COPPER weekly special report based On 1.00 Lot Calculation:

TECHNICAL REVIEW:

-

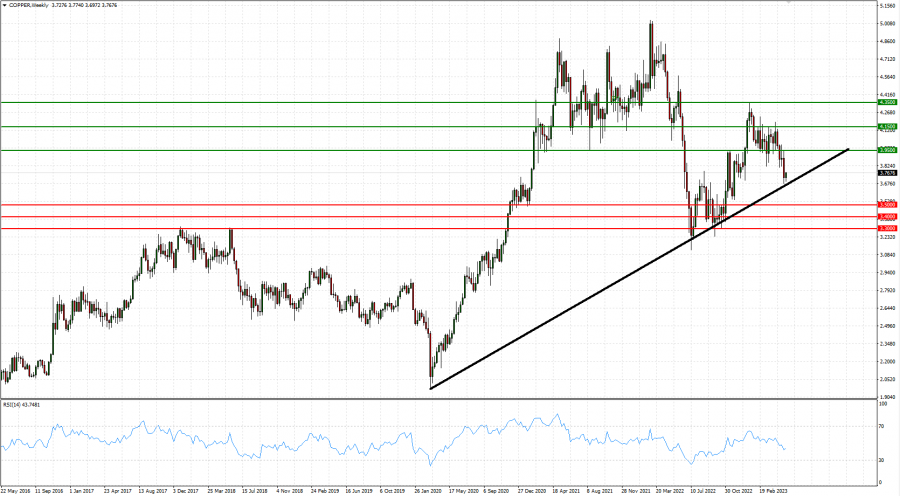

FIVE AND A HALF MONTH LOW (May 12, 2023=$3.6763): Copper tested its lowest rate since November 30, 2022.

-

LONG- TERM UPTREND (THREE YEARS): Copper has gone up by 82% over the past three years.

-

14- WEEK RELATIVE STRENGHT INDEX SUGGESTS COPPER IS ALMOST OVERSOLD OVER THE SHORT- TERM: The 14- week Relative Strength Index has fallen towards its oversold threshold of 30, which suggests a potential upward recovery could be ahead.

Graph (Weekly): COPPER (2016- 2023)

FUNDAMENTAL REVIEW:

-

COPPER USE: Copper is used in electronics as part of the auto industry, embracing 39% of the total market use. In the new era, copper is used throughout electric vehicles, charging stations and supporting infrastructure because of the metal’s durability, high conductivity and efficiency. Construction (wiring, plumbing, weatherproofing) takes up to 32% of the total use. Transportation equipment accounts for 11% while Consumer and General products account for 10% of the total use.

-

LARGEST PRODUCERS: Chile 27%, Peru 10%, China 8%, Congo 8%, USA 6%, while Russia is responsible for 4% of the global copper production.

-

LARGEST IMPORTERS: China is the largest copper importer, controlling a little over 30%. Also, China is the largest consumer of refined copper, being responsible for little over 50% of the market.

-

COPPER MARKET IN 2023: LOOMING SUPPLY SHORTAGE: Goldman Sachs predicts a 178,000 metric ton deficit in the copper market in 2023.

ANALYST OPINION:

-

GOLDMAN SACHS forecasts $5.5 per one pound.

-

BANK OF AMERICA forecasts $5.08 per one pound.

-

ALL- TIME HIGH: 5.036 (February 2022)

COPPER, May 15, 2023

Current Price: 3.7200

|

COPPER |

Weekly |

|

Trend direction |

|

|

4.3500 |

|

|

4.1500 |

|

|

3.9500 |

|

|

3.5000 |

|

|

3.4000 |

|

|

3.3000 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

COPPER |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

6,300 |

4,300 |

2,300 |

-2,200 |

-3,200 |

-4,200 |

|

Profit or loss in €2 |

5,806 |

3,963 |

2,120 |

-2,028 |

-2,949 |

-3,871 |

|

Profit or loss in £2 |

5,044 |

3,443 |

1,841 |

-1,761 |

-2,562 |

-3,363 |

|

Profit or loss in C$2 |

8,510 |

5,808 |

3,107 |

-2,972 |

-4,322 |

-5,673 |

-

1.00 lot is equivalent of 10,000 units

-

Calculations for exchange rate used as of 10:30 (GMT) 15/05/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.