Nvidia (#NVDA) Weekly Special Report based on 1 Lot Calculation:

THE COMPANY:

- NVIDIA develops and produces three-dimensional graphics processors and other related software. Additionally, the company also produces graphics processing units, which is a critical component when developing artificial intelligence and self-driving autonomous vehicles.

- NVIDIA’S LATEST PRODUCT PIPELINE FOR THE AI CHIP SECTOR: Nvidia’s CEO said the company now plans to release a new family of AI chips every year, accelerating its prior release schedule of roughly every two years. The current pipeline includes the Blackwell chip, set for release in 2024; The Blackwell Ultra, set for 2025; The Rubin chip, set for 2026 and the Rubin Ultra, set for 2027.

EVENTS & ANALYSIS:

- EVENT (JULY 28 TO AUGUST 1): SIGGRAPH at Colorado Convention Center. NVIDIA provided a detailed explanation of how it is advancing the development of humanoid robotics at the conference. New offerings include NVIDIA NIM and OSMO NIM microservices and frameworks for running multi-stage robotics workloads.

- EVENT (AUGUST 28, 2024 – AFTERMARKET): NVIDIA Q2 EARNINGS REPORT. Revenue is expected to come in at $28.44B which would be a year-on-year increase of 110% and EPS is expected to come in at $0.64 a share, which would be an increase of 156% Year-on-Year.

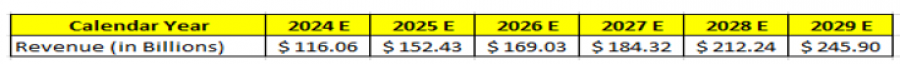

- NVIDIA MIGHT CONTINUE ITS GROWTH:

*Note: E stands for Expected

Source: Bloomberg

OTHER NEWS

- NVIDIA SHARES ADDED NEARLY $1 TRILLION IN VALUE TO THE S&P 500 IN THE SECOND QUARTER ALONE – According to the most recent reports, Nvidia’s stock value added almost $1 Trillion over the second quarter period. The significant value add reaffirms Nvidia’s momentum, as Wall Street banks continue to forecast higher price targets.

- NVIDIA CONTINUES TO REMAIN ONE OF THE LARGEST COMPANIES IN THE WORLD, NOW WORTH NEAR $3 TRILLION: Nvidia continues to remain one of the largest companies in the world in terms of market capitalization, making it the most valuable company in the world. The company has increased its market value by almost 200% since the beginning of 2024.

NVIDIA: PRICE ACTIONS

- NVIDIA HIT AN ALL TIME HIGH OF $140.49 (June 20, 2024). The price of stock trades currently around $109 and if it follows a full recovery to its most recent all- time high of 140.49, this could provide an upside potential of around 29%. However, the stock price could further decline.

- ANALYT OPINION: Wells Fargo forecasts $155, Jefferies forecasts $150, Citigroup forecasts $150, Rosenblatt forecasts $200, Barclays forecasts $145.

Nvidia, July 31, 2024

Current Price: 109

|

NVIDIA |

Weekly |

|

Trend direction |

|

|

200 |

|

|

160 |

|

|

125 |

|

|

98 |

|

|

95 |

|

|

90 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Profit or loss in $ |

91,000 |

51,000 |

16,000 |

-11,000 |

-14,000 |

-19,000 |

|

Profit or loss in €² |

84,141 |

47,156 |

14,794 |

-10,171 |

-12,945 |

-17,568 |

|

Profit or loss in £² |

70,911 |

39,741 |

12,468 |

-8,572 |

-10,909 |

-14,806 |

|

Profit or loss in C$² |

125,939 |

70,581 |

22,143 |

-15,223 |

-19,375 |

-26,295 |

- 1.00 lot is equivalent of 1000 units

- Calculations for exchange rate used as of 09:30 (GMT+1) 31/07/2024

There is a possibility to use Stop-Loss and Take-Profit.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique could protect the profit.