WEEKLY TREND: UP

Fundamental Overview:

- President Elect Joseph Biden asked the US Congress for additional $1.9 trillion. The U.S. Congress has already approved a $900 billion coronavirus aid package in late 2020. The US Congress approved on December 21, 2020 a $900 billion coronavirus aid package. In January US President Joseph Biden laid out a proposal worth 1.9 trillion dollars to boost the US economy. President Elect Joseph Biden wants to increase the recently enacted $600 rebate checks to $2,000 per person. The markets believe that this is possible as the Democrats will run the White House and the US Congress (House and Senate) next two years. Last time this happened was back in the 2008- 2010 period when gold rose more than 500 dollars. The new money coming in could devalue the US currency due to inflationary pressure and high money supply, which in turn could have a positive impact on dollar- denominated Gold and Silver.

- US Federal Reserve Monetary Policy Meeting (January 27). In addition, the US Federal Reserve (January 27 meeting) said it will maintain its “POWERFUL” massive asset purchasing programme (monthly 120 billion dollars) (equivalent to 1.44 trillion dollars per annum) until it sees substantial further progress in employment and inflation. The Fed did not announce policy changes, which was a bit of disappointment to some investors. The dot plot projections on interest rates said that 0.00%- 0.25% rate should stay in place until the end of 2023.

- MORE THAN 3 TRILLION DOLLARS TO BE INJECTED INTO THE U.S. ECONOMY IN 2021: Increased money supply in the U.S. is expected to increase upward pressure on inflation, which could grow hot later this year. Therefore, the US Dollar’s purchasing power could fall, while the markets could still expect the Gold and Silver prices to recover.

- INDUSTRIAL USE RISES: According to the Financial Mirror, around one third of the global silver demand comes from investors, while two thirds are needed for industrial applications, such as semiconductors in electronics, solar panels, water purification, batteries, and LED lighting as well as jewelry. A recovery of global industries, once the corona crisis can be better contained due to successful vaccination programmes, will support the silver price.

- ANALYSTS OPINION (GOLDMAN SACHS): GOLDMAN SACHS increased its price target to $33 per ounce.

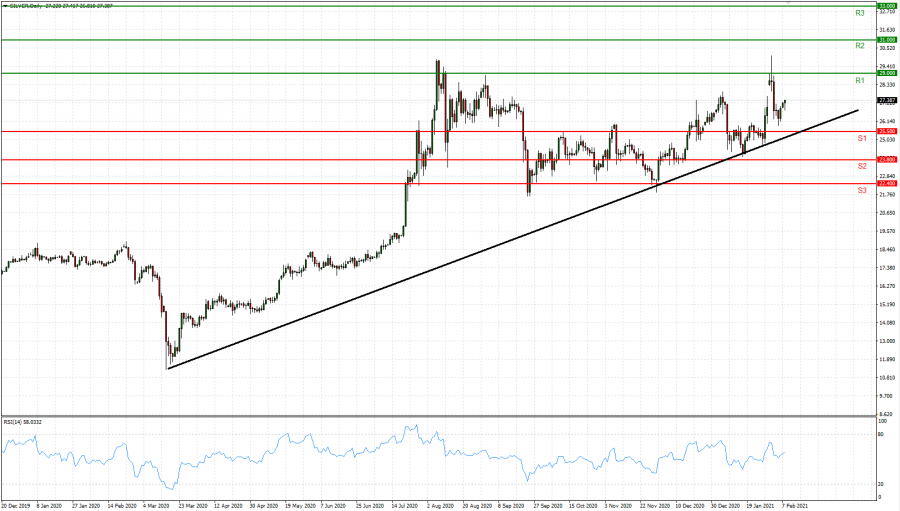

Graph: (Silver, Daily)

Current Price: 27.20

|

SILVER |

Weekly |

|

Trend direction |

|

|

33.00 |

|

|

31.00 |

|

|

29.00 |

|

|

25.50 |

|

|

23.80 |

|

|

22.40 |

Example of calculation based on trend direction for 1.00 Lot*

|

SILVER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

58,000.00 |

38,000.00 |

18,000.00 |

-17,000.00 |

-34,000.00 |

-48,000.00 |

|

Profit or loss in €** |

48,170.76 |

31,560.15 |

14,949.55 |

-14,119.01 |

-28,238.03 |

-39,865.45 |

|

Profit or loss in £** |

42,343.80 |

27,742.49 |

13,141.18 |

-12,411.11 |

-24,822.23 |

-35,043.15 |

|

Profit or loss in C$** |

74,050.92 |

48,516.12 |

22,981.32 |

-21,704.58 |

-43,409.16 |

-61,283.52 |

* 1.00 lot is equivalent of 10000 units

** Calculations for exchange rate used as of 14:02 (GMT) 08/02/2021

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Client Manager regarding their use.

*** You may wish to consider closing your position in profit, even if it is lower than suggested one

**** Trailing stop technique can protect the profit – Ask your Client Manager for more details