Crude Oil weekly special report based on 1.00 Lot Calculation:

GEOPOLITICS: MIDDLE EAST TENSIONS KEEP MARKETS NERVOUS

- APRIL 22: ISRAEL- HAMAS WAR TO EXTEND AS PRIME MINISTER NETANYAHU PROMISES INCREASED MILITARY PRESSURE IN COMING DAYS: According to Reuters, Prime Minister Binyamin Netanyahu on Sunday said Israel will increase "military pressure" on Hamas in a bid to secure the release of hostages held in Gaza. Israel is willing push on with its offensive against Hamas, including into the southern Gaza city of Rafah. Israel’s military intends to direct a significant portion of Rafah’s population of 1.4 million toward humanitarian islands in central Gaza ahead of Israel’s planned ground offensive.

- APRIL 19: ISRAEL RETALIATED AGAINST IRAN: Israel conducted a limited strike on targets in Iran in an act of retaliation after the Iranian attack on Israel on April 13.

- APRIL 13: IRAN CONDUCTED STRIKES ON ISRAEL. FEARS OF A FULL-BLOWN WAR BETWEEN ISRAEL AND IRAN CONTINUE TO RISE. The attack involving more than 300 missiles and drones was the first on Israel from another country in more than three decades. In total, around 170 drones, more than 30 cruise missiles and more than 120 ballistic missiles were launched at Israel by Iran. Most of the more than 300 Iranian munitions, the majority of which are believed to have been launched from inside of Iran’s territory during a five-hour attack, were intercepted before they got to Israel, more than 1,100 miles (1,770 kilometres) from their launch points.

ANALYST EXPECTATIONS

- CITIGROUP: OIL COULD HIT $100 WITHIN THE NEXT 12- 18 MONTHS. According to CNBC, the catalysts for oil to hit $100 per barrel include higher geopolitical risks, deeper OPEC+ cuts and supply disruptions from key oil-producing regions.

- GOLDMAN SACHS SEES OIL AT $100 if a more severe conflict between Iran and Israel occurs.

- JP MORGAN SEES OIL AT $100 BY SEPTEMBER. Moscow’s decision to reduce oil output is likely to drive the price of oil to $100 a barrel this year unless other suppliers take action, J.P. Morgan Global Commodities Research said Wednesday in a report.

- BANK OF AMERICA SEES OIL AT $95. According to Yahoo Finance, the bank raised its oil price forecast for several reasons, including increased geopolitical tensions between Western nations and the oil-producing countries of Russia, Iran, and Venezuela.

- MORGAN STANLEY RAISED ITS OIL PRICE TARGET $94. Morgan Stanley lowered its supply forecast for OPEC and Russia by 0.2-0.3 million barrels per day and sees a modest deficit in the second quarter, increasing to a larger deficit in the third quarter as demand ramps up.

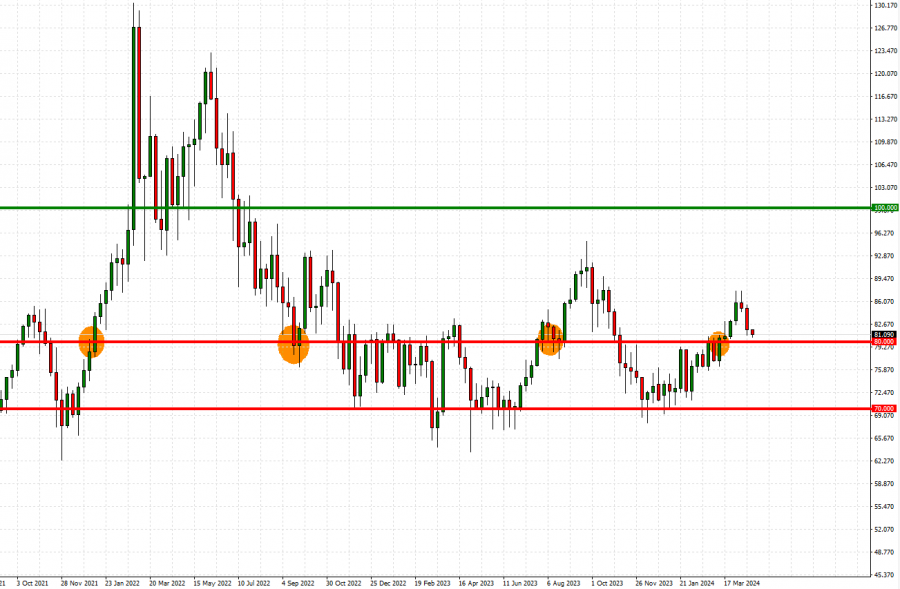

TECHNICAL ANALYSIS: FORMER RESISTANCE BECOMES NEXT SUPPORT

- FORMER RESISTANCE OF $80, COULD BE NEXT SUPPORT OF $80. After breaking above the mark of $80, which used to be strong resistance for a long time, Crude oil prices could see the same level of strong support, as crude oil prices have traded above the mark since late February 2024.

Please note that past performance does not guarantee future results

- CRUDE OIL ABOVE $80: Crude oil has traded above the mark of $80 for almost two months, finding strong technical support at $80

GRAPH: Weekly (October 2021- April 2024)

Please note that past performance does not guarantee future results

Crude Oil, April 22, 2024

Current Price: 81

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

100 |

|

|

93 |

|

|

86 |

|

|

77 |

|

|

76 |

|

|

75 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

19,000 |

12,000 |

5,000 |

-4,000 |

-5,000 |

-6,000 |

|

Profit or loss in €2 |

17,866 |

11,283 |

4,701 |

-3,761 |

-4,701 |

-5,642 |

|

Profit or loss in £2 |

15,434 |

9,748 |

4,062 |

-3,249 |

-4,062 |

-4,874 |

|

Profit or loss in C$2 |

26,060 |

16,459 |

6,858 |

-5,486 |

-6,858 |

-8,230 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 13:10 (GMT) 22/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail