Gold Weekly Special Report based on 1.00 Lot Calculation:

GEOPOLITICS:

- MIDDLE EAST TENSIONS KEEP MARKETS NERVOUS: According to Reuters, Israel will go after the remaining Hamas battalions in Rafah despite strong international criticism and is preparing a plan to get civilians out of harm’s way, Prime Minister Benjamin Netanyahu said. Rafah is a small city on the southern border with Egypt where over half of Gaza's 2.3 million people are now living. Egypt warned of "dire consequences" of a potential Israeli military assault on Rafah, which lies near its border.

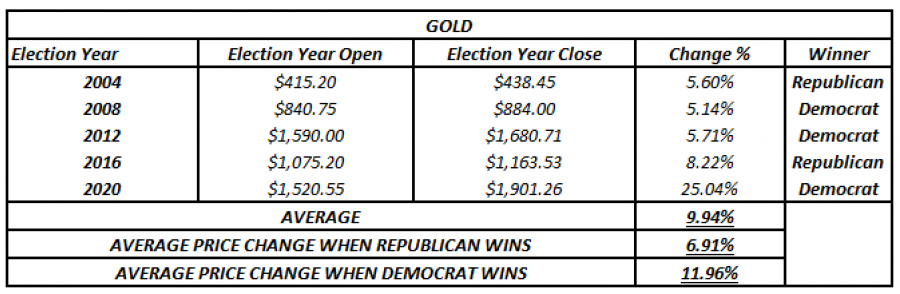

- ELECTION YEAR IN THE US: The United States Election Year has statistically been favorable for gold, rising on average 9.94%. According to the last five election cycles, gold prices have risen on average 9.94%, with the commodity rising 11.96% on average when Democrats win and 6.91% on average with a Republican victory.

Source: Bloomberg and MT4

However, please note that past performance does not guarantee future results.

ECONOMICS:

- US INFLATION DOWN FROM 3.4% TO 3.1% IN JANUARY. Inflation in the US has shown a further decline towards Fed’s target of 2.00%. Inflation has no come down from 9.1% in June 2022 to current 3.1%. A falling inflation could support the case for a more aggressive interest rate cut cycle by the Fed in 2024, which could have positive impact on Gold.

- US FEDERAL RESERVE EXPECTED TO CUT INTEREST RATES IN 2024. According to recent market expectations, the US Federal Reserve could cut the current interest rate of 5.50% down to at least 4.50% by the end of the year. Falling interest rates put negative pressure on the US Dollar, which in turn, support the price of Gold.

ANALYST OPINION

- CITIGROUP: GOLD COULD HIT $3000 WITHIN THE NEXT 12 TO 18 MONTHS. Gold could rise 50% if central banks sharply ramp up purchases of the yellow metal, a possible stagflation, or in case of a deep global recession. However, the price could decline further. Central banks’ gold purchases have “accelerated to record levels” in recent years, as they seek to diversify reserves and reduce credit risk. China and Russian central banks are leading gold purchases, with India, Turkey, and Brazil, also increasing bullion buying.

TECHNICAL ANALYSIS

- SUPPORT AT $2000: Gold has respected the support of $2000 since November 2023.

GRAPH: Gold Price (November 2023- February 2024)

*Please note that past performance does not guarantee future results.

GOLD, February 20, 2024

Current Price: 2030

|

GOLD |

Weekly |

|

Trend direction |

|

|

2300 |

|

|

2150 |

|

|

2070 |

|

|

2000 |

|

|

1990 |

|

|

1980 |

Example of calculation based on weekly trend direction for 1.00 Lot

|

Gold |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

27,000.00 |

12,000.00 |

4,000.00 |

-3,000.00 |

-4,000.00 |

-5,000.00 |

|

Profit or loss in €2 |

24,955.06 |

11,091.14 |

3,697.05 |

-2,772.78 |

-3,697.05 |

-4,621.31 |

|

Profit or loss in £2 |

21,366.68 |

9,496.30 |

3,165.43 |

-2,374.08 |

-3,165.43 |

-3,956.79 |

|

Profit or loss in C$2 |

36,488.21 |

16,216.98 |

5,405.66 |

-4,054.25 |

-5,405.66 |

-6,757.08 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 13:50 (GMT) 20/02/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more details.