Natural Gas weekly special report based on 1.00 Lot Calculation:

EUROPE HAS STARTED ACQUIRING BIG QUANTITIES OF NATURAL GAS

- EUROPEAN NATURAL GAS STORAGE REFILLING SEASON STARTS MARCH-APRIL AND ENDS IN NOVEMBER.

- MANDATE: EUROPEAN NATURAL GAS STORAGE MUST BE AT LEAST 90% FULL BY NOVEMBER.

- CURRENT: AT AROUND 40%, UP FROM 35% IN LATE MARCH;

- EUROPE ACQUIRES BIG QUANTITIES OF LIQUEFIED NATURAL GAS (LNG) FROM THE USA: The US supplies more than 45% of Europe's total LNG imports.

- 68% OF TOTAL U.S. LNG EXPORTS WENT TO EUROPE IN APRIL 2024: In April, Europe accounted for around 68% of total exports, importing 6.3 million tons out of a total of 9.3 million.

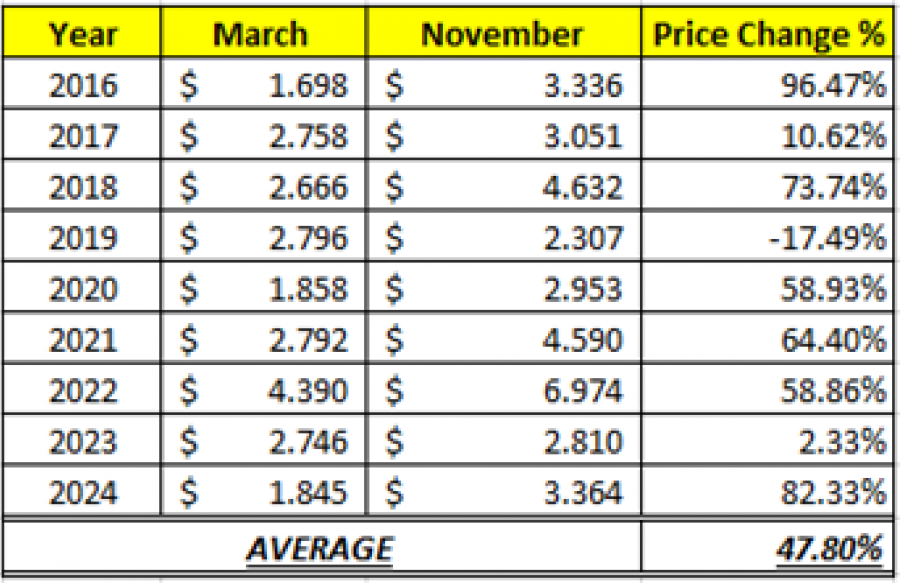

- STATISTICS (2016-2024): NATURAL GAS PRICES ROSE 47.80% ON AVERAGE DURING THE EUROPEAN REFILLING SEASON (MARCH–NOVEMBER)

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

US NATURAL GAS

- THE US EXPORTED A RECORD AMOUNT OF LIQUEFIED NATURAL GAS (LNG) IN APRIL. According to LSEG, the US exported 9.3 million metric tons of LNG, matching its previous monthly record. On April 9, 2025, feedgas deliveries reached a new all-time high of 17.3 billion cubic feet per day (Bcf/d). (Source: American Gas Association)

- AROUND 40% OF ELECTRICITY IN THE U.S. IS PRODUCED FROM NATURAL GAS: Rising consumption of electricity in the US is expected to be accompanied by rising demand for natural gas.

- U.S.A. IS THE LARGEST EXPORTER OF LIQUEFIED NATURAL GAS (LNG) IN THE WORLD. In total, the US exported 88.3 million tons of LNG in 2024, up 4.4% from 2023’s 84.5 million tons. (Source: EIA)

MIDDLE EAST TENSIONS:

- MAJOR NATURAL GAS SHIPPING ROUTES AT RISK AMID RISING MIDDLE EAST TENSION. Rising tensions in the Middle East are threatening key natural gas routes through the Red Sea and Strait of Hormuz. A potential U.S. strike on Iran could spike global gas prices, as Iran could try to block Hormuz, a passageway for about 20% of global LNG trade. Disruptions could raise prices and energy security concerns, especially in Europe and Asia.

NATURAL GAS: PRICE ACTION

- NATURAL GAS PRICES HIT $9.972 IN AUGUST, 2022. Natural gas prices surged as Europe’s energy crisis and reduced Russian supply drive up U.S. LNG imports. Though prices dipped recently after Trump’s tariffs, demand for American gas stays strong. A rebound to $9.972 would mean around 177% rise from today’s $3.6, though further declines are possible.

TECHNICAL ANALYSIS

- STRONG SUPPORT AT $3: NATURAL GAS PRICES HAVE MAINTAINED STRONG SUPPORT OF $3 SINCE NOVEMBER 2024. Natural gas has four times tested levels near the mark of $3 since November 2024. However, there remains a risk of a potential breakout below this level if market conditions change.

GRAPH (Daily): November 2024 – May 2025

Please note that past performance does not guarantee future results

Natural Gas, May 06, 2025

Current Price: 3.60

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

5.00 |

|

|

4.60 |

|

|

4.10 |

|

|

3.20 |

|

|

3.10 |

|

|

3.00 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

NATURAL GAS |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

14,000 |

10,000 |

5,000 |

-4,000 |

-5,000 |

-6,000 |

|

Profit or loss in €² |

12,371 |

8,836 |

4,418 |

-3,535 |

-4,418 |

-5,302 |

|

Profit or loss in £² |

10,526 |

7,519 |

3,759 |

-3,008 |

-3,759 |

-4,511 |

|

Profit or loss in C$² |

19,354 |

13,824 |

6,912 |

-5,530 |

-6,912 |

-8,294 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 10:00 (GMT+1) 06/05/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.