Natural Gas weekly special report based on 1.00 Lot Calculation:

TECHNICAL ANALYSIS:

- BREAKING (AUGUST 24): NATURAL GAS PRICES TESTED THEIR LOWEST LEVELS SINCE NOVEMBER 2024 ($2.735)

- STRONG SUPPORT AT: $3. Natural Gas prices have tested the mark of $3 or near 6 times since November 2024. This is the seventh time Natural Gas to trade near the mark of $3 since late 2024.

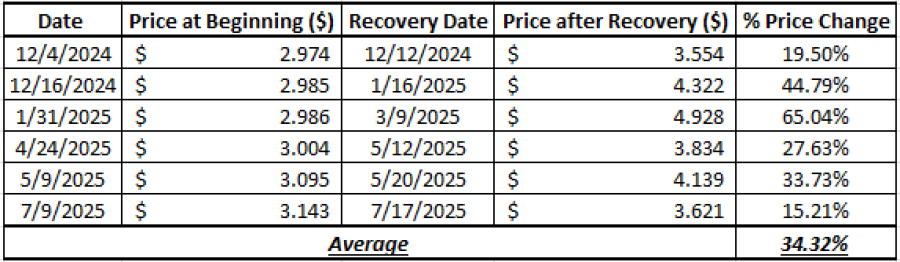

- STATISTICS (NOVEMBER 2024 - SEPTEMBER 2025): NATURAL GAS WOULD RISE ON AVERAGE AROUND 34.32% AFTER TESTING FIRST LEVELS NEAR THE MARK OF $3. According to the table below, Natural Gas prices would see an average price recovery of around 34% after first testing the area near the mark of $3.

GRAPH (Daily): November 2024– September 2025

- 2024-2025 STATISTICS: NATURAL GAS TENDS TO RECOVER BY AROUND 34.32% ON AVERAGE AFTER TESTING THE MARK OF $3 OR NEAR IT.

Data Source: Meta Trader 4 Platform

Please note that past performance does not guarantee future results

GEOPOLITICS:

- BREAKING: U.S.A. DEMANDS E.U. STOPS BUYING RUSSIAN GAS AS US PRESIDENT TRUMP THREATENED “SECOND PHASE” OF SANCTIONS ON RUSSIA. According to U.S. Energy Secretary Chris Wright European countries must halt imports of Russian oil and gas if they expect Washington to escalate sanctions against Russia. His comments follow U.S. President Donald Trump's claim that he is prepared to begin a second phase of sanctions on Russia.

E.U. TOTAL NATURAL GAS IMPORTS FROM RUSSIA (%): 11.4%.

RUSSIAN NATURAL GAS PRODUCTION: Russia produces around 17% of total natural gas production in the world, making it the 2nd largest natural gas producer in the world after the USA.

RUSSIAN NATURAL GAS EXPORTS: Russia is the second largest natural gas exporter (including both pipeline and Liquified Natural Gas (LNG) exports) in the world, responsible for around 15% of total global exports in the world.

EUROPE EXPECTED TO SOON START BUYING BIG QUANTITIES OF NATURAL GAS FROM USA

- U.S.A. - E.U. TRADE DEAL (JULY 27, 2025): EU AGREED TO PURCHASE ENERGY PRODUCTS FROM THE USA WORTH UP TO $750 BILLION IN NEXT THREE YEARS. As part of the deal, the EU intends to purchase $750 billion in US energy products, particularly oil, liquified natural gas (LNG) and nuclear energy products by 2028.

- LARGEST TOTAL NATURAL GAS SUPPLIERS TO THE EUROPEAN UNION: Norway (33.6%), USA (16.7%), Russia (11.4%), Algeria (14.1%), U.K. (4.8%) and rest (19.4%).

- LIQUIFIEND NATURAL GAS (LNG): EUROPE BUYS BIG QUANTITIES OF LIQUIFIED NATURAL GAS (LNG) FROM THE USA: US supplies 45% of Europe's total LNG imports. US President Trump wants to push the EU to buy event more.

Natural Gas, September 9, 2025.

Current Price: 3.120

|

NATURAL GAS |

Weekly |

|

Trend direction |

|

|

4.000 |

|

|

3.700 |

|

|

3.400 |

|

|

2.900 |

|

|

2.800 |

|

|

2.700 |

Example of calculation based on weekly trend direction for 1.00 Lot1

|

NATURAL GAS |

||||||

|

Pivot Points |

||||||

|

Profit or loss in $ |

8,800 |

5,800 |

2,800 |

-2,200 |

-3,200 |

-4,200 |

|

Profit or loss in €² |

7,489 |

4,936 |

2,383 |

-1,872 |

-2,723 |

-3,574 |

|

Profit or loss in £² |

6,488 |

4,276 |

2,064 |

-1,622 |

-2,359 |

-3,097 |

|

Profit or loss in C$² |

12,148 |

8,007 |

3,865 |

-3,037 |

-4,418 |

-5,798 |

- 1.00 lot is equivalent of 10,000 units

- Calculations for exchange rate used as of 11:35 (GMT+1) 09/09/2025

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than the suggested one.

- Trailing stop techniques could protect the profit.