Copper Weekly Special Report based On 1 Lot Calculation:

FUNDAMENTAL FACTORS:

- COPPER’S ESSENTIAL ROLE: Copper is an essential metal with a long history of use in various industries, making it a valuable commodity.

- SUPPLY AND DEMAND DYNAMICS: The price of copper is driven by supply and demand dynamics, and the consensus is that a supply deficit may emerge by 2026 as a result of ESG-related constraints which could drive prices higher.

- RENEWABLE ENERGY TRANSITION: Copper is pivotal to the global transition towards renewable energy, and it plays a key role in the electrification of the global vehicle fleet and the adoption of renewable energy sources.

CHINA:

China is the world's largest consumer of copper. The growth in Chinese electric vehicle sales and solar installations, as well as government initiatives, indicate a sustained increase in green demand for copper, which could be expected to positively impact copper prices over the long term.

- NEW STIMULUS PACKAGES ON THE WAY FOR Q3 AND Q4 OF 2023: The People's Bank of China reduced the rate on 401 billion yuan ($55.25 billion) of one-year medium-term lending facility loans to certain financial institutions by 15 basis points, now at 2.50%. Simultaneously, the central bank injected 204 billion yuan via seven-day reverse repos, lowering borrowing costs by 10 basis points to 1.80%.

- CHINA REOPENS ITS ECONOMY (2023): China’s COVID-Zero policy has ended. The Chinese government is no longer ordering lockdowns and quarantines. China’s Vice Premier Liu He said the economy could rise to its pre-COVID growth trends in 2023.

UPCOMING DATA RELEASE:

China economic data will be closely watched into year-end as investors are eager to see if the Chinese economy will be able to end the new 2024 year stronger. Analysts expect the following data to have impact on commodities, and Copper in particular:

- December 7 at 03:00 GMT: CHINA TRADE (IMPORT/EXPORT) DATA FOR NOVEMBER.

- December 9 at 01:30 GMT: CHINA INFLATION (CPI) DATA FOR NOVEMBER

- December 15 at 02:00 GMT: CHINA INDUSTRIAL PRODUCTION DATA FOR NOVEMBER

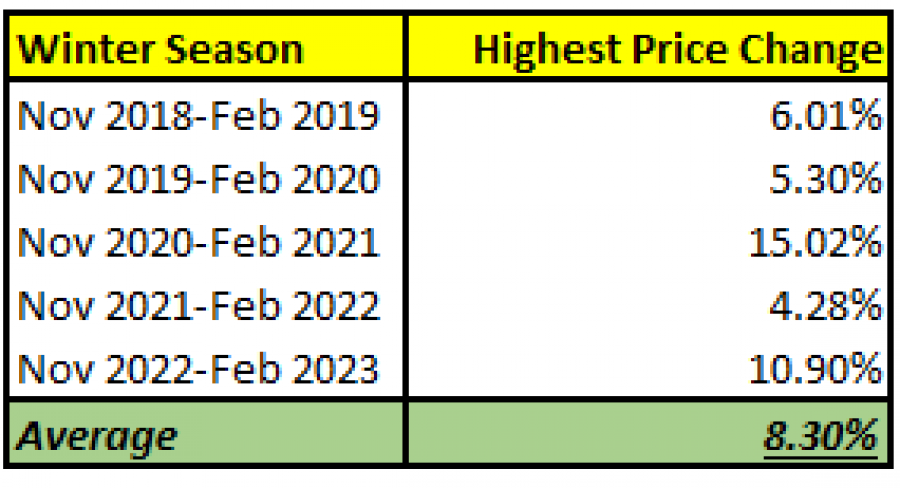

HISTORICAL PRICE MOVEMENT:

- SEASONAL DEMAND FOR COPPER: Throughout the year, copper prices tend to be driven by seasonal demand. In the winter months, when temperatures drop, the demand for copper increases as it is used to make heating systems and insulation.

Source: MT4 Platform

*Please note that past performance does not guarantee future results.

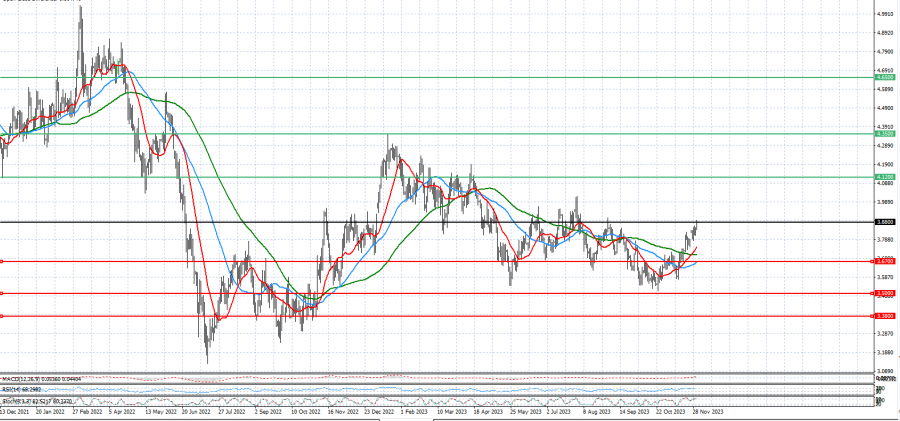

- TECHNICAL REVIEW: The market faces substantial resistance near the $4.10 level. A decisive break above this threshold could trigger a rush of bullish (buying) trading activity. Beyond this point, the 200-Day Exponential Moving Average enters the picture, followed by a target of $4.50, which could be attainable at some point during the winter season. Beneath the current price action, the $3.60 level has provided support over the last couple of months.

Graph: Copper Price (2021-2023)

Source: MT4

PRICE ACTION: Copper reached an all-time high of $5.036 (February 2022). At its current price of $3.79, the potential upside stands at ~32.87%. However, the price could decline further.

Copper, December 5, 2023

Current Price:3.79

|

Copper |

Weekly |

|

Trend direction |

|

|

4.50 |

|

|

4.25 |

|

|

4.00 |

|

|

3.60 |

|

|

3.50 |

|

|

3.40 |

Example of calculation based on weekly trend direction for 1 Lot1

|

|

||||||

|

Profit or loss in $ |

7,100.00 |

4,600.00 |

2,100.00 |

-1,900.00 |

-2,900.00 |

-3,900.00 |

|

Profit or loss in €² |

6,550.09 |

4,243.72 |

1,937.35 |

-1,752.84 |

-2,675.39 |

-3,597.94 |

|

Profit or loss in £² |

5,620.22 |

3,641.27 |

1,662.32 |

-1,504.00 |

-2,295.58 |

-3,087.16 |

|

Profit or loss in C$² |

9,623.98 |

6,235.25 |

2,846.53 |

-2,575.43 |

-3,930.92 |

-5,286.41 |

1. 1 lot is equivalent of 10,000 units

2. Calculations for exchange rate used as of 09:45 (GMT) 05/12/2023

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.