GOLD weekly special report based on 1.00 Lot Calculation:

GEPOLITICAL TENSIONS:

- ISRAEL: FEARS OVER AN ALL-OUT WAR WITH HEZBOLLAH RISE HIGH, DECISION TO BE MADE SOON. According to Reuters, Israel could soon make a decision an all-out war with Hezbollah in Lebanon. Hesbollah’s leader Nasrella said last week that militant leaders from Iran, Iraq, Syria, Yemen and other countries had previously offered to send tens of thousands of fighters to help Hezbollah, but he said the group already had more than 100,000 fighters. The tensions in the Middle East could cause high economic uncertainties.

EVENTS:

- TUESDAY, JULY 2 AT 14:30 GMT+1: FEDERAL RESERVE CHAIR JEROME POWELL SPEAKS AT ECB CENTRAL BANKING FORUM: The European Central bank will be holding a central banking forum in Sintra, Portugal, where its widely expected that the central bank heads will be discussing monetary policy. Federal Reserve Chair Jerome Powell will be speaking, and could cover interest rate expectations. Shuold the expectations come off dovish, gold prices could move higher.

- FRIDAY, JULY 5 AT 13:30 GMT+1: US NFP & UNEMPLOYMENT. The United States will be reporting NFP and Unemployment data later this week. Should NFP come in lower than expected, gold prices could move higher due to potentially dovish sentiment on the back of that data.

- THURSDAY, JULY 11 AT 13:30 GMT+1: US CPI DATA FOR JUNE. The United States will be reporting CPI data. The US CPI has been trending lower, well below its 2022 peak of 9.1%. The most recent print showed CPI at 3.3%. Should the CPI come in lower than expected, gold prices could move higher on dovish expectations.

TECHNICAL VIEWS:

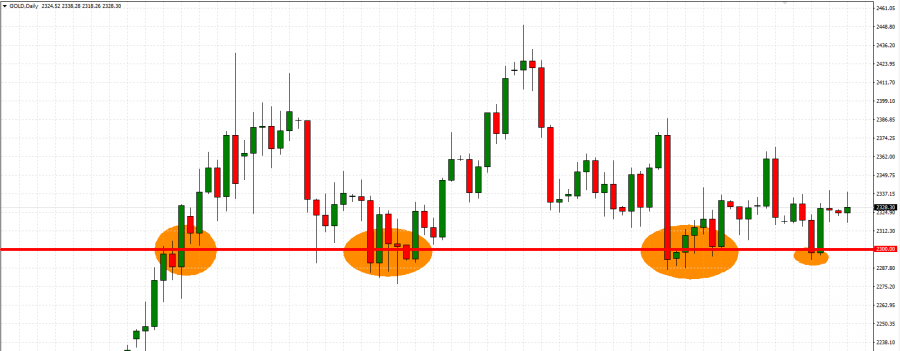

- STRONG SUPPORT AT $2,300 SINCE EARLY APRIL 2024. After testing the mark of $2300, Gold would tend to rise back above $2,350 since the pattern came into exisctance in early April 2024.

- LEVEL OF $2,300 HAS BEEN TESTED FOUR TIMES SINCE EARLY APRIL. This is the fourth time that Gold is testing the mark of $2300 since early April 2024.

GRAPH (Daily): Gold Price April 2024 – June 2024

Please note that past performance does not guarantee future results.

GOLD, July 1, 2024

Current Price: 2325

|

GOLD |

Weekly |

|

Trend direction |

|

|

3000 |

|

|

2600 |

|

|

2400 |

|

|

2270 |

|

|

2265 |

|

|

2260 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

67,500.00 |

27,500.00 |

7,500.00 |

-5,500.00 |

-6,000.00 |

-6,500.00 |

|

Profit or loss in €2 |

62,791.28 |

25,581.63 |

6,976.81 |

-5,116.33 |

-5,581.45 |

-6,046.57 |

|

Profit or loss in £2 |

53,303.22 |

21,716.13 |

5,922.58 |

-4,343.23 |

-4,738.06 |

-5,132.90 |

|

Profit or loss in C$2 |

92,499.30 |

37,684.90 |

10,277.70 |

-7,536.98 |

-8,222.16 |

-8,907.34 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 13:55 (GMT+1) 01/07/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail