Crude Oil weekly special report based on 1.00 Lot Calculation:

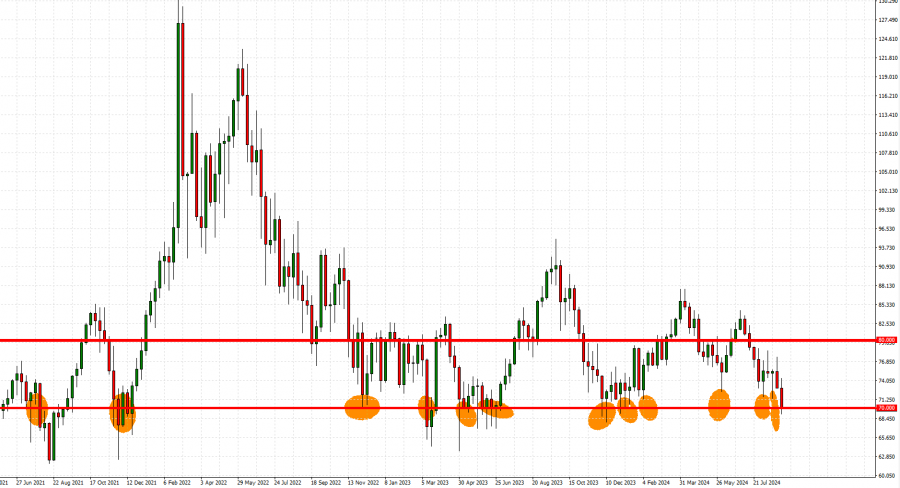

TECHNICAL ANALYSIS:

- CRUDE OIL PRICES TESTED THEIR LOWEST LEVELS IN 9 MONTHS ON AUGUST 5 ($69.165). Crude oil has remained under negative pressure trading around the mark of $70 on September 4.

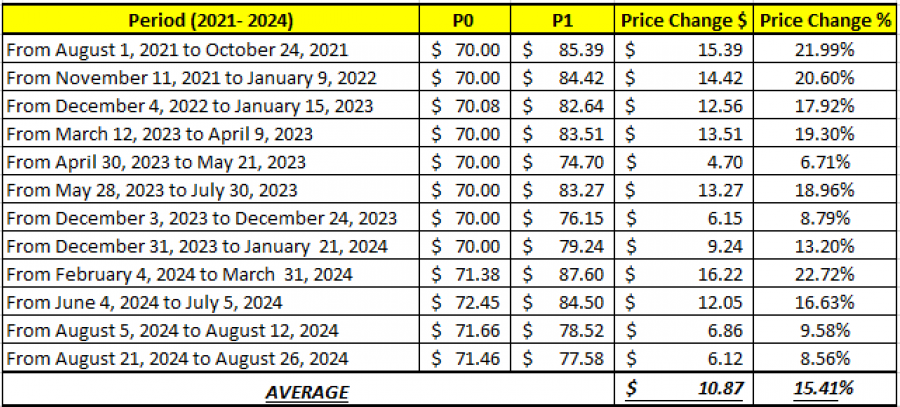

- CRUDE OIL PRICES HAVE TESTED THE MARK OF $70 (OR NEAR) 12 TIMES SINCE 2021. This is the 13th time that the Crude Oil prices are testing levels near the mark of $70.

GRAPH (Daily): July 2021 – September 2024

- 2021- 2024 STATISTICS: CRUDE OIL TENDS TO RECOVER BY AROUND 15% AFTER TESTING THE MARK OF $70 OR NEAR IT.

DATA SOURCE: Fortrade MetaTrader 4

Please note that past performance does not guarantee future results

OIL MARKET EVENTS:

- WEDNESDAY, SEPTEMBER 4 AT 21:30 GMT+1: US WEEKLY OIL INVENTORIES DATA (AMERICAN PETROLEIUM INSTITUTE). If the inventories fall, the supply gets lower, which in turn could support positively the oil prices. Last time, the API reported a decline of 3.4 million barrels.

- THURSDAY, SEPTEMBER 5 AT 16:00 GMT+1: US WEEKLY OIL INVENTORIES DATA (US GOVERNMENT). If the inventories fall, the supply gets lower, which in turn could support positively the oil prices. Last time, the US Government reported a decline of 0.85 million barells.

ECONOMIC EVENTS:

- FRIDAY, SEPTEMBER 6 AT 13:30 GMT+1: US NONFARM PAYROLLS AND UNEMPLOYMENT RATE (AUGUST). The US labour market has seen some weakness over the past few months as the unemployment rate managed to rise to its highest since late 2021 (4.3%). This is creating a headache to the US Federal Reserve ahead of the September meeting and this week’s data could give better clues whether the Fed could be more aggressive in cutting interest rates in the next few months.

- WEDNESDAY, SEPTEMBER 18 AT 19:00 GMT+1: US FEDEERAL RESERVE INTEREST RATE DECISION The most recent economic turmoil in the US raised chances that the Fed could cut interest rates by 25 basis points in September, another 50 basis points in November and 25 basis points in December 2024. All in all, that could reduce interest rates from the current 5.5% (the highest in over 20 years) to 4.50%.

Crude Oil, September 4, 2024

Current Price:69.40

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

82 |

|

|

78 |

|

|

74 |

|

|

66 |

|

|

65 |

|

|

64 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

12,600 |

8,600 |

4,600 |

-3,400 |

-4,400 |

-5,400 |

|

Profit or loss in €2 |

11,398 |

7,780 |

4,161 |

-3,076 |

-3,980 |

-4,885 |

|

Profit or loss in £2 |

9,602 |

6,554 |

3,506 |

-2,591 |

-3,353 |

-4,115 |

|

Profit or loss in C$2 |

17,081 |

11,659 |

6,236 |

-4,609 |

-5,965 |

-7,320 |

1. 1.00 lot is equivalent of 1000 units

2. Calculations for exchange rate used as of 09:40 (GMT+1) 04/09/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop technique could protect the profit.