COCOA (#COCOA) Weekly Special Report based on 1 Lot Calculation:

GLOBAL COCOA MARKET:

- Cocoa is a versatile ingredient used worldwide in confectionery. From chocolate bars to baked goods, cocoa enriches flavor and texture. It also contains antioxidants, potentially providing health benefits. Additionally, cocoa cultivation supports millions of farmers globally.

- Total world cocoa production remains relatively small, at about 5 million tons annually. (Source: Statista)

- The Global Cocoa Market size is expected to reach $38.3 billion by 2030, rising at a market growth of 4.8% CAGR during the forecast period. (Source: International Cocoa Organization)

KEY FUNDAMENTALS:

- TOP COCOA PRODUCERS (tons): 1. Ivory Coast - 2.200m, 2. Ghana - 1.100m, 3. Indonesia - 0.667m, 4. Ecuador - 0.337m, 5. Cameroon - 0.300m

- SUPPLY DISRUPTIONS: Ghana and Ivory Coast, which produce over 60% of the world's cocoa, are facing severe harvest problems.

- The world is facing the largest cocoa supply deficit in more than 60 years and consumers could start to see the effect at the end of this year or early 2025.

- Issues such as black pod disease, swollen shoot virus, and aging trees have impacted cocoa yields, exacerbated by heavy rains and El Niño weather conditions.

- CONSUMER TRENDS:

- Traditional consumer markets for cocoa include Europe, North America, and South America, where consumption has shown stagnation in recent years.

- However, the market is experiencing growth driven by rising consumption in Asia, reflecting changing consumer preferences and increasing demand in emerging economies.

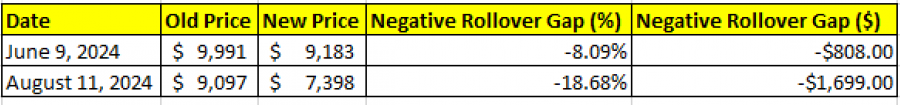

RECENT DEVELOPMENTS: CONTRACT ROLLOVER ON Fortrade Meta Trader 4 Platform

- JUNE 9, 2024: COCOA CONTRACT ROLLOVER. The new contract traded down by around 8% at $9,183 after the rollover and it managed to recover to previous contract’s price of $9,991 within the following 4 days, marking an increase of around 8.8% (Source: MetaTrader 4 Platform).

- AUGUST 11, 2024: COCOA CONTRACT ROLLOVER. The new contract traded down by around 18% after the rollover, fluctuating slightly above the mark of $7,000. If the price follows a recovery to its previous contract close price of $9,097, this could then offer an upside of around 26%. However, the price could further decline.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

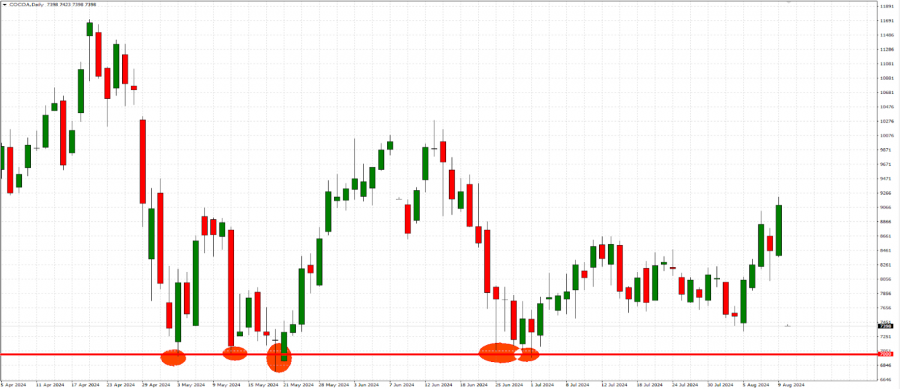

TECHNICAL REVIEW

- STRONG SUPPORT AT $7000 SINCE EARLY MAY 2024: Five times tested over the past four months.

GRAPH (DAILY): APRIL 2024 - AUGUST 2024

Please note that past performance does not guarantee future results

COCOA (#COCOA) AUGUST 12, 2024

Current Price: 7,200

|

Cocoa |

Weekly |

|

Trend direction |

|

|

12,000 |

|

|

10,000 |

|

|

9,090 |

|

|

6,500 |

|

|

6,250 |

|

|

6,000 |

Example of calculation based on weekly trend direction for 1 Lot1

|

Cocoa |

||||||

|

|

||||||

|

Profit or loss in $ |

48,000 |

28,000 |

18,900 |

-7,000 |

-9,500 |

-12,000 |

|

Profit or loss in €² |

43,962 |

25,645 |

17,310 |

-6,411 |

-8,701 |

-10,991 |

|

Profit or loss in £² |

37,615 |

21,942 |

14,811 |

-5,486 |

-7,445 |

-9,404 |

|

Profit or loss in C$² |

65,888 |

38,434 |

25,943 |

-9,609 |

-13,040 |

-16,472 |

- 1.00 lot is equivalent of 10 units

- Calculations for exchange rate used as of 09:00 (GMT+1) 12/08/2024

There is a possibility to use of Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique could protect the profit.