Palladium weekly special report based On 1.00 Lot Calculation:

PALLADIUM USE AND MARKET SHARE:

- Palladium is mostly used in catalytic converters by the car industry to reduce harmful gas emissions while tightening regulation is forcing automakers to put more Palladium into each vehicle, which in turn could keep the demand outlook positive. Palladium has also been used in fuel cells to generate power.

- MARKET SHARE (PRODUCERS): Russia is the largest producer holding 43% of the markets, while South Africa is the second largest with 33.00% of the markets. Canada is third on the list with 9.5% of the global production.

- MARKET SHARE (CONSUMERS): China is the largest Palladium consumer with 31%, while Europe and North America (USA) hold 20% each. Japan stands at 11%.

- RUSSIA EXPECTED TO CUT PRODUCTION IN 2024: NORNICKEL, THE LARGEST PALLADIUM PRODUCER IN THE WORLD, TO CUT PRODUCTION IN 2024. The Russian miner said the output of the metal may fall almost 15% to as low as 2.3 million ounces. The company said that its production was down 17% year on year in Q4 of 2023.

CHINA:

- MOST RECENT ECONOMIC DATA IN CHINA (FEBRUARY): China industrial production rose at a rate of 7%, exceeding analysts’ expectations for an increase of 5.3%. This was its best result in two years. Exports in February increased by 7.1%, exceeding analysts’ expectations for an increase of 1.9%. Imports rose by 3.5%, beating analysts’ expectations for an increase of 1.5%. In addition, Inflation came out at 0.7%, up from the previous -0.8%.

- NEW STIMULUS PACKAGES IN Q1 OF 2024 TO TAKE EFFECT STARTING Q2 OF 2024: CHINA CENTRAL BANK CUT THE RESERVE REQUIREMENT RATIO (RRR) ON FEBRUARY 5. For some context, China went with two RRR cuts in 2023 i.e. one in March and one in September. They were both for 0.25% points each. There will be a hefty reduction this time around, as the Chinese central bank announces a 0.50% points cut to the reserve requirement ratio (RRR), from 10.5% to 10%. This could release around 140 billion dollars to the economy. This is on top of the expected stimulus of 278 billion dollars.

- CHINA REOPENS ITS ECONOMY (2023): China’s COVID-Zero policy has ended. The Chinese government is no longer ordering lockdowns and quarantines. China’s Vice Premier Liu He said the economy could rise to its pre-COVID growth trends in 2024.

EVENTS (CHINA): ECONOMIC DATA (MONTHLY) FOR MARCH

- APRIL 11 AT 02:30 GMT+1: CHINA INFLATION (CPI) (MARCH) (PREVIOUS: 0.7%)

- APRIL 12 AT 04:00 GMT+1: CHINA TRADE DATA (EXPORT/ IMPORT) (MARCH) (PREVIOUS IMPORT: 3.5%; PREVIOUS EXPORT: 7.1%)

- APRIL 16 AT 03:00 GMT+1: CHINA GROSS DOMESTIC PRODUCT (GDP) (Q1) (PREVIOUS: 5.2%)

- APRIL 16 AT 03:00 GMT+1: CHINA INDUSTRIAL PRODUCTION (MARCH) (PREVIUS: 7.00%)

EVENTS (USA):

- APRIL 10 AT 13:30 GMT+1: US INFLATION (CPI) (MARCH). Inflation rate in the US showed an increase from 3.1% to 3.2% in February. According to Bloomberg, March rate could show a further increase from current 3.2% to 3.4%. If actual rate comes in lower than expected, the Palladium prices could go up.

- MAY 1 AT 19:00 GMT+1: US FEDERAL RESERVE INTEREST RATE DECISION. The US Fed will meet early May with markets expecting that the bank will start cutting interest rates in June, currently at 5.50%. The rates are expected to come down to at least 4.75% by the end of the year.

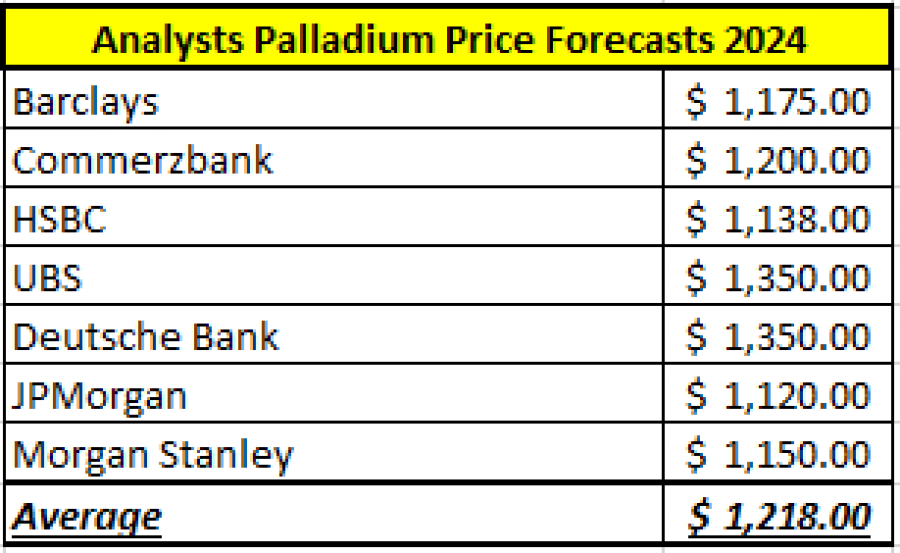

ANALYST EXPECTATIONS 2024:

SOURCE: Bloomberg

PALLADIUM, April 9, 2024

Current Price: 1060

|

PALLADIUM |

Weekly |

|

Trend direction |

|

|

1350 |

|

|

1250 |

|

|

1150 |

|

|

980 |

|

|

960 |

|

|

950 |

Example of calculation base on weekly trend direction for 1.00 Lot1

|

Pivot Points |

||||||

|

Profit or loss in $ |

29,000 |

19,000 |

9,000 |

-8,000 |

-10,000 |

-11,000 |

|

Profit or loss in €2 |

26,686 |

17,484 |

8,282 |

-7,362 |

-9,202 |

-10,122 |

|

Profit or loss in £2 |

22,860 |

14,977 |

7,095 |

-6,306 |

-7,883 |

-8,671 |

|

Profit or loss in C$2 |

39,332 |

25,769 |

12,206 |

-10,850 |

-13,563 |

-14,919 |

1. 1.00 lot is equivalent of 100 units

2. Calculations for exchange rate used as of 11:00 (GMT) 09/04/2024

Fortrade recommends the use of Stop-Loss and Take-Profit, please speak to your Senior Account ManagerClient Manager regarding their use.

- You may wish to consider closing your position in profit, even if it is lower than suggested one.

- Trailing stop technique can protect the profit – Ask your Senior Account ManagerClient Manager for more details.