Natural Gas weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

- BREAKING (AUGUST 13): NATURAL GAS PRICES TESTED THEIR LOWEST LEVELS SINCE NOVEMBER 2024 ($2.759)

- STRONG SUPPORT AT: $3. Natural Gas prices have tested the mark of $3 or near 6 times since November 2024. This is its 7th time to test the area around $3.

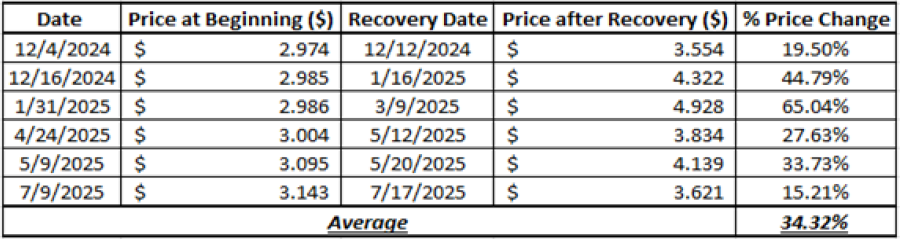

- STATISTICS (NOVEMBER 2024 - AUGUST 2025): NATURAL GAS ROSE ON AVERAGE AROUND 34.32% AFTER TESTING FIRST LEVELS NEAR THE MARK OF $3. According to the table below, Natural Gas prices would see an average price recovery of around 34% after first testing the area near the mark of $3.

GRAPH (Daily): November 2024– August 2025

- 2024-2025 STATISTICS: NATURAL GAS TENDS TO RECOVER BY AROUND 34.32% ON AVERAGE AFTER TESTING THE MARK OF $3 OR NEAR IT.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

EVENTS:

- THURSDAY, AUGUST 21 AT 15:30 GMT+1: ENERGY INFORMATION ADMINISTRATION (EIA) NATURAL GAS INVENTORY DATA (USA). If data showed a declining inventory for the past week, then positive support for the natural gas price could be expected. However, the price could decline.

Natural Gas, August 19, 2025.

Current Price: 2.90

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

4.50 |

|

|

4.00 |

|

|

3.40 |

|

|

2.60 |

|

|

2.50 |

|

|

2.40 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

NATURAL GAS |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

16,000 |

11,000 |

5,000 |

-3,000 |

-4,000 |

-5,000 |

|

Profit or loss in €² |

13,706 |

9,423 |

4,283 |

-2,570 |

-3,426 |

-4,283 |

|

Profit or loss in £² |

11,846 |

8,144 |

3,702 |

-2,221 |

-2,962 |

-3,702 |

|

Profit or loss in C$² |

22,135 |

15,218 |

6,917 |

-4,150 |

-5,534 |

-6,917 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 13:35 (GMT+1) 19/08/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.