GOLD weekly special report based on 1.00 Lot Calculation:

STATISTICS (2025):

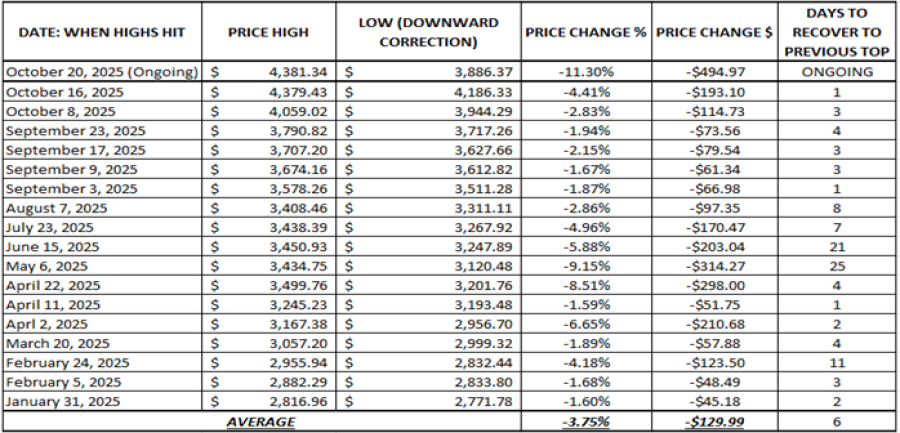

- STATISTICS (2025): GOLD HAS UNDERGONE 17 DOWNWARD CORRECTIONS IN 2025, FOLLOWED BY PRICE RECOVERIES TO PREVIOUS TOPS.

- AVERAGE NUMBER OF DAYS NEEDED TO RECOVER TO PREVIOUS TOP: 6

- CURRENT: THE CURRENT DOWNWARD CORRECTION IS THE 18TH THIS YEAR. Since October 20, 2025, gold has lost around 495 dollars after testing $3,886.37 on October 28, 2025.

- TECHNICAL SUPPORT: $3,900. Over the past few days, after the most recent decline in gold prices, gold has tried to maintain near-term support of $3,900, which area has been tested 3 times over the past few days.

- GOLD HIT AN ALL-TIME HIGH OF $4,381.34 (October 20, 2025): Gold has traded last around $3,990 and if a full recovery to its recent all-time high takes place, then gold could see an upside potential of around 391 dollars. Despite the recent price correction, gold is still up around 51% since the beginning of 2025.

- ANALYSTS’ OPINION: Bank of America forecasts $5,000; Societe General forecasts $5,000; Standard Chartered forecasts $4,500; Goldman Sachs forecasts $4,900; J.P. Morgan forecasts $5,055; Julius Baer forecasts $4,500;

Data Source: Meta Trader 4

Please note that past performance does not guarantee future results

EVENTS:

- WEDNESDAY, NOVEMBER 5 AT 13:15 GMT: US ADP NONFARM EMPLOYMENT CHANGE (PRIVATE SECTOR) (OCTOBER). In the absence of official Nonfarm Payrolls (NFP) and Unemployment Rate data due to the ongoing government shutdown, markets are expected to rely on the private ADP Nonfarm Employment Change report for October. Last month, the ADP report showed a decline of 32,000 jobs, missing expectations for an increase of 52,000.

GEOPOLITICS: USA - VENEZUELA CONFLICT

- BREAKING (NOVEMBER 3): U.S. ARMY PREPARES FOR GROUND OPERATIONS IN VENEZUELA AGAINST NARCO-CARTELS AND MADURO’S REGIME AS U.S. ARMY TROOPS INCREASED PRESENCE NEAR THE VENEZUELA COAST. According to Reuters, the USA has increased its naval forces to 16,000 troops, 8 warships and a nuclear submarine.

USA: GOVERNMENT SHUTDOWN ENTERED ITS 35 DAY (November 4, 2025)

- BREAKING: THE CURRENT U.S. GOVERNMENT SHUTDOWN TO BE THE LONGEST IN HISTORY? According to Reuters, as President Donald Trump rebuffed a request by top Democratic lawmakers to meet until the three-week-old U.S. government shutdown ends, prolonging the saga, the US Government Shutdown is entering its 35th day.

US FEDERAL RESERVE:

- BREAKING (OCTOBER 29): US FEDERAL RESERVE CUT INTEREST RATE TO 4.00% FROM 4.25%. The Fed cut rates again in October after the one earlier in September. In total, this year, rates have fallen from 4.50% to the current 4.00%.

- NEXT: DECEMBER 10: The US Federal Reserve is expected to finish the year 2025 by cutting the rates to 3.75% on December 10.

GOLD, November 04, 2025.

Current Price: 3,990

|

GOLD |

Weekly |

|

Trend direction |

|

|

4,380 |

|

|

4,250 |

|

|

4,100 |

|

|

3,890 |

|

|

3,870 |

|

|

3,850 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

GOLD |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

39,000 |

26,000 |

11,000 |

-10,000 |

-12,000 |

-14,000 |

|

Profit or loss in €2 |

33,879 |

22,586 |

9,556 |

-8,687 |

-10,424 |

-12,162 |

|

Profit or loss in £2 |

29,818 |

19,879 |

8,410 |

-7,646 |

-9,175 |

-10,704 |

|

Profit or loss in C$2 |

54,854 |

36,569 |

15,472 |

-14,065 |

-16,878 |

-19,691 |

- 1.00 lot is equivalent of 100 units

- Calculations for exchange rate used as of 08:00 (GMT) 04/11/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.