FEDERAL RESERVE INTEREST RATE DECISION ON MARCH 20, 2024

SPECIAL REPORT: US Stocks, Commodities, US Dollar

DATE: March 20, 2024

EVENT: US Federal Reserve Interest Rate Decision (18:00 GMT). Press Conference at 18:30 GMT.

FEDERAL RESERVE INTEREST RATE (CURRENT): 5.50%

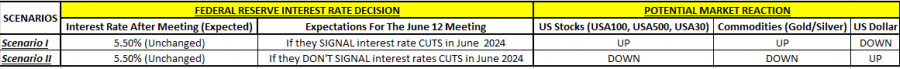

TABLE I: FEDERAL RESERVE INTEREST RATE DECISION AND ITS POTENTIAL IMPACT ON THE MARKETS

SOURCE: CMEGROUP.COM

- SCENARIO I:

EXPECTED OUTCOME: US Stocks UP, Gold UP, US Dollar DOWN

According to Scenario I, which maintains better chances of occurrence, the Federal Reserve could signal that the next interest rate cut cycle would start in June this year. The commodity prices depend on Central Banks’ interest rates. When interest rates fall in the US, the commodity prices denominated in US Dollars (Gold, Silver, Palladium, Platinum, and Copper) could become cheaper as lower interest rates push the value of the US dollar down. Cheaper prices, naturally, increase demand for the commodity, causing higher prices thereafter. Therefore, with lower interest rates incoming, especially in the US, one could expect higher commodity prices. In addition to that, lower interest rates make borrowing and lending money more affordable, which could enable companies in general to raise cash and invest in their profitable projects. To this end, lower interest rate could mean higher stock prices, too.

- SCENARIO II:

EXPECTED OUTCOME: US Stocks DOWN, Gold DOWN, US Dollar UP

According to Scenario II, the Federal Reserve could postpone the start of the next rate cut cycle. This could lead to certain investors’ disappointment. In this case, higher for longer interest rates could support positively the US dollar, while commodities, led by Gold, and US Stocks could be expected to fall. Scenario II is opposite of Scenario I in terms of expected market reaction.