Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

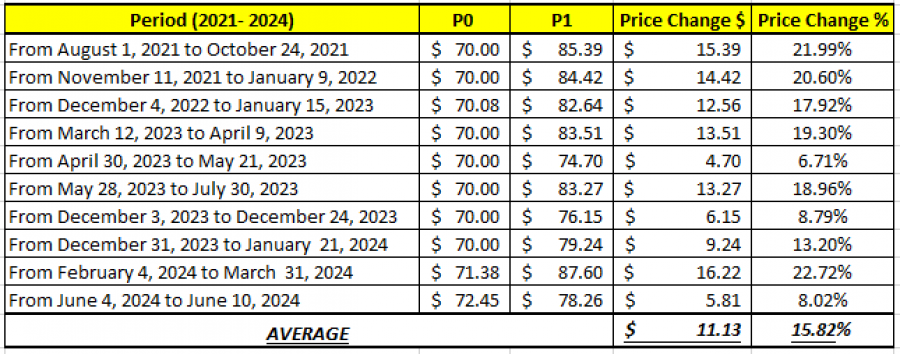

- CRUDE OIL PRICES TESTED THEIR LOWEST LEVELS IN 4 MONTHS ($72.45).

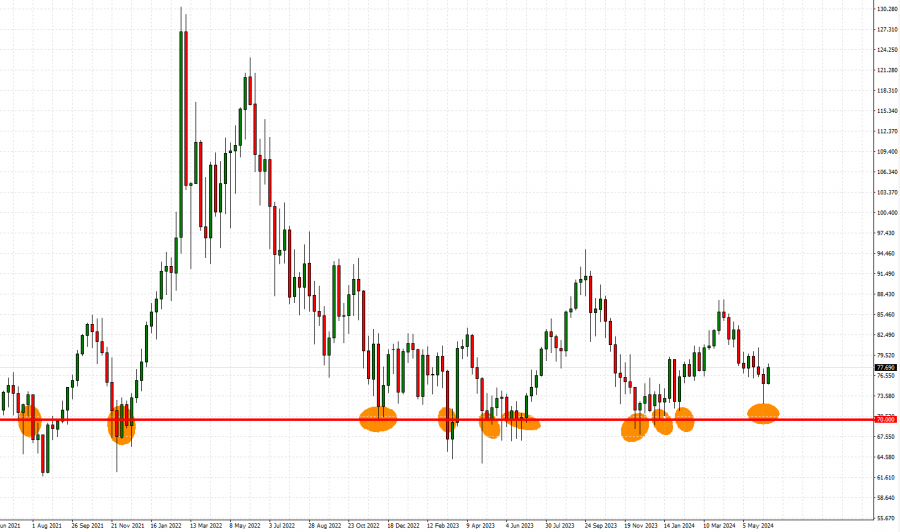

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 10 TIMES SINCE 2021.

GRAPH (Daily): November 2021 – June 2024

- 2021- 2024 STATISTICS: CRUDE OIL RECOVERED BY AROUND 16% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

FUNDAMENTAL ANALYSIS:

- OPEC+ MEETING (JUNE 2): MOST OF THE CURRENT OIL PRODUCTION CUTS TO REMAIN IN PLACE UNTIL THE END OF 2025. According to Reuters, the Organization of the Petroleum Exporting Countries and allies led by Russia, together known as OPEC+, are currently cutting output by a total of 5.86 million barrels per day (bpd), which is about 5.7% of global demand. This includes 3.66 million bpd of cuts that were due to expire at the end of 2024, and voluntary cuts by eight members of 2.2 million bpd to expire by the end of June 2024. The group, however, agreed to extend the cuts of 3.66 million bpd by a year until the end of 2025. It will also prolong the cuts of 2.2 million bpd by three months until end-September 2024, before phasing it out over a year from October 2024 to September 2025.

- OPEC+ PRODUCTION CUTS EXPECTED TO DELIVER DEFICIT TO THE GLOBAL OIL MARKET: According to OPEC, the global oil markets could see a deficit of 1.8 million barrels a day in 2024. This expectation seems to be supported by the current OPEC+ policy to cut their oil supply.

- US DRIVING SEASON (MAY 27 - SEPTEMBER 2): During the period, the US citizens travel around, consuming a lot of fuel and therefore reducing federal inventories. This period could be bullish for the oil prices. According to CNN Business, 212 million people are expected to travel in the US this summer or 82% the U.S. population, which would be the highest in 20 years.

Crude Oil, June 11, 2024

Current Price: 77.50

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

90.00 |

|

|

86.00 |

|

|

82.00 |

|

|

73.00 |

|

|

71.50 |

|

|

70.00 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

12,500 |

8,500 |

4,500 |

-4,500 |

-6,000 |

-7,500 |

|

Profit or loss in €2 |

11,622 |

7,903 |

4,184 |

-4,184 |

-5,579 |

-6,973 |

|

Profit or loss in £2 |

9,822 |

6,679 |

3,536 |

-3,536 |

-4,715 |

-5,893 |

|

Profit or loss in C$2 |

17,207 |

11,701 |

6,195 |

-6,195 |

-8,259 |

-10,324 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:47 (GMT+1) 11/06/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail