MICROSOFT (#MICROSOFT) weekly special report based On 1 Lot Calculation:

ARTIFICIAL INTELLIGENCE:

-

ARTIFICIAL INTELLIGENCE TECHNOLOGY CONTINUES TO GROW: According to the IDC, investments in Artificial Intelligence are expected to grow by 31% per year, to 251 billion dollars by 2027. Bloomberg estimates that the Generative Artificial Intelligence market could grow to 1.3 trillion dollars by 2032. The market is currently worth around 40 billion dollars today.

-

MICROSOFT IS A LEADER FOR ARTIFICIAL INTELLIGENCE PLATFORMS: According to recent data, Microsoft has introduced “BING AI” and Copilot for Microsoft 365. From before, Microsoft has partnered with OpenAI, which developed the most demanded AI application, ChatGPT. ChatGPT has already acquired more than 180 million monthly users (generating billions of dollars of revenue), and it was the fastest application to attract 100 million users.

MICROSOFT: THE MOST VALUABLE COMPANY IN THE WORLD

-

MICROSOFT DETHRONES APPLE, BECOMING THE MOST VALUABLE COMPANY IN THE WORLD. Microsoft has reached a market capitalization of 2.9 trillion dollars, surpassing Apple with 2.84 trillion dollars.

-

ARTIFICIAL INTELLIGENCE VS. iPhone: Investors started paying attention to the AI developments in late 2022, and was the strongest catalyst over the past few months to support the US stock markets. However, investors seemed to be favouring more A.I. rather than any other tech product, sending Microsoft to the throne.

MICROSOFT: EVENTS

-

EVENT (JANUARY 30, AFTERMARKET): Q4 EARNINGS REPORT. Microsoft is expected to print the highest ever quarterly revenue figure in late January (61.10 billion dollars). This could be an increase of 8.11% compared to the previous quarter and a 15.83% increase compared with the same period last year. The company is expected to report 20.75 billion dollars in terms of net earnings.

-

QUARTERLY REVENUE AND EARNINGS: LAST 8 QUARTERS. Microsoft has beat revenue expectations 6 out of the last 8 times. Microsoft has beaten earnings expectations 6 out of the last 8 times.

MICROSOFT: DIVIDEND POLICY

-

DIVIDEND PAID EACH QUARTER: $0.75 a share. This has been recently raised by 10% from 0.68.

-

TOTAL ANNUAL DIVIDEND: $3 share.

-

EXAMPLE: If an investor owns 10,000 shares, he could each year expect to receive $30,000 in dividends.

MICROSOFT: PRICE ACTION

-

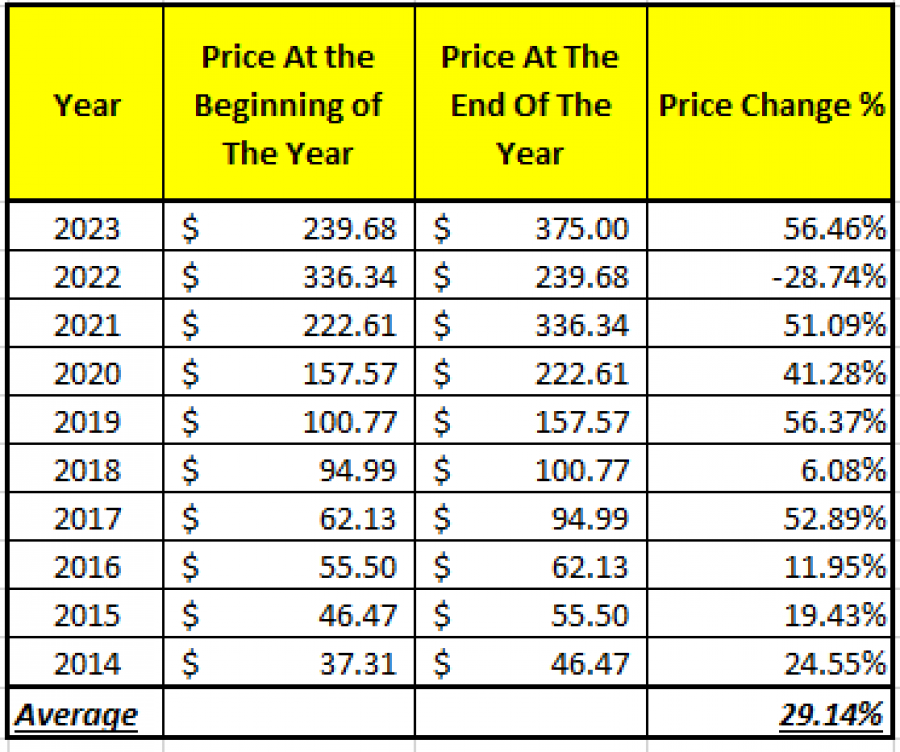

MICROSOFT IN 2023: The stock rose 56.46%.

-

MICROSOFT OVER THE PAST 10 YEARS: The stock has risen on average around 29% each year over the past 10 years. The only negative return was recorded in 2022 when the whole market entered a bear run.

Data Source: Meta Trader 4

Please note that past performance does not guarantee future results.

-

ANALYSTS OPINIONS: BNP PARIBAS forecasts $471. Wedbush forecasts $450. WELLS FARGO forecasts $435. GOLDMAN SACHS forecasts $450.

#MICROSOFT, January 18, 2024

Current Price: 390

|

Microsoft |

Weekly |

|

Trend direction |

|

|

550 |

|

|

470 |

|

|

425 |

|

|

360 |

|

|

350 |

|

|

340 |

Example of calculation based on weekly trend direction for 1 Lot1

|

MICROSOFT |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

160,000 |

80,000 |

35,000 |

-30,000 |

-40,000 |

-50,000 |

|

Profit or loss in €2 |

146,968 |

73,484 |

32,149 |

-27,557 |

-36,742 |

-45,928 |

|

Profit or loss in £2 |

126,153 |

63,077 |

27,596 |

-23,654 |

-31,538 |

-39,423 |

|

Profit or loss in C$2 |

215,813 |

107,906 |

47,209 |

-40,465 |

-53,953 |

-67,442 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 13:00 (GMT) 18/01/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

-

You may wish to consider closing your position in profit, even if it is lower than suggested one

-

Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more detail