Crude Oil weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

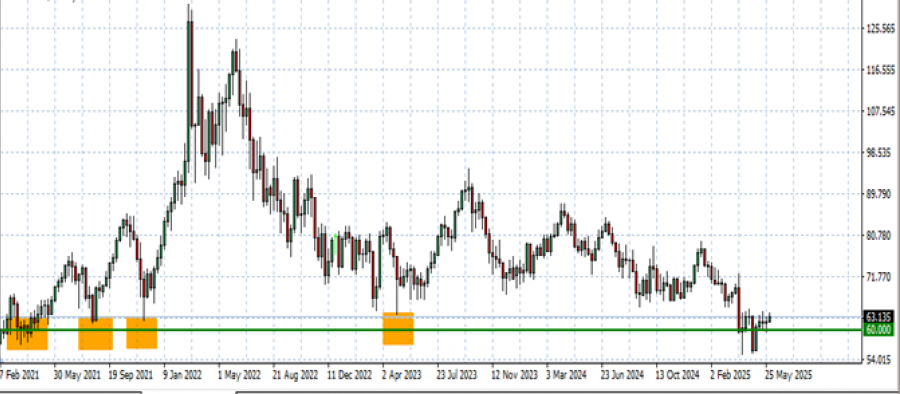

- LONG-TERM SUPPORT AREA BELOW THE PSYCHOLOGICAL MARK OF $60: Crude oil price has recently tested levels below $60, which has been acting as a support area since early 2021. However, there remains a risk of a potential breakout below this level if market conditions change.

- 4-YEAR AVERAGE DAILY PRICE (MAY 2021 – MAY 2025): $79.60. The Crude Oil average price in the period between May 2021 and 2025, which includes the Russia-Ukraine war, has been $79.60. (Source: MetaTrader 4)

- BREAKING (MAY 5): CRUDE OIL PRICES TESTED THE LEVEL OF $55.36. After testing the mark of $55.36, Crude oil prices managed to recover and hit $64.140 on May 20 (Data Source: MetaTarder 4).

- BREAKING (APRIL 9): CRUDE OIL PRICES HIT THEIR LOWEST LEVEL SINCE FEBRUARY 2021 ($55.115): Crude oil prices fell to their lowest in more than four years to hit the level of $55.115 on April 9. After testing the mark of $55.115, Crude oil prices managed to recover and hit $64.845 on April 23 (Data Source: MetaTarder 4).

GRAPH (Weekly): February 2021 – June 2025

Please note that past performance does not guarantee future results

GLOBAL TRADE:

- EVENT (EXPECTED: THIS WEEK (June 3 – June 8)): US PRESIDENT DONALD TRUMP TO SPEAK WITH CHINA PRESIDENT XI. President Trump is expected to speak with China’s President Xi this week, a White House official told CNBC, amid tensions that could jeopardize a tentative trade deal.

- BREAKING (MAY 12): U.S. AND CHINA ANNOUNCED A TARIFF RELIEF FOR 90 DAYS: U.S. and China have reduced tariffs, 145% to 30% (U.S.) and 125% to 10% (China). The deal could boost oil demand by easing trade and stimulating China’s economy, which is expected to drive higher usage of oil, supporting global prices.

GEOPOLITICS:

- RUSSIA – UKRAINE POTENTIAL PEACE AGREEMENT IN JEOPARDY AS NO PROGRESS ANNOUNCED AFTER TALKS ON JUNE 2. Uncertainties remain high after Monday’s (June 2) talks in Turkey and all that, even after President Trump- President Putin's phone call that took place on May 19. The phone call happened after another round of unsuccessful talks between Russia and Ukraine in Istanbul, Turkey, on May 16, where there were no signs of a major breakthrough either.

- US – IRAN NUCLEAR TALKS: MIDDLE EAST TENSIONS RISE AS NO CONCRETE DEALS HAVE BEEN MADE BETWEEN THE USA AND IRAN. The latest round of talks between the US and Iran in Rome, Italy, brought no concrete agreements. Iran is still insisting on continuing its uranium enrichment program, while the USA wants zero uranium enrichment from Iran. The next and sixth round of talks is expected to take place sometime in June.

EVENTS (OIL):

- TUESDAY, JUNE 3 AT 21:30 GMT+1: AMERICAN PETROLEUM INSTITUTE (API) WEEKLY OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could also decline.

- WEDNESDAY, JUNE 4 AT 15:30 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) OIL INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the oil price could be expected. However, the price could also decline.

Crude Oil, June 3, 2025

Current Price: 62.40

|

Crude Oil |

Weekly |

|

Trend direction |

|

|

67.00 |

|

|

66.00 |

|

|

64.50 |

|

|

60.50 |

|

|

60.00 |

|

|

59.50 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

Crude Oil |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

4,600 |

3,600 |

2,100 |

-1,900 |

-2,400 |

-2,900 |

|

Profit or loss in €² |

4,035 |

3,158 |

1,842 |

-1,667 |

-2,105 |

-2,544 |

|

Profit or loss in £² |

3,407 |

2,667 |

1,556 |

-1,407 |

-1,778 |

-2,148 |

|

Profit or loss in C$² |

6,317 |

4,944 |

2,884 |

-2,609 |

-3,296 |

-3,982 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 11:15 (GMT) 03/06/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.