GOLD weekly special report based on 1.00 Lot Calculation:

STATISTICS (2025):

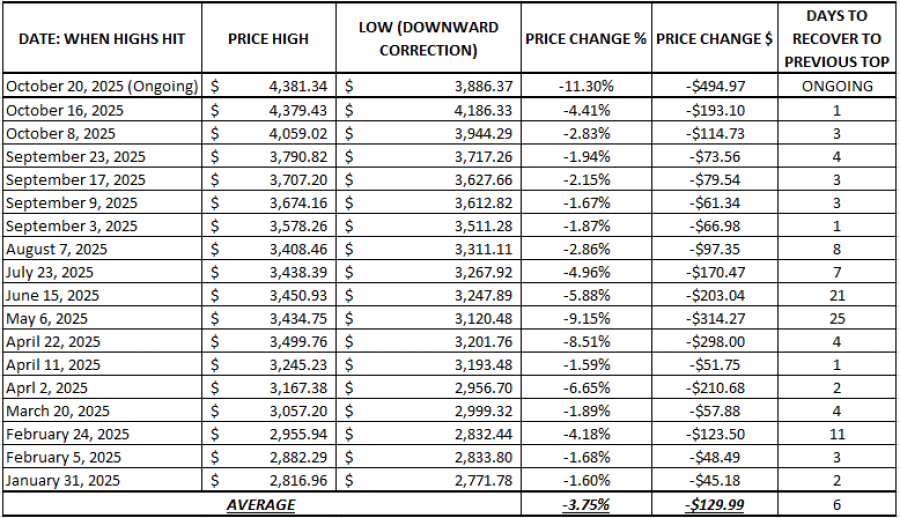

- STATISTICS (2025): GOLD HAS UNDERGONE 17 DOWNWARD CORRECTIONS IN 2025, FOLLOWED BY PRICE RECOVERIES TO PREVIOUS TOPS.

- AVERAGE NUMBER OF DAYS NEEDED TO RECOVER TO PREVIOUS TOP: 6

- CURRENT: THE CURRENT DOWNWARD CORRECTION IS THE 18TH THIS YEAR. Since October 20, 2025, gold has lost around $495 after testing $3,886.37 on October 28, 2025.

- TECHNICAL SUPPORT: $3,900. Over the past few days, after the most recent decline in gold prices, gold has tried to maintain near-term support of $3,900, which area has been tested 3 times over the past few days.

- GOLD HIT AN ALL-TIME HIGH OF $4,381.34 (October 20, 2025): Gold has last traded at around $3,970, and if a full recovery to its recent all-time high takes place, then gold could see an upside potential of around $411. Despite the recent price correction, gold is still up around 51% since the beginning of 2025.

Data Source: Meta Trader 4

Please note that past performance does not guarantee future results

USA: GOVERNMENT SHUTDOWN ENTERED ITS 30th DAY (October 30, 2025)

- BREAKING (WEDNESDAY, OCTOBER 1 AT 05:00 AM GMT+1): US GOVERNMENT SHUTDOWN BEGAN WITH NO DEAL IN SIGHT. According to Reuters, President Donald Trump rebuffed a request by top Democratic lawmakers to meet until the three-week-old U.S. government shutdown ends, prolonging the saga. According to Reuters, U.S. President Donald Trump and his Democratic opponents have made no progress in ending the government shutdown. Without passage of funding legislation, parts of the government have remained closed since Wednesday (October 1).

US FEDERAL RESERVE:

- BREAKING (OCTOBER 29): US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%. The Fed cut rates again in October after the one earlier in September. In total, this year, rates have fallen from 4.50% to the current 4.00%.

- NEXT: DECEMBER 10: The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

- FED CHAIR JEROME POWELL'S TERM ENDS IN MAY 2026, BUT U.S. PRESIDENT TRUMP MAY ANNOUNCE THE POTENTIAL SUCCESSOR BY THE END OF 2025. The US administration has already announced the 5 candidates that could possibly replace Mr. Powell as the next Fed Chair. According to ABC News, the five people under consideration are: Federal Reserve governors Christopher Waller and Michelle Bowman; former Fed governor Kevin Warsh; White House economic adviser Kevin Hassett; and Rick Rieder, senior managing director at asset manager BlackRock.

PRICE ACTION:

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe General forecasts $5,000; Standard Chartered forecasts $4,488; ANZ forecasts $4,600; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; Julius Baer forecasts $4,500; TD Securities forecasts $4,400;

GOLD, October 30, 2025

Current Price: 3,970

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,380 |

|

|

4,250 |

|

|

4,120 |

|

|

3,850 |

|

|

3,825 |

|

|

3,800 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

41,000 |

28,000 |

15,000 |

-12,000 |

-14,500 |

-17,000 |

|

Profit or loss in €2 |

35,300 |

24,107 |

12,915 |

-10,332 |

-12,484 |

-14,637 |

|

Profit or loss in £2 |

31,048 |

21,203 |

11,359 |

-9,087 |

-10,980 |

-12,874 |

|

Profit or loss in C$2 |

57,164 |

39,039 |

20,914 |

-16,731 |

-20,216 |

-23,702 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 08:00 (GMT) 30/10/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.