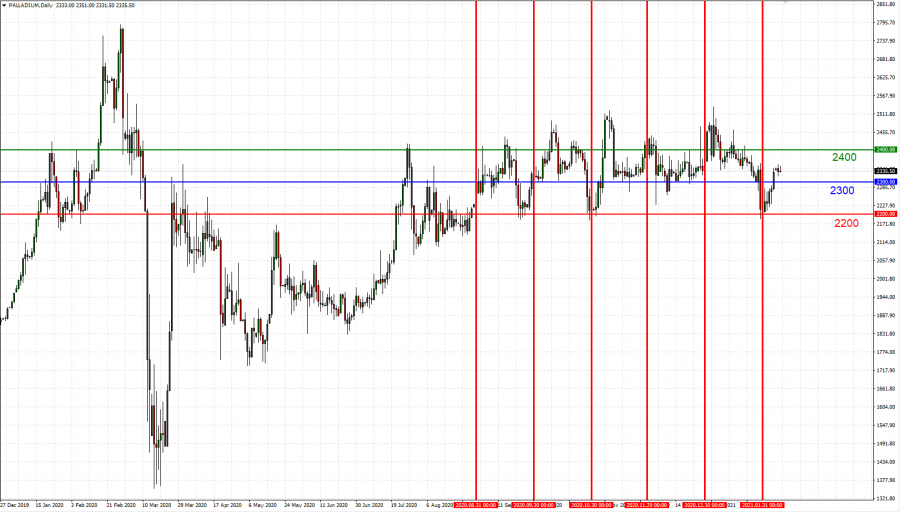

Palladium Statistics During a Period of Consolidation: The Case of Palladium Breaking Under $2300 per Ounce (Period 1 September 2020 - 31 January 2021)

- TRADING RANGE: $2200 AND $2400. MEAN: $2300.

- TIMES TO TEST $2200: 3

- TIMES TO TEST $2400: 10

- FOUR MAJOR BREAKS BELOW $2300: Palladium has slipped only four times below $2300 in the last five months.

- TOTAL NUMBER OF DAILY SESSIONS: 129

- SESSIONS SPENT BELOW $2300: 19 (14.7%).

- SESSIONS SPENT ABOVE $2300: 110 (85.30%).

Please note that past performance does not guarantee future performance.

Graph: (Palladium, Daily): Consolidation period between 1 September 2020 and 31 January 2021

Current Price: 2302

|

Palladium |

Weekly |

|

Trend direction |

|

|

2500 |

|

|

2450 |

|

|

2400 |

|

|

2210 |

|

|

2170 |

|

|

2130 |

Example of calculation based on weekly trend direction for 1.00 Lot*

|

Palladium |

||||||

|

Profit or loss in $ |

19,800.00 |

14,800.00 |

9,800.00 |

-9,200.00 |

-13,200.00 |

-17,200.00 |

|

Profit or loss in €** |

16,404.31 |

12,261.81 |

8,119.30 |

-7,622.20 |

-10,936.21 |

-14,250.21 |

|

Profit or loss in £** |

14,385.04 |

10,752.45 |

7,119.87 |

-6,683.96 |

-9,590.03 |

-12,496.09 |

|

Profit or loss in C$** |

25,210.94 |

18,844.54 |

12,478.14 |

-11,714.18 |

-16,807.30 |

-21,900.42 |

* 1.00 lot is equivalent of 100 units

** Calculations for exchange rate used as of 13:00 (GMT) 09/02/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details